The Software as a Service (SaaS) business model revolutionized the on-premise software industry. I started out in software in 2004. One-time software sales and annual maintenance at 18% of the perpetual license.

We weren’t talking CAC Payback and Gross Revenue Retention. But we were talking gross margins and margins by revenue stream.

SaaS introduced a unique set of financial management challenges that differs significantly from traditional businesses and the on-prem model.

I’ve helped over one hundred SaaS companies in their accounting and finance set up. What’s their biggest roadblock? Their accounting foundation.

Accounting isn’t sexy, but it sure is satisfying. I want you to enjoy that same satisfaction that leads to better financial decisions. In this post, I’ll cover the steps that I follow when assessing and improving the accounting foundation.

Key SaaS Accounting Principles and Best Practices

SaaS businesses must follow accounting principles specific to recurring revenue business. This dictates how we set up our accounting structure.

You can’t work in SaaS with hearing someone talk about “rev rec.” Revenue recognition is a fundamental concept in SaaS accounting. And it must be “bullet proof” to stand up to your Board, investors, and auditors.

Under ASC 606, revenue should be recognized when the performance obligation is satisfied, typically over the subscription period. This may lead to deferred revenue on your balance sheet. Payments received in advance are recorded as a liability until the service is delivered or the obligation is satisfied.

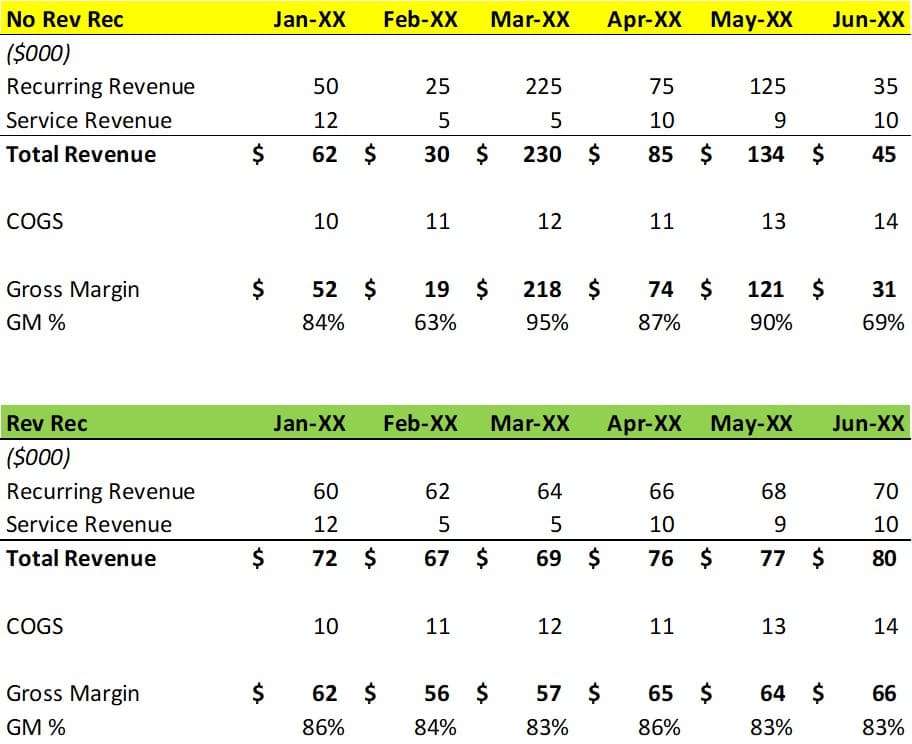

The picture below is a slide from my SaaS Metrics Foundation course. You can see why accrual accounting and rev rec helps us understand the true business economics. I’ll cover cash vs accrual later in the post.

GAAP compliance is critical for SaaS businesses, especially those considering large investment rounds or an exit to private equity or a strategic buyer.

We must make our financial data easily consumable for our stakeholders.

