One of the most critical aspects of SaaS financial management is having clear and distinct revenue streams. A well-structured SaaS P&L provides fundamental data for analyzing margins, operational efficiency, and business health.

However, many SaaS companies do a poor job of clearly defining their revenue streams. This has major impacts on how you manage your SaaS business and how you create SaaS metrics.

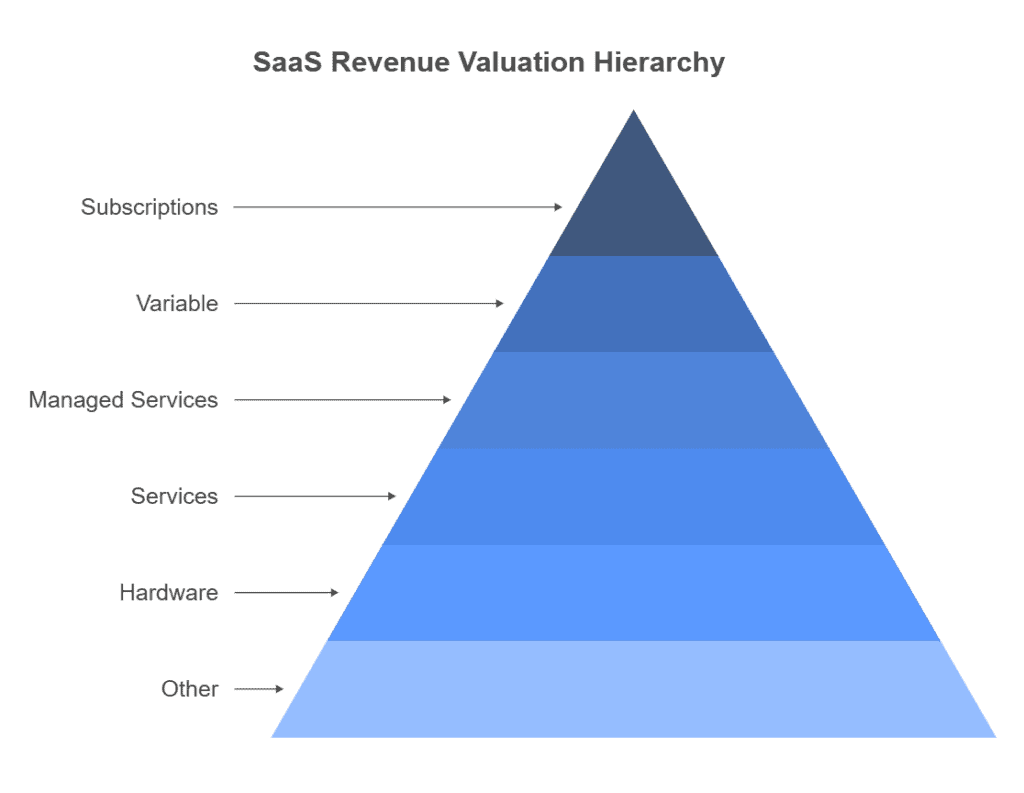

For my SaaS clients, I run a P&L deep dive meeting where we define the major SaaS revenue streams and the characteristics of each. This includes defining recurring and non-recurring revenue and further segmenting categories such as subscription, variable, services, manages services, hardware, and other revenue streams.

Let’s break down the six major SaaS revenue streams and the key metrics you should be tracking for each. We will see if outcome-based revenue makes it on a future list.

Subscription Revenue: The Core of Recurring Revenue Businesses

Subscription revenue is the foundation of most SaaS companies. This includes revenue from monthly or annual contracts where customers pay for ongoing access to your software. Within this category, it’s essential to:

- Track revenue by major product lines

- Track revenue by pricing plans (e.g., Starter, Pro, Enterprise plans) if applicable

- Track resold products separately from your IP

- Track multi-year contracts separately from month-to-month subscriptions

Key Metrics for Subscription Revenue

- Annual Recurring Revenue (ARR) / Monthly Recurring Revenue (MRR) – one of the ultimate SaaS metrics.

