Customer acquisition cost, or CAC, is a ubiquitous SaaS metric. It’s a core sales and marketing efficiency metric. CAC measures the amount of expense to acquire a new customer and the associated revenue from that customer.

However, CAC as a standalone measure does not tell us much. We need context. This context comes in the form of the LTV to CAC ratio and the CAC payback period.

We can calculate two forms of the CAC payback period. Traditionally, you calculate CAC on a customer count basis. But today’s pricing models are changing. Maybe, count doesn’t tell us much, or it’s all about expansion revenue growth to drive net dollar retention. We can eliminate “logo bias” by calculating the CAC payback period on a dollar basis.

What is CAC

Customer acquisition costs are the sales and marketing expenses associated with acquiring new customers. When referencing CAC, we must clarify a bit. We could be referencing the gross sales and marketing expenses associated with customer acquisition. Or we could be referencing the unit cost associated with acquiring new customers.

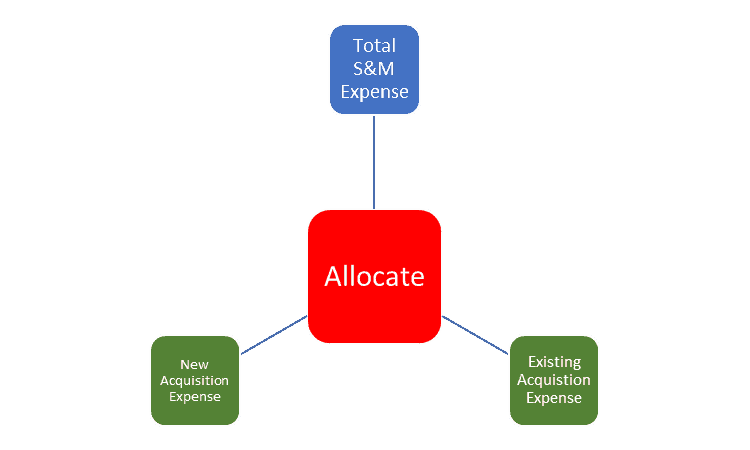

When calculating the unit cost of acquisition, we must allocate sales and marketing expense between new and existing customer acquisition. We must then input the expense associated with new acquisition only into the CAC formula.

In early-stage SaaS, new business focus may be 100% of your sales and marketing expense. With mature sales and marketing departments, you may see a 70/30 split between new and existing.

What is the CAC Payback Period

CAC payback period is the number of months required to pay back the upfront customer acquisition costs after accounting for the variable expenses to service that customer. My payback period formula is gross-margin adjusted, hence the “variable expenses” in the description above.

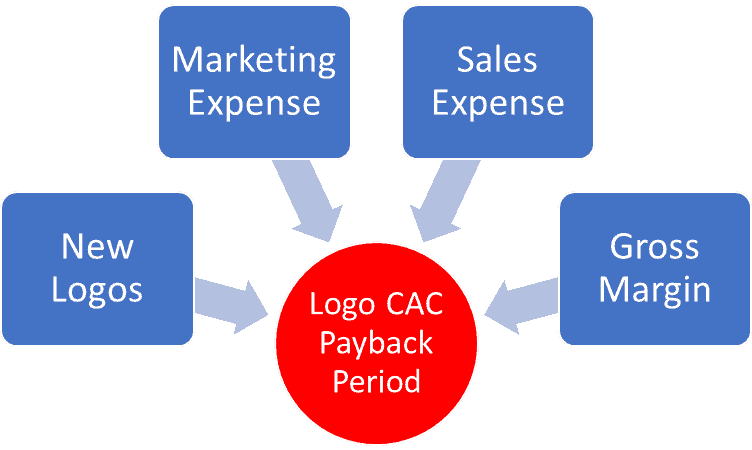

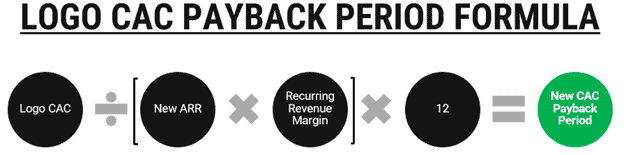

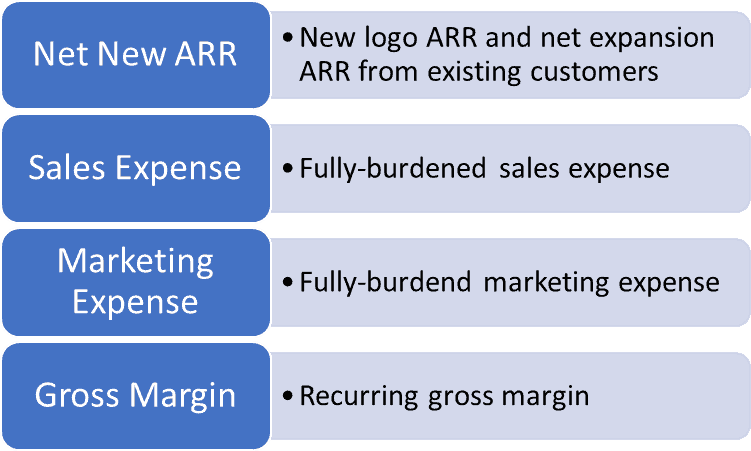

The traditional CAC payback period calculation focuses on new customer CAC. It doesn’t factor in any expansion revenue. To calculate the logo-based CAC payback period, we need the inputs below.