Capitalized commissions are another important consideration for SaaS companies. Thanks to ASC 606, certain sales commissions can be capitalized and amortized over the expected customer life (debatable point), rather than accrued and expensed immediately. The joy!

Accrual Accounting vs. Cash Accounting

If you are a SaaS founder, you will be involved in an accrual versus cash discussion whether you like it or not. SaaS companies typically start with cash-basis accounting and then switch to accrual over time. I say “over time” because you may start doing rev rec but not do pre-paid expenses, for example.

Around the $3M ARR mark is when you should get serious about your accrual accounting.

Accrual accounting is essential for SaaS financial management, because it provides a more accurate picture of your financial and economic health. Your record revenue and expenses when they are earned or incurred, regardless of when cash changes hands.

Accrual accounting and cash-basis accounting are two fundamental methods used in financial reporting. Your accounting team should have no issues with accrual accounting, but it’s a good question to ask your bookkeeper.

Cash-basis accounting only records transactions when money is received or paid out. While simpler to maintain your books with the cash-basis method, it makes it difficult to understand your true monthly financial performance.

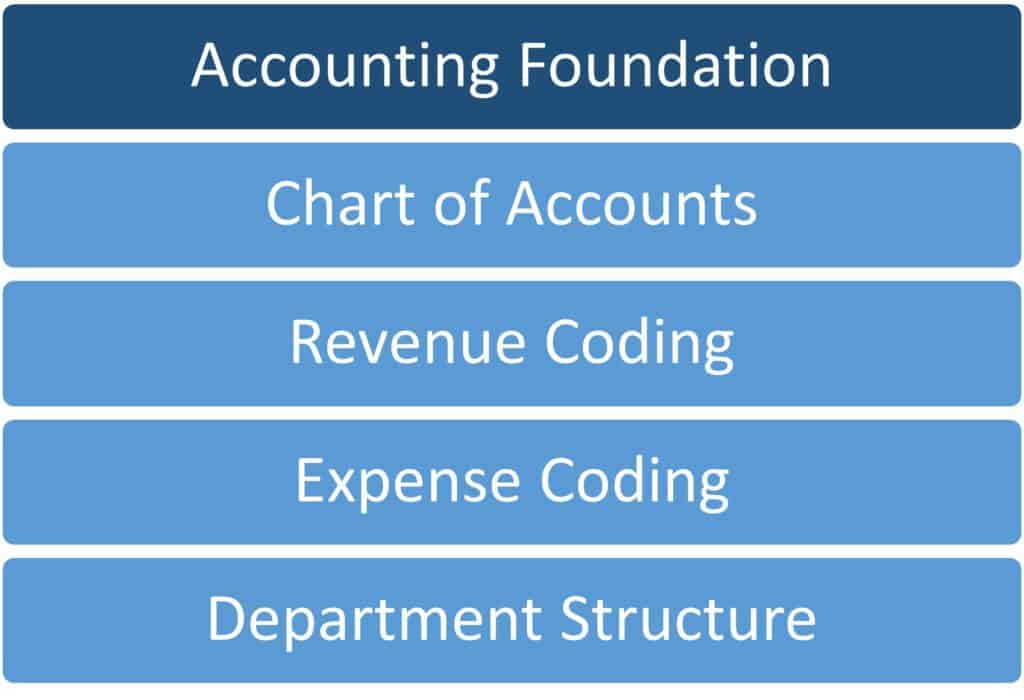

The Building Blocks of the SaaS Accounting Foundation

After helping so many SaaS companies with their accounting, I see common mistakes in their initial set up. These mistakes can be overcome, but if you let them linger, it becomes much more work down the road. Don’t find yourself in that position.

You can almost guarantee that when you need clean accounting data, you’ll be trying to raise funds or be approached for an exit. Give yourself plenty of runway to fix your accounting (and calculate your metrics).

Bad accounting data and fundraising don’t mix.

My accounting building blocks include the chart of accounts (COA), revenue coding, expense coding, and COA structure. Let’s tackle your COA first.

