SaaS revenue recognition is an ongoing priority for SaaS accounting teams. Software subscriptions are the life of every SaaS business and must be accounted for properly in your general ledger.

However, most SaaS companies I have spoken with are incorrectly recording their most important revenue stream. That is SaaS subscription revenue and the corresponding deferred revenue balance.

And I don’t blame you. Often, your SaaS accounting is outsourced to a bookkeeper or accountant who is not familiar with the SaaS business model. Your accountant compiles your financial statements but does the accounting on a cash basis or quasi-cash basis. Proper SaaS revenue recognition is not a priority.

What is SaaS Revenue Recognition?

Revenue recognition’s core principle states that an entity should only record revenue when it has been earned, not when the related invoice has been posted or related cash has been collected.

The core principle to the guidance in ASC 606 / IFRS 15 is to “recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.” As a result, we have the following five-step framework to revenue recognition.

I know this is getting a bit technical. The good and bad news in the new revenue recognition guidance is that it is a framework. It is not going to tell you exactly how to recognize your revenue. Rather, it’s more of a map, which means a lot of companies might interpret the directions differently.

With 2019 as the first year of implementation for private companies, I believe you will see the interpretation evolve and solidify over time.

Check out my video lesson below on SaaS revenue recognition.

SaaS Revenue Recognition Example

Ok, let’s get to the basics of SaaS revenue recognition. Under a cash basis of accounting, your accountant invoices an annual, one-year subscription for $12,000, for example. Your accountant records the entire revenue amount (from the invoice total) in a single month in your financial statements. That’s not what we want.

Of course, there are so many new nuances with ASC 606 that I will assume that you are pure play SaaS. Under proper SaaS revenue recognition, your accountant will invoice the customer for $12,000. However, this transaction will affect only your balance sheet. No subscription revenue will be recorded! Yet.

The journal entry will create a debit to Accounts Receivable and a credit to Deferred Revenue. As you fulfill the obligations of that subscription, you will recognize the revenue ratably over the contract term.

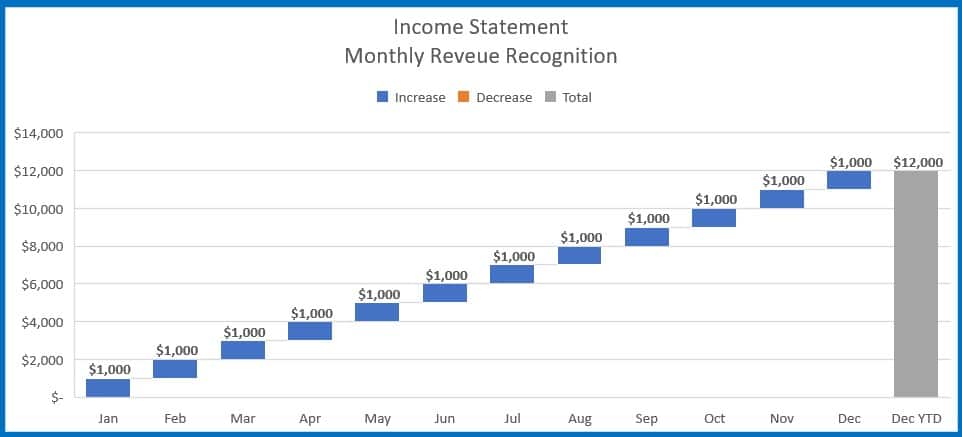

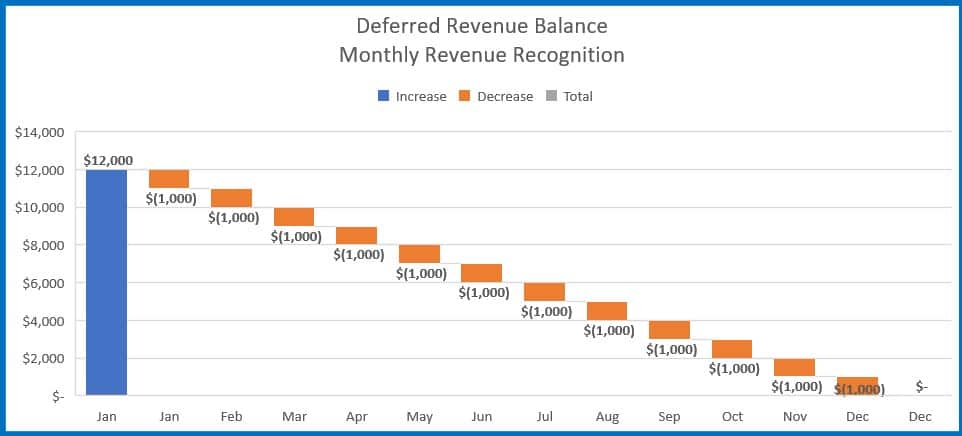

In this example, we will recognize $1,000 a month over a twelve month period. At the end of twelve months, we have recognized the full $12,000 as seen in the chart below.

