I speak with many SaaS teams who do not have a CFO or finance team yet. The focus is on product, go-to-market, and building out your team to support revenue delivery. Then, you’re at several million of ARR and realize that you can’t manage your business with just your bank account and poorly formatted and/or inaccurate financial statements.

You have more questions than answers on the operations of your SaaS business. Do I have enough cash? When can I hire? Where should I invest?

When speaking with SaaS founders, I noticed that role of the SaaS CFO can be quite ambiguous.

Just like any role on the executive team, a SaaS CFO provides tactical and strategic value to the company. In this post, I’ll explain the major tactical and strategic duties of a SaaS CFO.

Tactical Role of the SaaS CFO

Accounting

I know your eyes may glaze over when I mention the subject of accounting. It’s not sexy, but it’s the foundation for good decision-making. Timely and accurate accounting is vital to your success. It’s the foundation for any SaaS CFO.

Early on, accounting is often ignored. However, as you scale past $1M in ARR (annual recurring revenue) it’s time to think about your finance and accounting roadmap.

At $3M in ARR, you need to get serious about your finance and accounting.

Typically, accounting is outsourced to a bookkeeper or accounting firm. This is a great way to start, but make sure that they understand SaaS (please contact me if you’re having accounting issues). I’ve switched several accounting firms because they did not have experience in SaaS.

Some of the major functions of an accounting team are listed below.

- Creation of financial statements (IFRS and/or GAAP)

- Financial reporting

- Payroll (may also be handled by human resources)

- Customer Invoicing (accounts receivable)

- Vendor/employee payments (accounts payable)

- Entity taxes

- Compliance

For more detail on the tactical duties of accounting, check out this post on the role of finance and accounting.

My high-level expectations for the accounting function.

- Books “closed” in five business days. Or at least a “soft close” by day five.

- Close discipline. Major balance sheet accounts reconciled and documented. Subledgers for relevant accounts, especially deferred revenue if applicable.

- Not waiting until year-end to reconcile accounts or true-up accruals (bonus, commissions, rent, vacation, etc.).

- Pass a financial statement audit.

- “Good standing” with state and tax authorities.

- Good communication with customers and internal departments.

Compliance

Oh, the joy of compliance in the United States. I won’t go into too much detail, but compliance is an on-going duty of any CFO.

CFO’s must ensure that their company is legal to do business.

- Entity taxes – paying profit-derived taxes to federal and state governments

- Sales tax – paying sales-derived taxes to state governments

- Company registrations – registering as a business entity and then as a “foreign” entity depending on your business activity in each state

- State payroll taxes – remitting federal payroll taxes and state payroll taxes to the states where your employees are located

Strategic Role of the SaaS CFO

Now on to the value creation side of a SaaS CFO. But remember. You can’t evolve as a SaaS CFO unless you have the fundamentals in place above. I have a saying. What should be routine, let’s make routine.

Often, we get so wrapped up in the operations of the business that we forget that we are still the department head for finance and accounting. Don’t forget to focus on the core and improve.

Partnering with Operations

This was really driven home by my time spent in the airline industry. To be effective in finance, you must understand the operations of the business. Without an operational understanding, it’s almost impossible to tell the financial story of your business.

You must work with your department leaders as a challenger and a facilitator.

As a SaaS CFO, you must understand the operations of each department. Working with those leaders to educate, challenge, and facilitate. Departmental understanding allows you to pull together the overall financial story of your business.

Financial Planning & Analysis (FP&A)

I progressed through the ranks of FP&A, so this is a key function for me. I started out as a Financial Analyst at a major airline in the US. This was a great finance training ground because I learned the importance of financial discipline through forecasting and analysis.

The FP&A function does the analytical heavy lifting.

A SaaS CFO must understand the operations of your business.

FP&A is responsible for many roles.

- Financial statement forecasting including headcount.

- Communicate risks, opportunities, and drivers of forecast variances in an insightful way to facilitate timely and proactive decision-making.

- Cash forecasts (part of financial statement forecasting but cash is always top dog).

- Lead annual budgeting process.

- Lead strategic long-term planning.

- Work with leaders to develop long-range strategic plans which then should align with annual financial objectives.

- Monthly financial performance analysis.

- Actual to budget/forecast variance reporting and analysis.