The SaaS Chart of Accounts

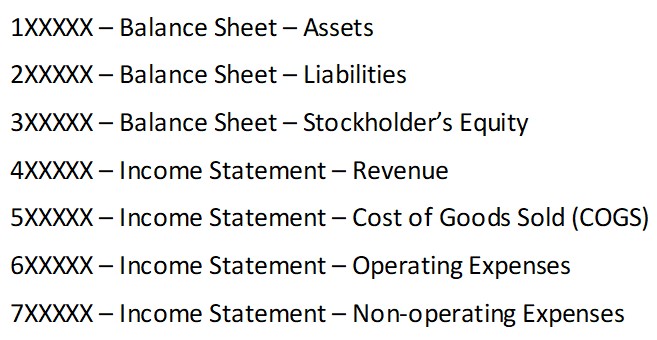

A chart of accounts, often abbreviated as COA, is simply a numerical and descriptive listing of all the accounts on your general ledger from the balance sheet to the income statement (aka P&L). The numbers typically start at 1XXXX (can be for 4 or 5-digit) and end at 9XXXXX.

What is a general ledger? The general ledger, or GL, is where your accountant or bookkeeper records the debits and credits. Your financial transactions. It contains the history of your financial transactions from day zero.

We sum all those debits and credits into categories which creates structure for your accounting data. That structure forms the basis of your financial statements.

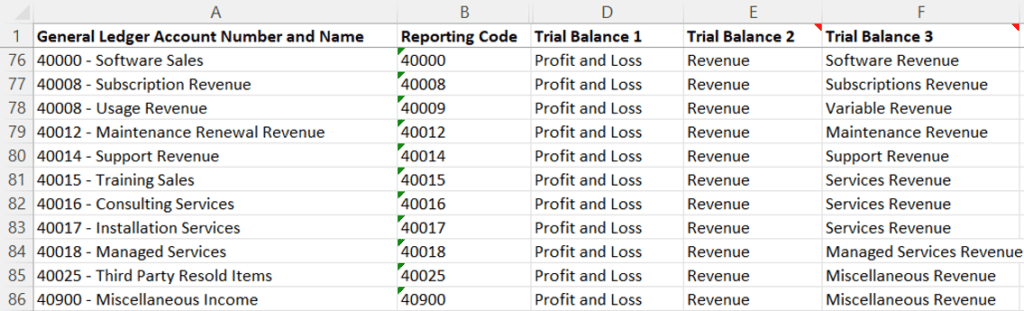

Your accounting software is loaded with an “off the shelf” COA structure. However, you can’t use that stock Xero or QBO chart of accounts. It’s too generic. We must add detail in the form of GL accounts (GLA) in the revenue and expenses areas to “SaaSify” your chart of accounts.

On the balance sheet side, the stock COA usually serves us fairly well. However, we will have specific accounts for deferred revenue and capitalized commissions, for example.

SaaS Revenue Categories

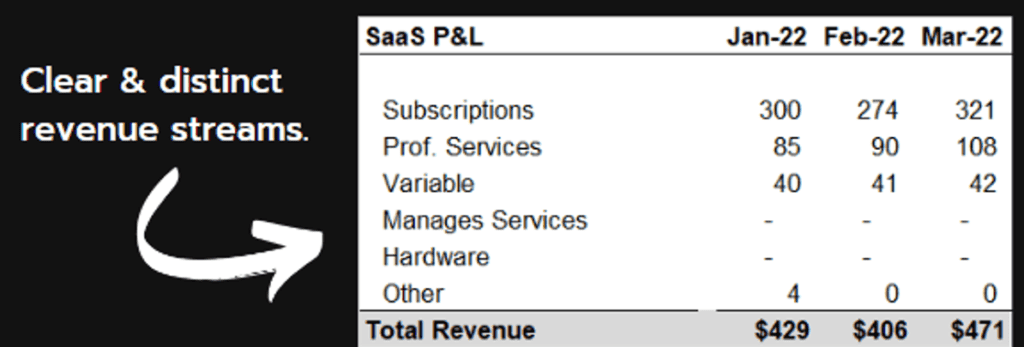

We must create clear and distinct revenue streams on our SaaS P&L. This impacts more than just accounting. It impacts how we forecast, how we create SaaS metrics, and how we present to our Board and investors.

