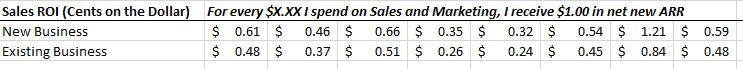

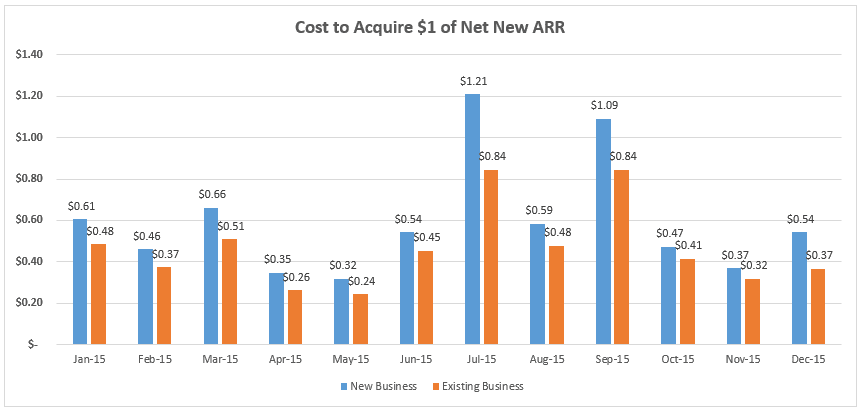

Sales Efficiency Metrics – Cents on the Dollar

Recently, I was reading a Tom Tunguz article on how to compensate sales teams. In his article, he cites sales efficiency metrics and customer acquisition costs on a dollar basis from the recent Pacific Crest Securities SaaS survey. It is an interesting way to look at CAC. The survey cites new business acquisition costs, but also what I believe to be the forgotten acquisition cost…the cost of existing business ARR or MRR.

Download the Excel template below

The Forgotten CAC Calculation

I’m not sure if there is anyone in SaaS who has not heard about new customer acquisition costs (CAC) and its relation to lifetime customer value (LTV). Commonly referred to as the CAC to LTV ratio.

I listen to a lot of SaaS podcasts (surprise!), and rarely does the host ask about the cost of customer acquisition in a dollar sense that isolates existing business. We take the necessary steps to calculate CAC but stop short of another key SaaS metric.

With a couple more pieces of data, we can measure the cost of acquiring existing business. Think upsells and expansion.

Sales ROI – Cents on the Dollar

I expanded my customer acquisition template and added the missing pieces of data required to determine upsell efficiency.

- ARR from New Business

- ARR from Existing Business

That’s it. That’s the only extension needed in the CAC calculation to determine the cost of a $1.00 of new ARR (or maybe MRR in your case).

What It Tells You

In the end, what you get with this calculation is a cents on the dollar calculation. So, for every $X.XX in sales and marketing spend, you will generate $1.00 of new ARR.

I like this calculation, because it is a very straight-forward and intuitive way to look at your sales and marketing spend and whether you should invest more in sales and marketing or wait until you have better traction.

Please download the Excel template below and let me know what you think. Do you measure any other sales efficiency metrics?

Please enter your valid email below (no spam) for the instant download.

If you do not receive the download, please contact me.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Hi Ben, Is it Sales ROI the same as the cost of net new ARR? Their formulas are the same. Hope I haven’t understood the concept wrong. Thanks and bests,