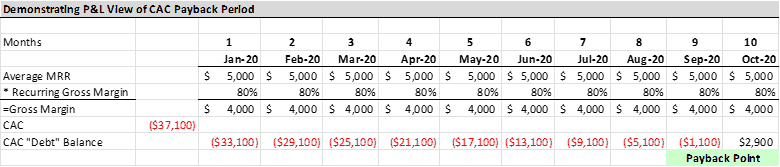

The spreadsheet snippet below visualizes the concept behind the payback period. In the example below, CAC is $37,100. The average MRR from that new customer cohort is $5,000 and our recurring gross margin is 80%. Every month, the gross profit goes towards the CAC payoff. Finally, in month ten, we have paid off the CAC and the gross profit drops to our bottom line.

What is Dollar-based CAC Payback Period

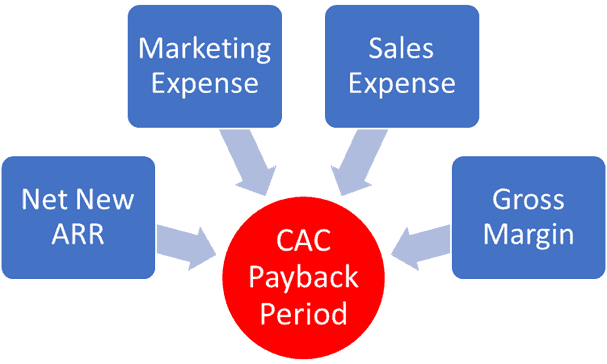

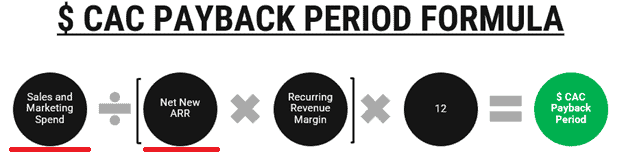

The dollar-based CAC payback changes two inputs in the payback period formula. We replace Logo CAC with all sales and marketing expense. We replace New ARR with all net new ARR coming into our business.

With these changes, we are now measuring the number of months to pay back ALL sales and marketing expenses associated with both new and expansion acquisition. We don’t have to allocated between new and existing sales and marketing expense. We also don’t have to worry about varying deal sizes that may bias the average ARR that we bring in from a new customer cohort.

Dollar-based CAC payback period measures the number of months to pay back ALL sales and marketing expenses associated with both new and expansion ARR acquisition.

The key to the dollar-based CAC payback period is that we don’t care about the count of logos (i.e. users, customers). We care about the recurring revenue dollars driven by new and expansion sales.

Please note that I multiply by 12, because I am using an ARR number in the formula. If you use MRR in the formula, do not multiply by 12.

In the net new ARR box above, I may also include an offset for downgrade bookings. If it requires a sales motion to renew an expired customer contract and that customer drops product, I will subtract the downgrade amount from net new ARR.

CAC Is Like Debt

Debt takes on many forms within a company. It could be a bond or a traditional term bank loan. Typically, there is a principal balance that you repay over time along with some type of interest component.

What if I were to say that Customer Acquisition Costs (CAC) were just another form of corporate debt with a twist? Stay with me. You have a balance or principal amount (the amount spent to acquire a new customer) and an interest component. In this case, the interest is the opportunity cost of monies tied up in CAC that could have spent elsewhere (for example, new product).

That’s why you hear people say that churn is a SaaS killer. If customers begin churning out before the payback month, it puts more burden on new customer acquisition to fund the business and pay off old CAC debts. Long CAC paybacks also tie up working capital.

Summary

CAC Payback Period is one of my favorite metrics and included in my CAC profile assessment. As traditional debt can steal away our free cash flow, so can your CAC debt. With a few key inputs, you’ll better understand the long-term economics of your SaaS business.

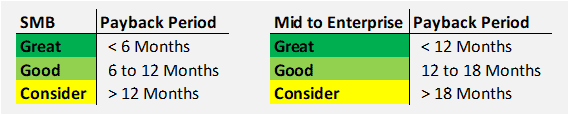

The table below is my general rule of thumb for CAC payback period benchmarks. It depends on your target market.

Download my CAC template below. Input your data and see where your payback period lands.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.