Co-mingling your revenue streams is one of the biggest mistakes that I see.

We can’t mix recurring revenue with one-time revenue streams. And one step further, we shouldn’t mix subscription revenue with variable revenue. Variable revenue includes usage-based, transactions, consumption, processing, etc. I also don’t like mixing overage revenue with other types of revenue.

To eliminate revenue mixing (this is not cocktail hour!), we must have enough GL detail on our chart of accounts (COA) so that we can distinctly code our revenue to the five major SaaS revenue streams.

These revenue streams include:

- Subscriptions – fixed MRR or ARR contracts

- Variable – by its nature, it fluctuates month-to-month based on specific drivers

- Professional Services – one-time revenue for the setup and configuration of our software for our customers

- Managed Services – people-powered services revenue on a subscription basis (not ARR, IMO)

- Hardware – physical products sold with our subscription

- Other – conference revenue, other small revenue items

The picture below provides an idea of the detail needed in the revenue section of our COA.

Department Coding

Our SaaS company is comprised of departments (eventually). Our accounting structure must follow our department structure.

We want to avoid the big bucket of expenses on our SaaS P&L. For example, I often see all employee wages coded to a non-specific department or just coded to “wages” on the P&L. That doesn’t cut it. We can’t determine where we are spending our money. We really can’t do much with that.

Enter the department coding structure. Every single expense that hits our P&L must be coded to a department. This may sound like a lot of work, but it’s just part of the normal close process.

I like to say that the expenses follow the people. That Wi-Fi charge on the United flight? It gets coded to that person’s department.

G&A cannot be your expense dumping ground.

Here are the common SaaS departments:

- COGS

- Technical Support

- Professions Services

- Customer Success

- Dev Ops

- OpEX

- R&D

- Sales

- Marketing

- G&A

Your SaaS COGS vs. OpEx coding is so important. Another common coaching call. Without coding discipline, your gross profit and your margins by revenue stream will be wrong.

If you tell me that you are $15M ARR running 90% gross profit, I’ll..well, you know, not believe you!

Your accounting software will have a specific department coding design. In QBO, for example, it’s common to use the Class structure. In other software, it might be called dimensions.

