The rule of 40 in SaaS is a simple financial framework that balances revenue growth versus profit margins. It’s a rule of thumb to quickly determine the health and/or attractiveness of your SaaS company.

You’ve probably heard of the rule of 40, but the application of the formula can be somewhat ambiguous. What exactly is the 40 number? What margins or time periods are you measuring?

In this post, I explain exactly how to calculate the rule of 40, understand the result, and apply this SaaS metric in your business.

Don’t be misled by the changing winds in SaaS strategy! Financial discipline never goes out of style. The Rule of 40 was out style and now it’s back in style. You need this metric in your dashboard.

How to Calculate the Rule of 40?

The rule of 40 formula requires just two inputs, growth and profit margin. To calculate this metric, you simply add your growth in percentage terms plus your profit margin.

For example, if your revenue growth is 15% and your profit margin is 20%, your rule of 40 number is 35% (15 + 20) which is below the 40% target.

To be “attractive,” you must increase either growth or profit to reach a total of 40% or greater.

Growth Input

For revenue growth, you can use either recurring revenue growth or total revenue growth. If subscription revenue comprises 80% or more of your total revenue, I am more inclined to use recurring revenue for growth.

With high levels of recurring revenue, you are definitely focused on growing your subscription revenue while the other revenue streams in your business most likely support the growth and retention of your recurring revenue.

For example, you may have a professional services team that implements and trains customers on your software to ensure that your customers are successful. This services revenue stream may produce margins, but it serves to support your recurring revenue stream.

Profit Input

For profit margin, it is common to use EBITDA margins. EBITDA is a common financial metric and very important in the SaaS world. EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

Your SaaS business is often roughly valued on multiples of ARR, but when exiting on a larger scale or exiting from private equity ownership, EBITDA is king. EBITDA is a rough proxy for the cash flow generated by your SaaS business.

Why use EBITDA in the rule of 40? Every company’s capital and entity structures are different as well the application of accounting principles on the capitalization of fixed or intangible assets.

EBITDA tries to place companies on a common playing field by stripping out interest from debt, differences in taxation, and accounting policies to approximate its operating cash flow.

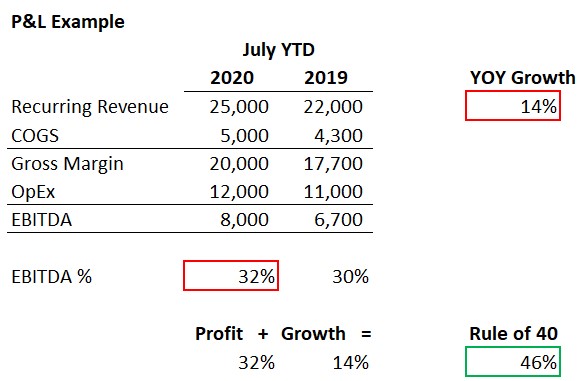

Rule of 40 Example

In the example below, I’m calculating my growth percentage using year-to-date (YTD) recurring revenue growth. You need to use a time period that is truly reflective of your growth and profit margins.

For example, you could calculate your rule of 40 on a trailing twelve months over the prior twelve months and continue to roll forward the calculation each month.

For margin, I am using the current year’s (2020) EBITDA margin.

Rule of 40 Video Lesson

Check out the video below if you’d like to learn this metric by video.

Growth vs. Profit

At its core, the rule of 40 SaaS focuses on the never-ending quest to balance the tradeoff between growth and profit. It’s hard to have a high profit AND high growth at the same time. There’s a trade-off, and you need to determine where you fall in this equation.

If you are experiencing high revenue growth, it’s unlikely that you have high margins, because you are likely investing heavily in sales and marketing.

On the flip side, if you have low growth, you better be generating high cash flow and high EBITDA margins to be attractive to your shareholders, investors, and potential acquirors.

It’s okay to be one or the other. Just recognize where you land in the tradeoff. This framework helps you quantify the tradeoff between growth and profit. It’s grading you on the execution of profit versus growth.