- Assorted reports including churn, retention, bookings, key SaaS metrics.

- Financial analysis

- Tons of ad-hoc analysis but commonly includes labor analysis, resource investment analysis (whether people, product, tech, etc.), acquisitions, sales pipeline, etc.

- Collaborate with internal departments to facilitate their goals and objectives.

- Board reporting

- Monthly and quarterly Board decks

Long-term Value Creation

A SaaS CFO develops a deep understanding of your business over time. The CFO understands the weaknesses and strengths in the business.

Armed with data, the CFO can act as the financial architect of value creation. The CFO understands where investments must be made in the business to drive growth and value.

An experienced CFO has great “contextual awareness.” Meaning, their global understanding of the business allows them to analyze decisions with all available data. Also, once in a business long enough, you see patterns in decision-making and “history repeats” moments.

Today’s CFO has supplemented their number skills with the following subject matter areas.

- Change agent – using data-driven persuasion and influence

- Talent management – ensuring departments receive the talent they need to grow

- Incentive setting – heavily involved in all department compensation plans to ensure corporate goal alignment

- Business model master – what creates value and operating leverage or just plain cost

- Cross-functional expert – global understanding of company and department operations

Technology

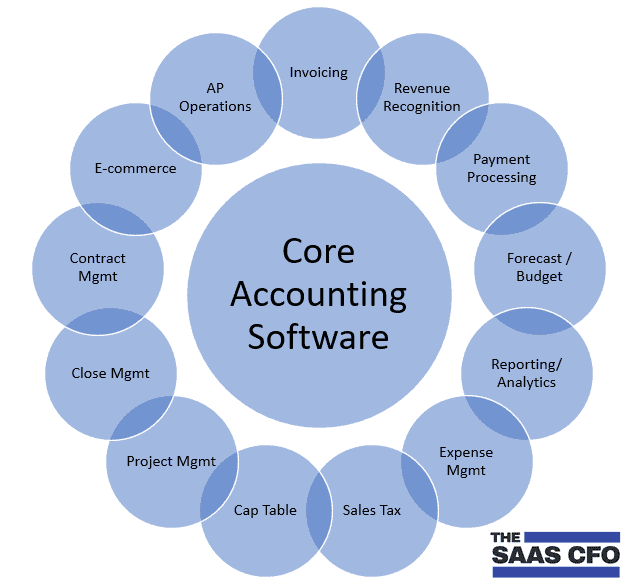

Technology is important to a highly functioning finance and accounting department. There is just too much data and transactions to take a manual approach.

You can’t throw heads at inefficiencies in your process and technology. The tech stack in finance and accounting has rapidly evolved beyond your general ledger/accounting software. We have complexities in invoicing, revenue recognition, affiliate payments, customer facing go-to-market pricing/contracts, and much more. Spreadsheets only go so far!

Just like a CTO has a product roadmap, the CFO is responsible for creating a roadmap for finance technology. Founders, this is a great interview question. What systems have you implemented in prior positions and how do see ours evolving?

SaaS CFO’s must architect their finance and accounting technology roadmap.

The modern SaaS CFO must embrace technology as part of his or her core duties. This not only moves the finance/accounting function forward but also moves the company forward.

Next Steps

It’s hard to completely define a role in one post. However, I hope you take away how a SaaS CFO can help your business in the short and long-run. Maybe, you are not ready for a full-time SaaS CFO, but you must be aware of what needs to done in finance and accounting.

A fractional SaaS CFO might be the answer. Or even coaching to make sure you are not headed over a cliff or missing out on growth opportunities. Just don’t start too late. I’ve seen some very messy departments at very inopportune times (fundraising, exit, etc.).

SaaS CFO’s – what other major areas would you add to this? Comment below and I’ll add to the post.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Hey Ben

Good article. One other aspect I would add is that having a CFO enables non-finance executives to focus on their primary responsibilities. I have encountered many founders who are time-poor and struggling with their finances because it isn’t in their core skill set. There is a very high opportunity cost. Having a CFO really eases that burden as well as boosting efficiency on several fronts concurrently.

Great article!

Hi Ben , great article I have been following you since the beggining and you do a fantastic work

I have a question for you, do you have or are planning to have a CV (personal summary) data-base for qualify persons with CFO expertiesse? it may work for company that need one, or people that may be looking for a change?

Carlos