What is the SaaS Quick Ratio?

You work hard to land new customers, but then you see your revenue growth and cash slip away through customer downgrades and churn. Enter the SaaS Quick Ratio.

Different than the SaaS Magic Number which measures the efficiency of your recognized revenue growth against your sales and marketing spend, the SaaS Quick Ratio measures the direction of your bookings growth. In other words, it measures the monthly net inflow or net outflow of ARR or MRR in our SaaS business.

In this post, I’ll explain how to calculate the SaaS Quick Ratio, what’s a good ratio, and why this metric is not an efficiency metric.

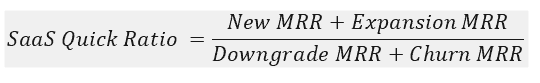

How to Calculate the SaaS Quick Ratio

The SaaS Quick Ratio measures bookings growth versus bookings contraction. It’s measured on a monthly basis and requires bookings and churn as inputs.

In the numerator, we are measuring bookings growth from all sources. This equates to newly landed MRR or ARR from new customers and expansion from existing customers.

In the denominator, we are measuring bookings contraction. This equates to lost MRR or ARR from existing customers via downgrades and churn.

You’ll notice in the formula that it uses MRR as inputs. If you live in the ARR world, just exchange MRR for ARR.

Also, I’m using the term “bookings” interchangeably with MRR and ARR. If you track on an ARR basis, you are familiar with the bookings concept and will input your ARR bookings numbers into the formula. Not recognized revenue.

If you live in an MRR world, your invoiced MRR will typically equal your bookings and your recognized revenue. Rather than your CRM system, this data might come from your payment processor or your accounting system.

SaaS Quick Ratio Example

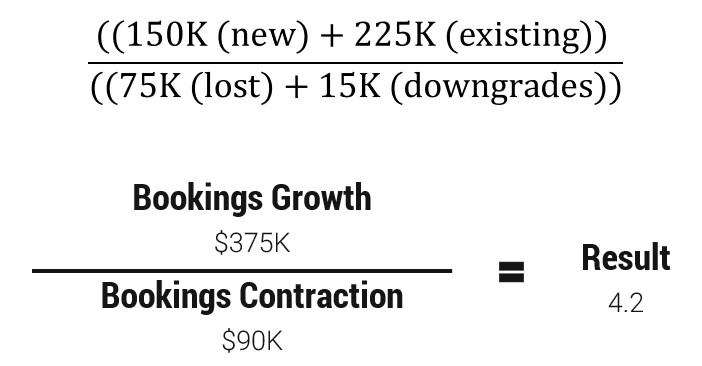

The quick ratio is straightforward to calculate. You just need accurate, monthly tracking of your new bookings, expansion bookings, downgrades, and churn. This data may be sourced from your CRM system and/or your payment processing software.

In the example below, we input $150K of new business and $225K of expansion business in the numerator. In the denominator, we input $75K of churned business and $15K of downgrades.

This equates to a SaaS Quick Ratio of 4.2. Great! Now, is that good or bad?

What is a Good SaaS Quick Ratio

Per Social Capital’s Mamoon Hamid, the following ranges will help determine the health of your MRR direction.

SaaS Quick Ratio < 1: You’re dead. You could sustain a Quick Ratio of less than one for a month or two if you already have a good customer base, but anything longer and your churn is going to kill your company.

1 < Quick Ratio < 4: You’re growing, and the growth might look good, but you are making it more difficult for yourself as you must constantly keep up high levels of customer acquisition to replace lost bookings. You will grow, but slowly, and less efficiently.

Quick Ratio > 4: You’re growing at a good rate, and doing it efficiently. Hamid won’t invest in a SaaS company with a Quick Ratio below four. This means that a SaaS company must be adding $4 of revenue for every $1 it’s losing for investors to even start looking favorably upon it.

SaaS Quick Ratio Video Lesson

Why the SaaS Quick Ratio is Important

MRR or ARR is everything to a subscription business. It keeps the lights on, so you need to know each month if you are net positive (recurring revenue will continue to increase) or net negative (expect recurring revenue to decrease). This is the pulse of your SaaS business.

A bad quick ratio will destroy your growth, the CAC spent on acquisition, and ultimately your cash balance.

Be careful, though, because the SaaS Quick Ratio will not pinpoint your problem. It will, however, provide focus on areas of your business that require extra attention.

First, assuming there is an issue, do you have a growth or retention problem? Or both? Or, maybe, fixing your new customer acquisition issue will boost your ratio above four.

In a sea of numbers, this ratio will provide tactical direction on areas of your business that require retooling.

