The SaaS P&L is critical to the management of your SaaS business. I talk about the SaaS P&L (profit and loss statement) almost every week with SaaS founders, finance, and accounting teams. At this point, I’ve reviewed hundreds of SaaS P&Ls (also called an income statement). I’d say about 90% of them are structured incorrectly, 5% are close, and 5% are correct.

A properly structured SaaS P&L is a foundational pillar of financial management for SaaS teams, Boards, and investors. In this post, I’ll dive into the SaaS P&L structure, so that you can perfect your SaaS P&L.

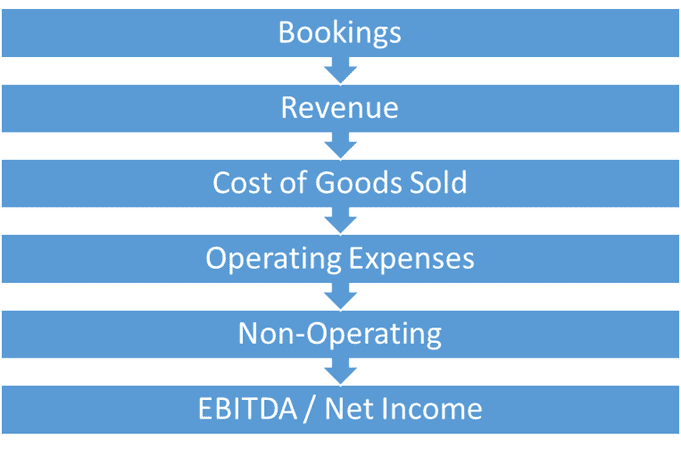

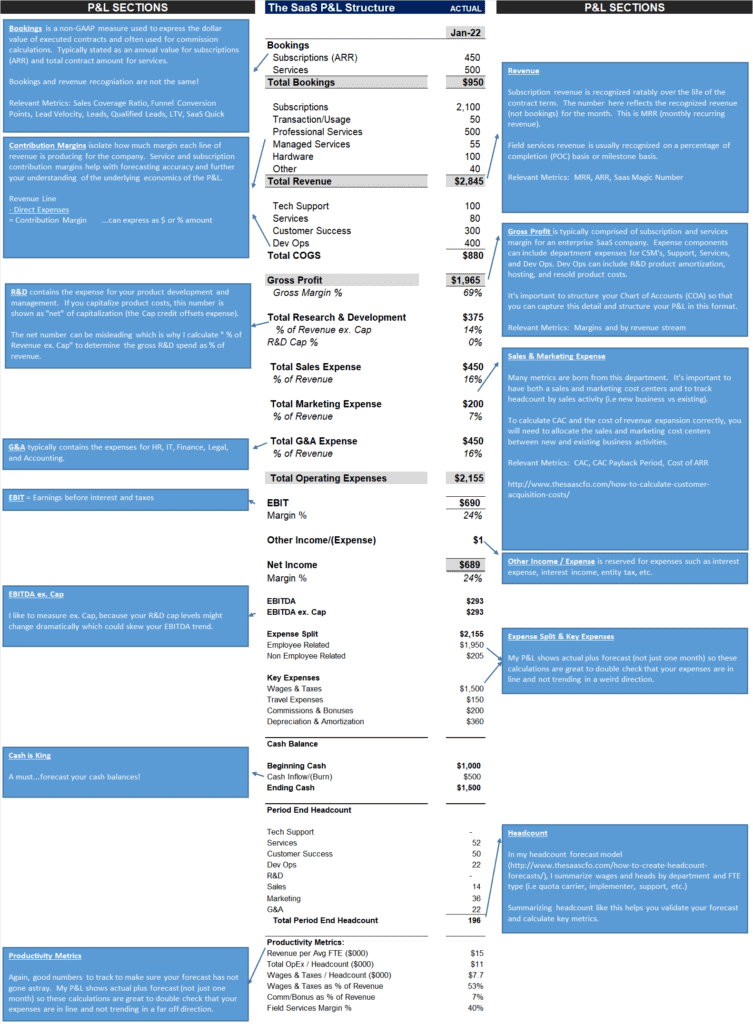

The SaaS P&L Structure

My SaaS P&L is structured in five major sections. These sections include bookings, revenue, cost of goods sold (COGS), operating expenses (OpEx), and non-operating.

