Why the SaaS Magic Number of One is So Lonely

The SaaS Magic Number is a sales-related SaaS metric that determines your efficiency in generating incremental recurring revenue. In the SaaS community, a SaaS Magic Number of 1 or greater is considered ideal, but should you really pour more money into sales and marketing if you have achieved the SaaS Magic Number of 1?

How to Calculate the Magic Number

The Magic Number formula is presented below. You simply take the growth in recurring revenue from a selected quarter minus the previous quarter’s revenue, annualize it by multiplying by four, and then divide the numerator by the previous quarter’s sales and marketing spend.

A Magic number of 1 means that you will pay back the selected quarter’s sales and marketing spend (denominator) from the incremental revenue generated over the next four quarters (numerator). It’s been deemed that 1 or better is efficient and a number below 1 means that you need to review your sales and marketing spend before you invest more in that area.

What Could be Wrong with 1?

SaaS metrics are much more meaningful when used with other metrics to tell a story. Can you have a Magic Number of 1 and still have economic health issues? The answer is yes, because the Magic Number does not consider your current gross margin.

Have you Considered Gross Margins?

Depending on the stage of your startup, you might only be concerned with high growth and cash balances to support that growth. At some point, however, you must move beyond the Magic Number and consider gross margins.

If it takes four quarters to pay off your sales and marketing expense, you have depleted all margin and have no margin remaining to cover service and overhead costs. You are not yet break even on this cohort of customers if you have only paid for the sales and marketing expenses to acquire those customers.

A Magic Number of 1 and 50% Gross Margins

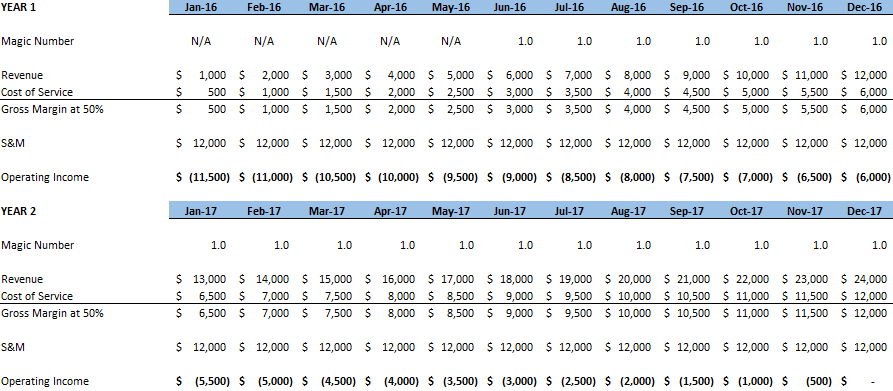

If your gross margin is 50% and your Magic Number is 1, your first year is spent paying back a quarter’s worth of sales and marketing expense from the incremental revenue generated, and the second is year is required to reach break even.

In the example below, a quarter of S&M expense equals $36K. The incremental revenue generated ((2Q – 1Q) x 4) equals $36K. Again, with the Magic Number at one, it takes twelve months of incremental revenue to pay pack the quarter’s worth of S&M expense ($36K).

None of this incremental revenue is covering your cost of service or cost of operations. Therefore, you need another year to reach a revenue level that covers both your S&M and your cost of service.

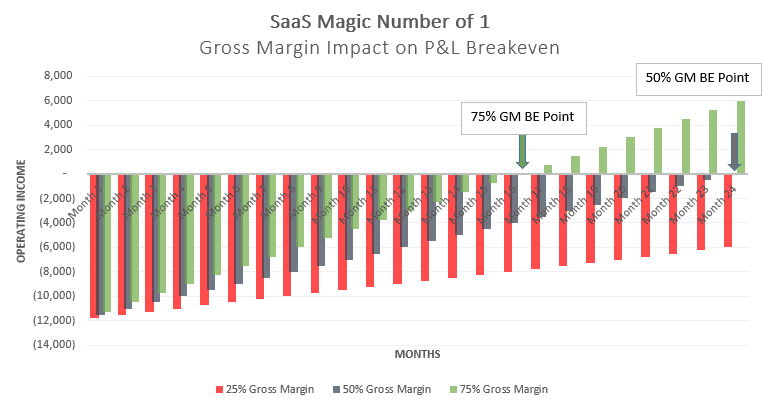

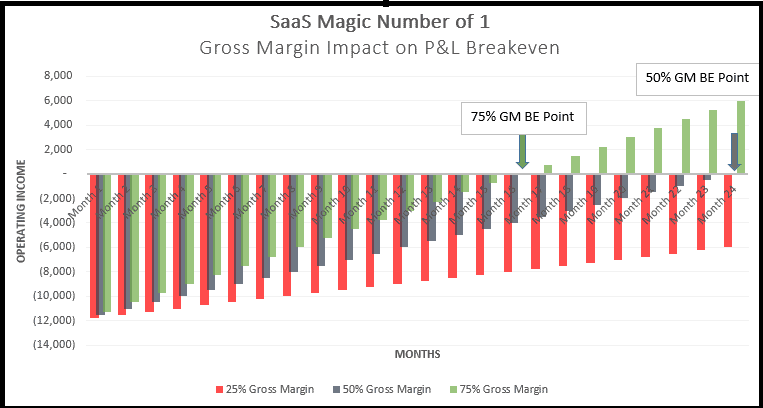

The higher your gross margin, the faster you reach the break even point. And vice versa for a lower gross margin.

You can see from the simple example below that our Magic Number is pegged at 1 and our gross margin is 50%. Based on our level of sales and marketing spend and our gross margin, we reach profitability in month 24. For simplicity, I assumed no churn but any churn would immediately decrease your Magic Number and lengthen the time it takes to reach profitability.

Conclusion

Startups and seasoned businesses must measure metrics that determine the health of their business, but the Magic Number or any other metric in isolation cannot determine the overall health of your business. SaaS Metrics are most powerful when used together.

A Magic Number of 1 is a great start but make sure you are calculating payback periods, gross margin, and churn so that is not just a lonely number. Don’t get into “CAC Debt” by focusing on just one SaaS metric.

Download Template

Need to calculate your SaaS Magic Number? Download my free template below.

This post was originally written for OnCFO.com, a provider of financial modeling software.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Good point: GM matters as Cost of Service needs to be covered before S&M!

Is the Magic Number applicable in the context of a Software company having prepayment deals with customers? I mean: in this case, the ARR could look smooth and the Magic Number could be high but the company could still hit a wall because cash was already collected.

What do you think?

Hi Alex,

The SaaS Magic Number focuses on revenue so there could be a disconnect between cash and revenue growth. I think it is still applicable b/c you are measuring revenue growth to S&M spend. However, if you have a long sales cycle, this metric might not be as applicable.

Ben