As your SaaS business moves into growth and scale mode, you will be very focused on SaaS gross margins, EBITDA, and EBITDA margins. With this financial focus, there are two ways that I think about profitability and margins. I manage my P&L by splitting it into two distinct sections to understand my operating leverage.

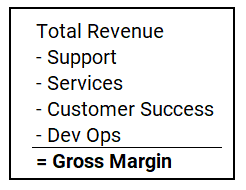

The first section, or top half, is your revenue and cost of goods sold (COGS) areas. Revenue less COGS results in gross profit.

The second section, or bottom half, is your gross profit and operating expense (OpEx) areas. Gross profit less OpEx results in operating income. Add back depreciation and amortization and you’ll have EBITDA.

You may not think that gross profit and operating expenses are related, but, like it or not, these two sections of your P&L are forever tied together as you scale. The interaction between these two P&L sections either creates never-ending pressure on your EBITDA margins, or it creates operating leverage, great cash flow, and EBITDA margins.

In this post, I address the importance of operating leverage to your SaaS business and how to calculate this financial statement metric. I’ll use HubSpot (HUBS) financials to demonstrate the calculation.

The First Layer of P&L Profitability | Gross Profit

Before we dive into operating leverage, we must understand the first layer of P&L profitability. And that is gross profit. Gross profit contributes to operating leverage and is a key component of the operating leverage formula.

Gross profit or margin is simply total revenue minus cost of goods sold (COGS). COGS contain our variable expenses and typically include support, services, customer success, and dev ops.

As revenue scales, we expect our COGS to scale at almost the same rate. For example, if we have achieved excellent gross margins of, say, 85%, I would expect to spend 15 cents for every dollar earned into the foreseeable future.

However, over the long run, we are always pushing for modest improvement in gross margins (assuming we already have solid margins). We must continue to invest in our COGS infrastructure to support our revenue streams.

HubSpot Gross Profit

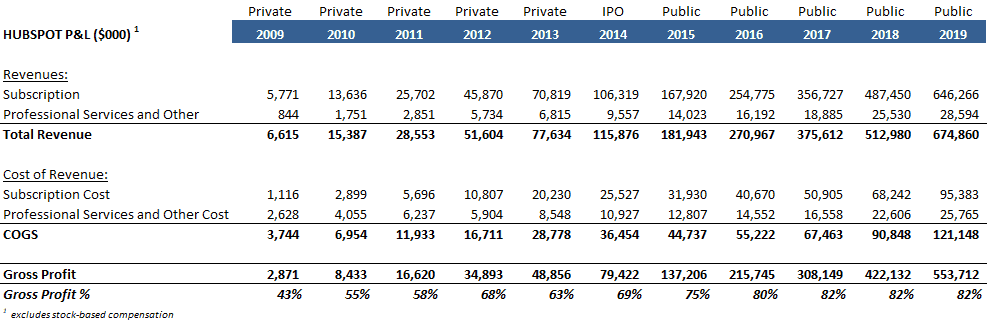

Let’s take a look at Hubspot’s financials to move from theory to practice. It’s interesting to see how HubSpot’s growth and margin profile changed dramatically from pre-IPO to post-IPO.

In the early, pre-IPO years, HubSpot’s revenue almost doubled each year, but its gross margins suffered. Its gross margin was very low as it presumably invested in COGS infrastructure, so it could efficiently scale in the future.

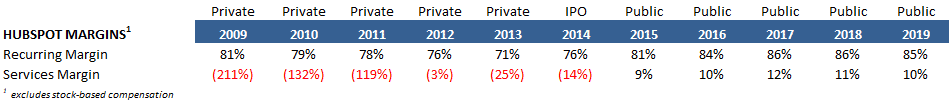

I must point out the Hubpot’s interesting mix in revenue stream margins. In the early years, it had solid recurring margins but very negative services margins. This is exactly the reason why you should always calculate your margins by revenue stream and set up the proper SaaS P&L.

Very negative service margins dragged down Hubspot’s overall gross margin. Over time, service margins improved while recurring margins dipped prior to IPO and then returned to great levels.

The Second Layer of P&L Profitability | Operating Leverage

The second layer of our P&L, below gross profit, covers our operating expenses. Operating expenses include R&D, sales, marketing, and G&A.