When I assess a SaaS P&L, I start with a macro view of these sections. Do we have the major blocks in place? If not, we need to dig into the major functions within your company and equate them to SaaS departments.

Understanding your business model is important to this process, especially for the definition of your COGS departments.

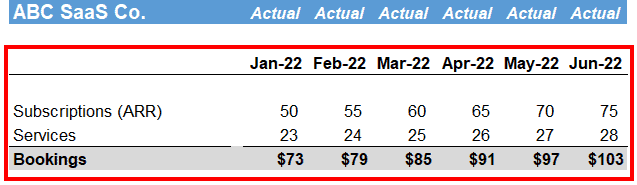

Section 1 | SaaS Bookings

A SaaS booking is an executed contract for product and/or services. This concept still applies if you offer a low price point, self-service delivery SaaS product. I like to summarize bookings at the top of my P&L. Why? Because everyone asks about bookings performance! If they don’t, they should.

Bookings are life of our SaaS business. It drives our revenue and is a common water cooler discussion. I summarize bookings based on our major streams. If we have only subscription revenue, we will summarize subscriptions bookings on an ARR-basis. If we sell professional services to onboard our customers, we will summarize the total, contracted one-time services revenue.

Tips and Tricks

- Proper CRM set up is critical to easy bookings measurement.

- ARR bookings include new bookings and expansion bookings.

- Bookings are recorded at the time of contract execution.

- Bookings do not mean invoicing or revenue yet. See this post on the SaaS revenue cycle.

See my SaaS bookings post on a deep dive into this topic.

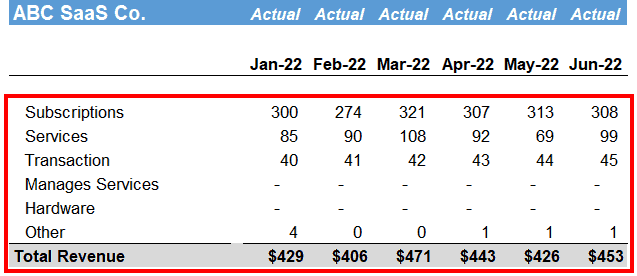

Section 2 | SaaS Revenue

The revenue section in our SaaS P&L is defined by our products, services, and pricing. We must show clear and distinct revenue streams. Recurring revenue must be separate from one-time revenue. Recurring revenue must be broken down into contracted versus variable.

Revenue Categories

- Subscriptions – contracted MRR or ARR. Fixed monthly or annual amounts for our software.

- Transaction/Usage/Consumption – this is our variable revenue driven by quantity and unit price. You may have pricing floors, or it may be completely variable.

- Professional Services – these are the one-time fees we charge to onboard our customers. This ranges from small fees for simple onboardings to complex, multi-month implementations.

- Managed Services – this is a new category that I’m seeing. If you are offering subscriptions for services work (for example, report writing) or tech-enabled services, you break this out from professional services to show the recurring nature.

- Hardware – I don’t see this often, but if you offer a point-of-sales (POS) solution, for example, you may provision and sell hardware to your customers.

- Other – this could include user conferences, accounting adjustments, etc.

Tips and Tricks

- The setup of your chart of accounts is important for revenue. You need different general ledger (GL) accounts for each revenue stream.

- If you don’t offer many products, you may have GL accounts for each product line.

- Please don’t use one generic sales discount GL account. If you are coding discounts to a separate GL account, create a GL discount account for each revenue stream. Why? Net revenue is used in SaaS metrics.

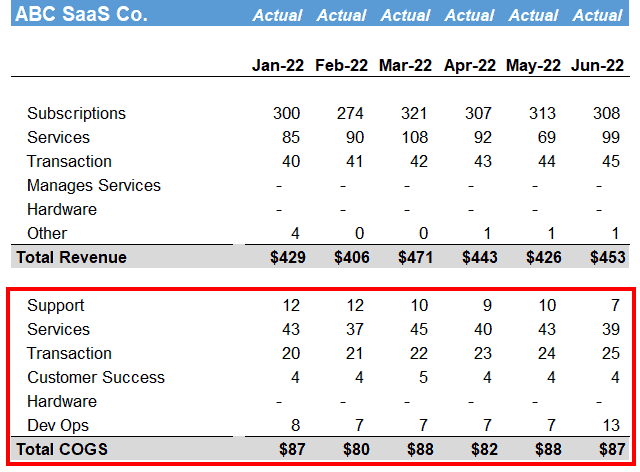

Section 3 | SaaS Cost of Goods Sold (COGS)

SaaS cost of goods sold, or COGS, are the expenses in our SaaS business that are required to deliver and/or support our revenue streams and customers. For pure play SaaS, you typically see Support, Services (if you have onboarding), Customer Success (if they don’t sell), and Dev Ops. Of course, you could also have transaction and hardware cost centers.