Obviously, the goal is to have profit plus growth greater than 40%. If you’ve achieved the rule of 40, you are deemed healthy or attractive to investors.

Profit vs. Growth with the Rule of 40

In this 3-minute video, I explain how to calculate your Rule of 40, how to interpret the result, and key considerations when using this financial rule of thumb. Not only should SaaS leaders be using this metric, but investors apply this framework to determine if you are operating an “attractive” business.

Download the PPT slides in this video below.

Time Period to Measure

I calculate the rule of 40 over longer time horizons. I include it when reviewing full-year performance, for example, in your forecast P&L.

This gives you enough data to minimize any month-to-month fluctuations that might make smaller measurement periods unreliable.

I like to use at least three months of year-over-year revenue growth. For example, 1Q24 versus 1Q23 revenue. For EBITDA %, I’ll use a trailing three-month or six-month basis for the profit input.

Why Does The Rule of 40 Matter?

The Rule of 40 helps both SaaS operators and investors. As an operator, it adds financial discipline to your decision-making process. As an investor, it helps assess the attractiveness of a SaaS business.

The Rule of 40 indicates the balance between growth and profitability. It may help with:

- Attracting new investors

- Added health metric for reporting to your Board and investors

- Enhance decision-making in the short-term and long-term (e.g. budget allocation, internal funding of new ideas)

- Never losing sight that financial discipline never goes out of style

As a rule of thumb, you should always aim for a percentage higher than 40.

Where Did The Rule of 40 Come From? Who Invented The Rule of 40?

In early 2015, the Rule of 40 entered the SaaS metrics arena when Techstars’ Brad Feld wrote a blog post about it: “40% rule for a healthy software company”. He does mention in his blog post that he had overheard a late-stage investor mention the Rule of 40.

During this board meeting, the investor mentioned this “new” rule. Contrary to common belief, Brad did not invent the rule himself. An unknown late-stage investor invented the rule for SaaS companies with at least $50 million in revenue.

When to Measure The Rule of 40 SaaS?

You should measure the rule of 40 when you are a more mature company. Startups should not be measuring this, because at that stage it’s more about product/market fit, go-to-market strategy, and cash flow.

Brad Feld states that you can begin to measure this when you’ve hit $1M of MRR. I think you can begin to measure this when you’ve built out most of the common, functional departments within your SaaS company.

For example, you have support, services, CSM, R&D, sales, marketing, and G&A. The build-out of these departments can definitely occur before you’ve hit $1M MRR.

By this point, with most departments in place, your eye should naturally be on gross margins, operating leverage, revenue growth, EBITDA, and so on.

Measuring the rule of 40 will be a simple extension of your monthly reporting package. Of course, it’s not the only metric, and you shouldn’t lose sight of other SaaS metrics such as CAC Payback Period.