- Gross Revenue Retention (GRR) – Percentage of recurring revenue retained after accounting for churn and contraction.

- Net Revenue Retention (NRR) – Accounts for expansion, contraction, and churn within your existing customer base. Do NOT include new customers.

- Contracted ARR (CARR) – Measures the minimum guaranteed revenue from contracts that include variable pricing.

- Renewal Rate – If you invoice annual and sign up customers to multi-year contracts, you must track renewal rate metrics.

Why This Matters

Investors and operators evaluate SaaS businesses largely on recurring revenue. A company’s ARR is a key valuation driver, so keeping subscription revenue clean and distinct is a non-negotiable item. I believe subscription ARR is at the top of the valuation pyramid.

Variable Revenue: Understanding the Usage-Based Model

Usage-based revenue became the hot pricing model. Now, I see SaaS founders switching back to subscription. Either way, we must keep variable revenue separate from subscription revenue.

Variable revenue may include usage, processing, transaction, and consumption pricing models. This could include:

- Overage charges for exceeding subscription or tiered thresholds

- Per-transaction fees (e.g., API calls, SMS messages via Twilio)

- Volume-based pricing where pricing changes with customer usage

Be careful with overages. If you are on a subscription + overage model, make sure you code overages to their unique GL revenue account. Don’t mix overages with subscription revenue.

Retention calculations can be much harder on variable revenue streams. I calculate GRR and NRR on each revenue category and then decide if we should combine the MRR schedules for a wholistic retention view.

Key Metrics for Variable Revenue

- Annual Recurring Revenue (ARR) / Monthly Recurring Revenue (MRR) – one of the ultimate SaaS metrics.

- Gross Revenue Retention (GRR) – Percentage of recurring revenue retained after accounting for churn and contraction.

- Net Revenue Retention (NRR) – Accounts for expansion, contraction, and churn within your existing customer base. Do NOT include new customers.

- Gross Margin on Variable Revenue – Usage-based models may have direct costs; tracking gross margins ensures profitability and scalability.

- Revenue Concentration Risk – If a few customers generate most of your variable revenue, this can be risky. Same for subscription revenue.

- Customer Elasticity – Measures how customer usage scales in response to pricing changes.

Why This Matters

Failing to separate subscription from variable revenue wreaks havoc on your SaaS metrics such as gross margins, revenue retention, and CAC payback periods.

Variable revenue streams tend to be higher margin but more volatile—investors and CFOs need clear visibility to assess risk and predictability. Unpredictable revenue will hurt your valuation. Make sure you have good retention calculations in place.

Services Revenue: Onboarding Customers

Many SaaS businesses offer professional services such as:

- Onboarding and implementation fees

- Custom integrations or development work

- Training and consulting services

Professional services play a huge role in customer success. Botch an implementation and most likely your new customer will churn before they even use your product. I have students in my academy who reach out to me during this critical phase to see if I can get the vendor back on track.

Do not co-mingle services revenue with any sort of recurring revenue.

Key Metrics for Services Revenue

- Services Gross Margin – Professional services often have lower margins, so tracking profitability is critical. I see so many SaaS teams completely misprice services revenue and/or not realize how much they are doing for free.

- Billable Utilization Rate – Measures the percentage of available hours that consultants or service employees are billing.

- Services Backlog – Each month you should calculate how much un-invoiced revenue is sitting in customer contracts. You should also know the number of months it would take to pull this backlog into revenue. See my post on Profession Services metrics.

- Attachment Rate – The percentage of new customers who also purchase services (e.g., onboarding packages). Helps with forecasting and budgeting.

- Services Revenue as % of Total Revenue – Ensures services aren’t overtaking SaaS revenue (investors may discount non-recurring revenue if it is material).

Why This Matters

If services revenue is too high as a percentage of total revenue, your business may not be viewed as a true SaaS company, potentially lowering your valuation. On the flip side, well-managed professional services can increase customer stickiness and reduce churn.

Hardware Revenue: When SaaS Comes with Physical Products

Some SaaS companies bundle their software with physical hardware, such as:

- IoT devices (e.g., Ring, Nest, EV charging stations, or hardware-dependent SaaS solutions).