COGS Cost Centers

- Tech Support – inbound phone, chat, and web support for customer requests, issues, and bugs.

- Services: implement and configure software and train customer on its use.

- Transaction – expenses associated with variable revenue.

- Customer Success – number one job is to retain customers and identify potential customer expansion.

- Hardware – cost of hardware sold to customers.

- Dev Ops – maintain customer-facing hosting infrastructure (i.e., AWS, Azure), customer upgrades, and hosting service level agreements (SLA’s).

Tips and Tricks

- Each cost center is fully burdened. Wages, taxes, benefits, travel, training, etc.

- Department managers should be coded to their respective cost centers.

- Correct cost center definition allows for easy gross margin calculations.

- Early stage employees wear multiple hats. You might want to reclass their wages to the respective departments if it has a material impact on your P&L. For example, a software engineer who also handles tech support.

For a deep dive on SaaS COGS, check out this post.

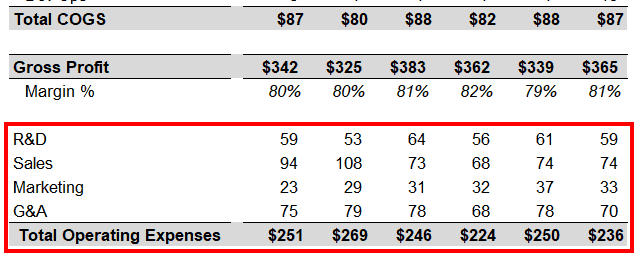

Section 4 | SaaS Operating Expenses (OpEx)

SaaS operating expenses, or OpEx, are the expenses below gross profit that support the infrastructure, growth, and continued development of our business model. I hate to say “always,” but SaaS OpEx almost always looks like the structure below. It really never varies from this.

OpEx Cost Centers

- R&D – design, develop, test, fix, and release software applications.

- Sales – sell your products and/or services to new and existing customers.

- Marketing – lead generation, pipeline creation, events, and brand.

- G&A – human resources, finance, accounting, internal IT, and legal.

Tips and Tricks

- Each cost center is fully burdened. Wages, taxes, benefits, travel, training, etc.

- Department managers should be coded to their respective cost centers.

- CEO, founder, and CFO should be coded to G&A.

Section 5 | Non-Operating

The non-operating section summarizes our non-operating expense and income. This could be interest expense on your debt and/or interest earned on cash investments. Of course, it gets more complicated than that.

With non-operating, we want to ensure that we are NOT coding this expense/income to G&A or some other spot on our P&L. I’ll also code corporate taxes to this line if the entity is taxed at the corporate level.

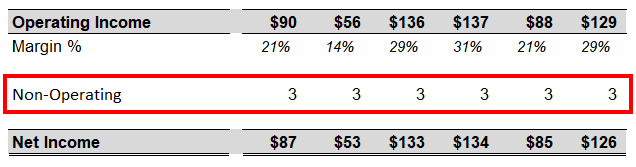

SaaS Benchmarks

Generally, here is what I am targeting for SaaS P&L benchmarks. For early stage SaaS, you will not hit these nor do you want to yet. But over time, you will want to keep these benchmarks in mind and your progress towards them.

- Overall gross margin – 70%+ with a target of 80%

- Recurring gross margin – 80%+

- Services gross margin – this varies widely but I like to make some margin, 15-25%

- R&D as % of revenue – 20%

- Sales and Marketing as % of revenue – I look at sales and marketing efficiency metrics

- G&A as % of revenue – <20%

Next Steps

Is your SaaS structured like the sections above? If not, you need to investigate your chart of accounts and department coding. There is so much insightful data coming from your SaaS P&L. It’s also much easier to calculate your SaaS metrics.

Download the my SaaS P&L “explained” template below to help guide you on your journey towards financial transparency.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Thanks for the article, really interesting!

Which accounting systems have you most enjoyed using to displaying data in this customised format?

Hi Matt, usually, difficult to have your accounting system produce this format. I usually have to use an FP&A tool for better reporting. Ben