The expectations of operating expenses are much different than those of COGS. Remember, once we have achieved solid gross margins, we expect COGS expense to grow with revenue.

However, with operating expenses, we want them to act more like fixed costs. As revenue and gross profit increase, we want operating expense to grow at a much slower pace.

Of course, we continue to invest in these departments as revenue increases, but we want to see some efficiency as a percent of revenue over time. Thus, we calculate the expense in these departments as percent of total revenue.

Our goal is to keep as much as gross profit as possible. But this profit must now cover our operating expenses. What remains is our operating income.

Operating leverage is created when we increase gross profit while keeping operating expenses as flat as possible.

Operating Leverage Formula for SaaS

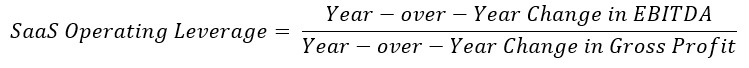

There are quite a few formulas for operating leverage. I like to keep it simple. With operating leverage, I want to drop as much gross profit to the bottom line, so I based my formula on this premise.

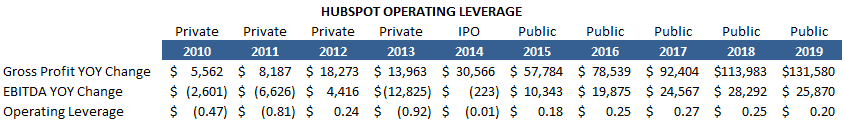

My operating leverage formula below requires EBITDA and gross profit. This formula compares the year-over-year (YOY) change in EBITDA to gross profit.

It answers the simple question. For every dollar of gross profit increase, how many cents flow to EBITDA?

The scale maximum for positive operating leverage is one dollar. For example, if we achieve $1 of operating leverage, it means that we kept our operating expenses flat on a period-over-period basis.

I suggest measuring operating leverage on a quarterly basis or longer. Anything shorter and there could be too much volatility in the numbers.

HubSpot Operating Leverage Example

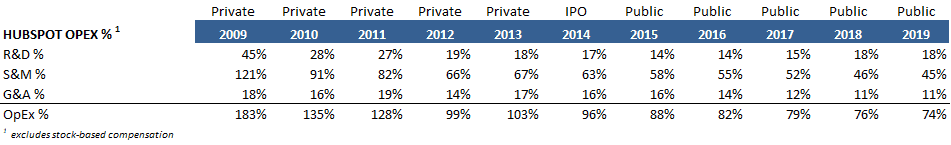

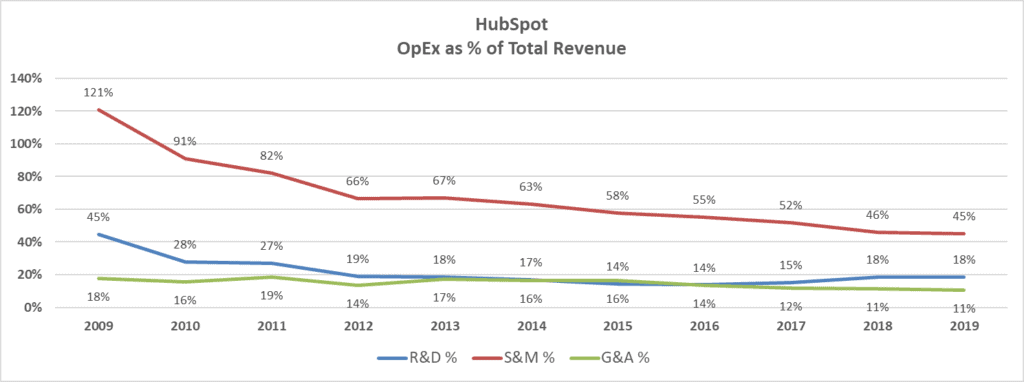

I’ll use HubSpot’s financials demonstrate the operating leverage formula. It’s really interesting to see how HubSpot’s operating expenses trended over this eleven-year period.

HubSpot experienced 60% compound annual growth in subscription revenue over this timeframe. Obviously, that growth requires decent investment in all areas of the company. You can see in the table below that HubSpot invested heavily in sales, marketing, and R&D as percent of total revenue.

However, their financial profile changed once they became a public company. Other than an uptick in R&D, operating expenses began a slow decline as a percent of total revenue.