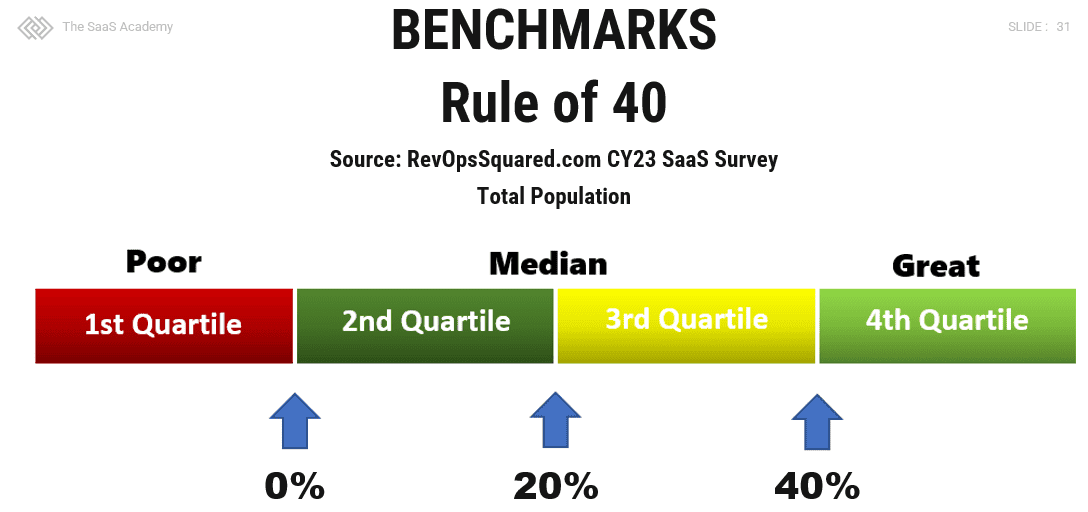

The Rule of 40 SaaS: Benchmarks

There are not many industry studies available for the rule of 40. However, we are in luck! I partner with Ray Rike of RevOpsSquared.com for the latest SaaS metrics benchmarks including the Rule of 40.

The chart below highlights the latest Rule of 40 benchmarks for SaaS companies. As you can see, the median performance benchmarks from his latest survey indicate a 42, just slightly higher than the target of 40.

Here are some additional Rule of 40 benchmarks from a Bain & Company study from 2017:

- In 2017, 40% of software companies outperformed the Rule of 40

- Out of 53 companies that outperformed the Rule of 40, 22 did so for three or more years.

- Software companies that outperform the Rule of 40 have valuations double that of companies that fall “below the line,” and they achieve returns as much as 15% higher than the S&P 500.

- In another master thesis Bas Hottenhuis concludes: “Based on the SaaS and E-commerce analysis, we conclude that the Rule of 40 indicator does in fact contain some information for company valuation. This effect is significantly higher for SaaS and eCommerce than for Tech.”

Three ways to beat the Rule of 40 SaaS

Beating the Rule of 40 is a choice for your SaaS business. How to beat it depends on your individual stage in the life cycle:

- Growth stage: your revenue is growing rapidly. You are burning cash or possibly breakeven from an EBITDA perspective. You are reinvesting all profits and efforts in revenue growth.

- Balanced growth stage: You have modest growth and profits which push you above 40. You are focused on new and existing revenue growth. You may be developing new products for existing and/or new markets.

- Profitability stage: You are focused on becoming more efficient and profitable. For example: reviewing org chart structures, changing pricing, cross-selling and expanding existing customers, exploring new business models, and improving renewal rates. Growth is slower but profits are up.

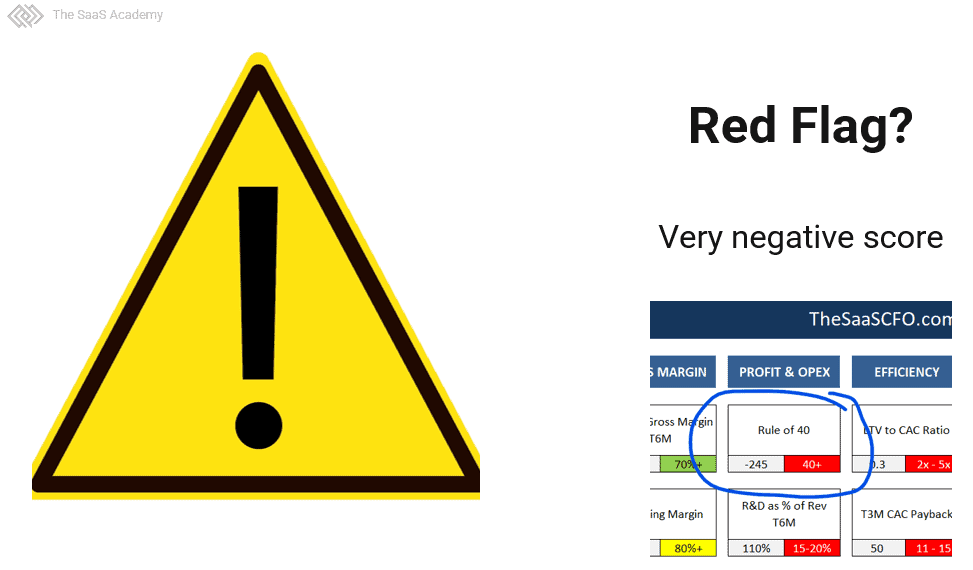

When Is the Rule of 40 a Red Flag for Early-stage SaaS

There is a lot of debate around when to use the Rule of 40. For early-stage SaaS, if you have a highly negative Rule of 40, that is a red flag!