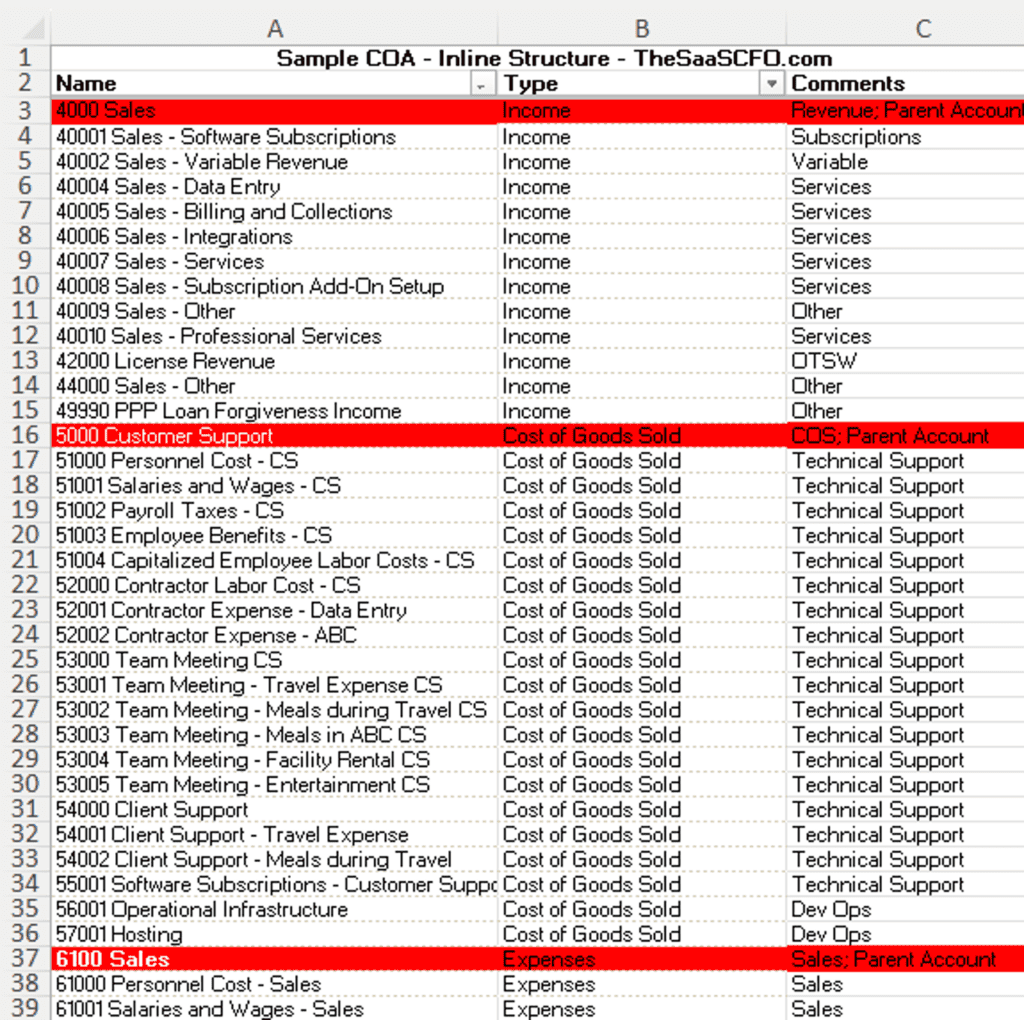

Inline or Department Accounting Structure

Okay, we’ve identified our current departments and future departments. Next, we must choose an accounting structure for our chart of accounts. I alluded to a “Class” structure in QBO above.

When coding debits and credits, at a minimum, we must pick GL accounts to post the entry to. But we can take it step a further and code the entry to an additional “dimension.”

When we code revenue or expenses to a GL account and dimension, it creates a multi-dimensional structure in our accounting data. That’s often called a department or multi-dimensional structure.

It provides the detail we need to roll up department expenses to a properly formatted SaaS P&L. It also provides the data we need for forecasting, financial analysis, and SaaS metrics.

With a department or dimensional structure, we maintain our COA with unique GL accounts. For example, only one wage account. But we segment wages by department by coding wages to the “wage GL” and then to the Class or dimension level.

If we don’t choose a dimensional structure, we are left with an “inline structure.” It’s one dimensional. We code expenses to just a GL account and not a second dimension such as a department.

But with the inline structure, we must repeat our GL accounts. For example, we will have multiple wage accounts. Wages – Support, Wages – Customer Success, and so on. It’s easy to create a SaaS P&L from the inline structure but we lose multi-dimensionality.

There are pro’s and con’s to inline and multi-dimensional structures, but if you see yourself scaling past $10M ARR someday, I recommend the department/dimension accounting structure.

Non-operating Expense

Just quick thoughts on non-operating expense and income. I see a lot of SaaS companies with debt. We record the interest payment to the P&L. I don’t like these coded to G&A. We should code to the non-op section of our P&L.

I create a department for non-operating, so we don’t comingle these expenses with operating expenses. Reporting is much easier and cleaner.

Implementing Robust Financial Systems for SaaS Companies

Technology is key to scaling your finance and accounting function. Don’t brute force it with heads. There’s just too much data to handle in the close process.