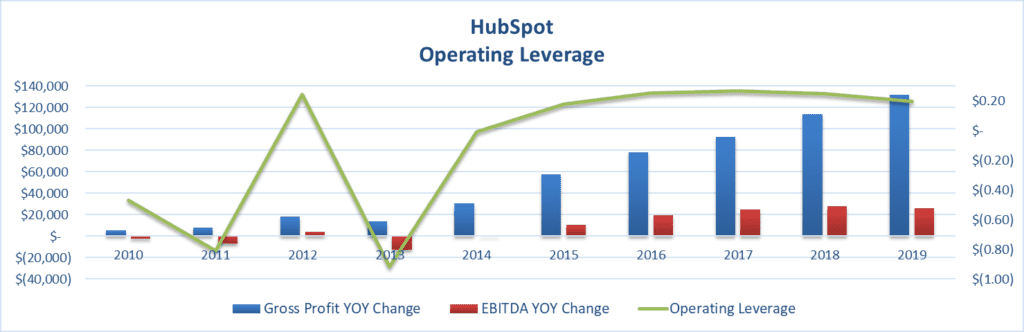

Prior to October 2014 (IPO month), gross profit was increasing YOY, but gross margins were very low. Operating leverage fluctuated in the early years as they invested in operating departments. However, after IPO, HubSpot found its groove in the public spotlight as gross profit increased each year and operating leverage stabilized.

It keeps around 25 cents of EBITDA for every dollar increase in gross profit.

Importance of Operating Leverage

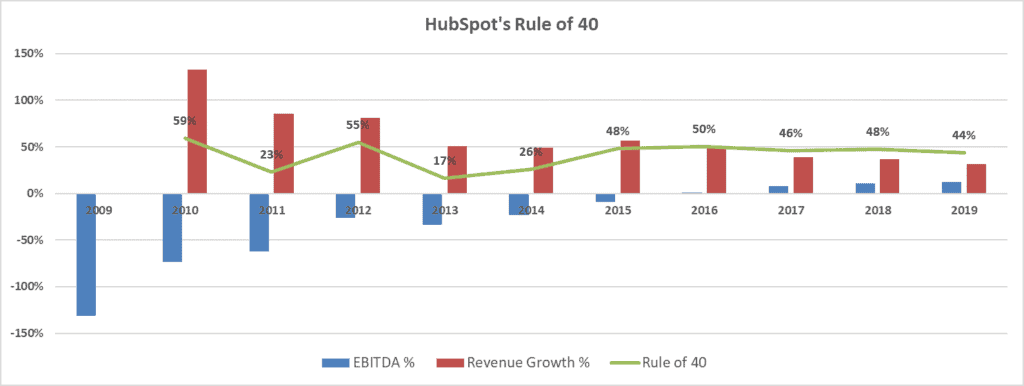

Financial management is a lot about trade offs. We don’t always need great operating leverage or an amazing Rule of 40 number (see bonus chart below). BUT…we do need to understand the financial trade offs that we are making as operators of our business.

Without clear focus on financial metrics, you may end up on that never-ending treadmill of increasing gross profits AND increasing operating expenses.

This results in flat or declining EBITDA margins. Why can’t my business get ahead of the curve?

It’s hard to do this analysis on the back of a napkin. A disciplined forecast and budget process facilitate great management discussions on the proper investments in your business. It also informs us on what it means for growth and margins. And it helps us clearly communicate with our Board, employees, and investors.

When to Measure Operating Leverage

The operating leverage metric is applicable to SaaS businesses that are in the growth/scale phase. It’s hard to pinpoint an ARR level. In theory, you have found product/market fit, are on focused on efficient growth, and are beyond funding rounds.

Action Plan

If you are in growth mode, open up your SaaS P&L and measure your operating leverage. How does it compare to Hubspot? I plan to post more public company data for SaaS benchmarks.

If you would like my Hubspot dataset, please post a comment below, and I’ll clean it up for consumption.

Do you measure operating leverage? Please comment below

Suggested Reading

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

I like to use the term Cost of Revenue since most companies are selling services and not a physical good. I realize COGS is an older accounting term and it may just be semantics, but using cost of revenue seems apropos. Thanks for a great website and keeping us Accounting & Finance types up to speed.