Takeaways The Rule of 40 SaaS

The rule of 40 metric simply adds your growth percentage plus your margin percentage. If that sums to 40% or greater, congratulations, you’ve got a healthy SaaS company. Again, I use recurring revenue growth and EBITDA margins over a representative time period.

If you are sacrificing growth for profit or profit for growth, run this quick test to see if your path forward is healthy.

Do you measure the rule of 40? I would love to hear your comments below.

Download the graphics and formula with the button below.

Suggested Reading

Brad Feld | his take on the Rule of 40

Monthly Recurring Revenue (MRR) | are you applying this correctly?

The SaaS P&L | proper setup is key to SaaS financial management

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Hi Ben,

Thank you very much for your post.

With your approach of taking EBITDA I wonder how you would account for the differences in capitalization of R&D costs. Ceteris paribus, a company that decided to capitalize R&D costs could perform significantly better on this metric compared to a company that does not capitalize R&D.

I would be keen to learn about your view on this.

Best regards,

Martina

Yes, great point, Martina. Seems like every company has different views on R&D capitalization. Even auditor views differ. When I’ve had significant R&D capitalization, I’ve tracked EBITDA with and without the impact of R&D. So I added the P&L credit back to EBITDA. I don’t think there is any standard, but at least it makes you aware of the difference and can be explained to management/owners.

Hi Martina,

Yes, R&D cap can cause a big difference. And everyone does it differently for cap. I always liked to look at EBITDA excluding and including R&D capitalization. Can tell different stories. Internally, you need to decide how to present to management and why. Sophisticated external consumers of your financials should understand the difference.

Ben

I did the calculations for the first time with the figures July YTD (2018 vs 2017) and we have a total of 38%. Basically leveraged on sales growth.

La Comunidad Argentina

Excellent!

Ben,

Two questions.

– When measuring quarterly assuming you’re using 10% vs. the 40%? So you’d expect a 10% growth Q1 FY17 vs. Q1 FY18, or do you still take a trailing twelve months and compare at 40%?

– Do you take out services because you’re assuming they’re one time revenue? If you have a recurring services business that runs paralell with your SaaS business, (i.e. you sell a yearly service along with your yearly SaaS platform and you expect both to renew) would you include that in, or still factor that out?

Hi Joshua,

I would still measure against the 40% number. Even if quarter over quarter. You want to pick a time period that best represents your growth.

Yes, I exclude services b/c it is non-recurring. You may want to calculate another rule of 40 with and without recurring services.

Ben

Great post. Do you exclude Stock Based Comp from EBITDA (effectively calculating an Adjusted EBITDA)?

Hi MJ,

I look at our straight EBITDA and then an adjusted EBITDA (approved add backs). Just depends on how your owners/investors/managers want to view EBITDA.

Ben

Hi Ben

Excellent article! On the calculations, we’ve got 2 types of revenue, a hardware component and recurring revenue. On calculating your EBITDA, I see you also only use Recurring Revenue but then do you need to exclude COGS for the hardware component?

Regards

Ben, thanks for another great post.

When looking at EBITDA on a trailing 12 month or annual basis as a percentage, do you calc it as a percentage of GAAP revenue (which in a growing business is not the same as MRR x 12). Or do you annualize your current month’s recurring revenue?

And I won’t ask about ASC 606 impact on Rule of 40….

Hi Richard, I will always calculate EBITDA as a percent of GAAP revenue. However, if you have acquired a company and it has deferred revenue which is written down to cost, I will make an adjustment for that in my EBITDA P&L. Ben.