Efficient or Directional?

I see the word “efficiency” used a lot in SaaS Quick Ratio articles. At a macro level, maybe, yes, you could say your company is efficient in bookings growth. It depends on how you are defining efficient.

However, I would classify this metric as directional. It answers the question, “what is our net inflow or outflow of MRR or ARR bookings?” It does not tell me anything about the financial efficiency of our bookings. You’ve seen in the formula that we do not use any sales and marketing expenses in the calculation.

If we are looking to quantify the efficiency of our bookings, I recommend the SaaS CAC Ratio and the CAC Payback Period formulas.

The SaaS Quick Ratio does not measure any sort of financial efficiency or payback on your bookings acquisition. Your CAC efficiency could be poor in acquiring new monthly recurring revenue (MRR) or annual recurring revenue (ARR), but you would NOT know that with this metric.

SaaS Quick Ratio < 1 | What Happens?

There are so many SaaS metrics that often we don’t know what metrics to use or if they even provide value to our financial management.

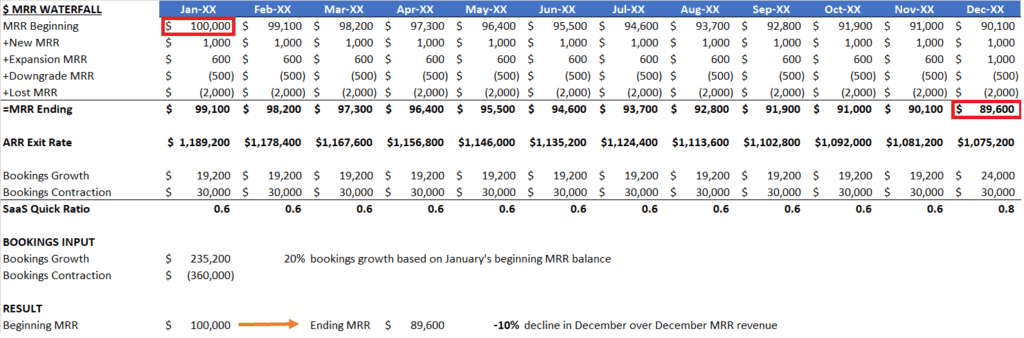

To prove the value of this metric, I ran a scenario with a sample SaaS business running a 0.6 ratio. In this example, I assume we begin the year with $100K of MRR ($1.2M ARR). We will book $235K of bookings growth and $360K of bookings contraction on an ARR basis.

This equates to 20% bookings growth, but our contraction far outpaces our growth. This results in a SaaS Quick Ratio of 0.6.

With a quick ratio of 0.6, we will experience a 10% reduction in our December over December MRR revenue.

Despite bookings growth of 20% from new and expansion business, the heavy churn and downgrades destroyed our growth.

That’s why you often hear of churn as a SaaS company killer. Despite the potential for 20% growth, churn is cold-hearted. It will eat through your cash until nothing remains.

This metric also reinforces the importance of a holistic view of our bookings and churn performance.

Why I Like This Metric

- Provides focus on areas of our business that require attention.

- Very relevant for high volume customer volume, low price point businesses. It can alert us to problem areas so that we can take proactive action. You could potentially measure weekly.

- MRR/ARR is the life of our business. As leaders, we should know if we are experiencing net growth or net contraction

- Simple to calculate and understand.

Action Items

Track down your bookings and retention data. Calculate your ratio for the last three months. Do you have net inflow or outflow of ARR/MRR?

For high volume, low price point businesses, implement the SaaS Quick into your monthly reporting package. Do you need take correction action? For mid-market and enterprise businesses, I would still calculate this metric but you have more time react as takes longer for bookings changes to work through your financials.

The SaaS Quick Ratio also reinforces the good habit of tracking and reviewing your software bookings in detail.

Suggested Readings

SaaS CAC Ratio – measure the efficiency of your bookings acquisition

CAC Payback Period – how soon do you payback your CAC?

Post Updated: May 11, 2020

To download the formula in Excel, please enter your valid email below for the instant download.

If you do not receive the download, please contact me.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

What happens if Downgrade MMR + Chrun MMR is 0? How applicable is this metric to very early stage growth startups?

Hi Dwayne,

You would have a great SaaS Quick Ratio. Of course, with every metric, you don’t want to take out of context. If you have very little growth and no churn/downgrades, then you still have a great number but then you would also be concerned with bookings growth. I think this metric would be applicable to early stage once you have some sort of sales team. For example, the founder is no longer selling the software. Detailed bookings tracking would be important to understand your go-to-market traction.

Ben