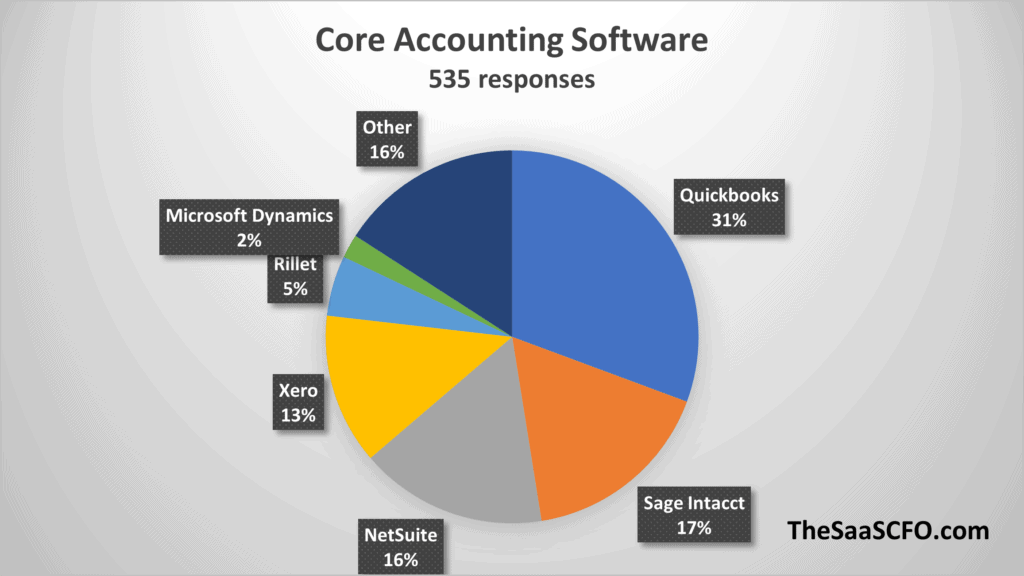

Here’s how I see the evolution of your accounting tech stack. You start with accounting software. Say, QBO or Xero. Then your company scales and becomes more complex.

The chart below is from my latest SaaS tech stack survey. Click the picture below for the full report.

Then you begin to look for point solutions that offer better functionality than your core accounting software. You may need specialized invoicing software, so you sign up for a subscription management system that offers better invoicing and revenue recognition capabilities.

Then there’s compliance. We must be compliant in sales and use tax. Taxing jurisdictions are becoming more sophisticated finding companies operating in their locale that are not remitting tax on their revenues.

Then you’ll want FP&A software and so on.

Just like our Dev team has their product roadmap, CFO’s need a product roadmap for the back office. Core accounting software just doesn’t offer enough features to manage our SaaS business.

Outsourced Bookkeeping

I help a lot of SaaS companies under $15M ARR. I’d say 90% outsource their bookkeeping. This can be very cost-effective, but make sure your bookkeeper understands SaaS!

This is a common complaint that I hear from SaaS founders. Like any service provider make sure they understand the SaaS business model.

Then there comes the “divorce.” Your local tax CPA says they can also handle your monthly accounting. There is some runway here but eventually it runs out. Another common complaint. Some tax shops are just not build to handle your monthly close.

If you are happy with your tax firm, then you find a bookkeeper that specializes in SaaS. It also helps diversify back office risk. Just like the bookkeeping firm that also handles your fractional FP&A or CFO work.

Here are my “go to” SaaS bookkeeping firms. I’ve known Monty and Rusty for years now.

Takeaways

Don’t let your accounting get out of control! It will cost you much more down the road. Not just consulting dollars but also financial blindness.

- SaaSify your chart of accounts

- Implement a department coding structure

- Don’t comingle your revenue streams

- Focus on good detail with your people expenses

- Don’t comingle employees and contractors

- Separate bonus from commission

- Don’t code all benefits and taxes to G&A

- Get serious at $3M ARR

- Plan the evolution of your back office tech stack

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.