- Point-of-Sale (POS) systems (e.g., Square, Toast).

- Connected sensors or proprietary computing devices.

Key Metrics for Hardware Revenue

- Hardware Gross Margin – Tracks profitability, which is often much lower than SaaS margins.

- Hardware Revenue as % of Total Revenue – Ensures that SaaS remains the primary driver of revenue and valuation if that is your business model. Are you a hardware company or a software company?

- Pricing – Not a metric but are you bundling the hardware in your subscription or selling it as a standalone item?

- Inventory Turnover Rate – Measures how quickly hardware inventory is sold and replaced.

Why This Matters

Hardware-heavy businesses have different unit economics than pure SaaS, affecting gross margin calculations. Investors typically expect overall SaaS margins above 70%, and if hardware drags it down, this can create confusion. Clearly reporting hardware margins offers more insight into your business model.

Managed Services Revenue: Recurring, But Not SaaS

Managed services revenue comes from hands-on, ongoing operational support provided to customers. Unlike one-time professional services, managed services are typically recurring and subscription-based, but they involve human effort (not IP) rather than just software usage. This is people-powered revenue.

Examples include:

- Ongoing platform administration (e.g., managing cloud environments for customers).

- Dedicated customer success or account management services beyond standard support.

- Security monitoring or compliance services bundled with SaaS products.

- Monthly reporting services

Key Metrics for Managed Services Revenue

- Managed Services Gross Margin – Tracks profitability, which is often lower than pure SaaS margins due to a labor-driven delivery model.

- Revenue Contribution % – Ensures managed services don’t overshadow core SaaS revenue.

- Customer Retention Rate (for Managed Services Clients) – You can also calculate retention on this revenue stream.

Why This Matters

Managed services can be a double-edged sword—they improve customer retention but require more people. Generally, if we must hire a bunch of services staff to scale (beyond PS), this is a red flag to pure SaaS investors.

If managed services become too large, your business starts looking more like an agency than a SaaS company, which can impact your valuation. Keeping managed services separate from core SaaS revenue ensures clearer financial reporting and better investor perception.

Other Revenue Streams: Miscellaneous but Important

Additional revenue categories may include:

- Advertising revenue

- User conference revenue

- Affiliate commissions or referral partnerships.

- Third-party integrations or reseller programs.

- Marketplace fees (if your SaaS has an ecosystem play).

Key Metrics for Other Revenue Streams

- Revenue Contribution % – Ensures these streams don’t overshadow core SaaS revenue.

- Partner Margin Contribution – Tracks how much margin is retained after sharing revenue with partners.

- Lifetime Value (LTV) of Referral Customers – Measures whether affiliate-acquired customers have a similar lifetime value as direct customers.

Why This Matters

These revenue streams might not contribute meaningfully to ARR but still impact profitability. Keeping them distinct ensures you have clear line of sight on their contribution to your SaaS P&L.

The SaaS Valuation Pyramid

SaaS valuation is art and science. There are many opinions on what data points contribute to your valuation. Regarding revenue importance, here’s my opinion on the valuation order.

- Subscriptions (annual contracts better than no commitment)

- Variable

- Managed Services

- Services

- Hardware

- Other

Action Items: Why This SaaS Revenue Hierarchy Matters

Clear revenue definitions create financial clarity. Without distinct revenue streams:

- SaaS metrics like CAC payback, LTV, GRR, and NRR become inaccurate.

- Revenue forecasting is difficult and inaccurate, leading to poor decision-making.

- Investors and potential acquirers may question financial integrity. If they question your data, the deal could go bust.

By correctly categorizing subscription, variable, services, managed services, hardware, and other revenue, SaaS companies can better track profitability, communicate financial performance accurately, and improve decision-making.

Recommended Action

✅ Review your revenue streams today—are they structured correctly?

✅ Align the right metrics to each revenue stream to track SaaS success.

✅ Make data-driven decisions based on a clear revenue hierarchy.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.