Whether your accountant is recording subscription correctly or not, as a SaaS founder or leader, you must understand the concept of SaaS revenue recognition and deferred revenue. If you do not know your revenue recognition policies, ask your accounting team today.

More importantly, it’s difficult to manage the financial performance of your business without proper SaaS revenue recognition.

ASC 606 – Revenue From Contracts with Customers

And remember, the deadline for private companies to comply with ASC 606 in the United States begins January 1, 2019.

What is SaaS Deferred Revenue?

Deferred revenue in accrual accounting is rooted in the matching principle. When you invoice a company for a one-year subscription, you have not earned that revenue yet. You earn it over the term of the subscription. Therefore, you must “park” the revenue on the balance sheet.

Deferred revenue is a payment from a customer for future goods or services. The seller records this payment as a liability, because it has not yet been earned.

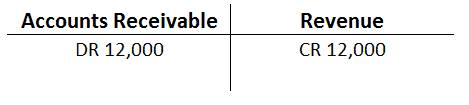

If you sell widgets, for example, you invoice the customer for the widget and then recognize the revenue at the same time on the income statement. You debit accounts receivable and credit revenue.

However, with long-term subscriptions, you invoice a customer for a one-year subscription, but you can’t recognize that revenue instantly on the income statement. You must park the revenue on your balance sheet as a deferred revenue liability.

Why a liability? Because you must perform or owe a service or obligation to your customer. In our case, it’s delivering the software as a service each month over the subscription term.

SaaS Deferred Revenue Example

Let’s assume a customer has signed up for one-year subscription that is payable now. You invoice the customer $12,000 for a one-year subscription on January 1. The subscription expires December 31 and they have access to the software today, January 1.

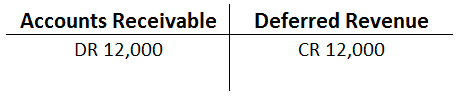

You invoice the customer for $12,000 which debits accounts receivable and credits deferred revenue. See the T account below.

Notice that this entry is a general ledger transaction on your balance sheet only. You have not touched the income statement yet.

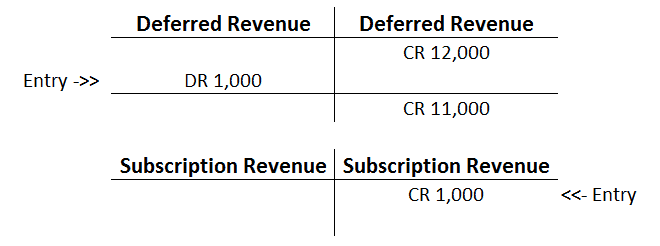

Now, it is February 1, and your accountant is “closing” your January books. Meaning, they are posting the entries necessary to create your January financial statements

The accountant will debit deferred revenue for $1,000 and credit subscription revenue for $1,000. This reduces your deferred revenue liability from $12,000 to $11,000, and your income statement now shows $1,000 of subscription revenue.

You then replicate this process each month until your deferred balance is zero (for this customer). You can see from the chart below that we start with a $12,000 deferred revenue balance and then pull $1,000 from this balance and record it as subscription revenue on our SaaS P&L.

Daily or Monthly SaaS Revenue Recognition

In this example, I’m assuming that you are recognizing revenue evenly over the twelve months. You may also recognize revenue based on the days in the month. For example, January recognition would be 31 / 365 * $12,000 = $1,019.18. Assuming no leap year.

Helpful Tip: When posting the subscription invoice, please do not credit revenue on the income statement account for $12,000 and then move $11,000 to the balance sheet. Post directly to deferred revenue on the balance sheet with initial general ledger entry. It’s so much cleaner this way and easier to maintain your deferred revenue sub-ledger (which your auditors will ask for!!)

Why is SaaS Revenue Recognition and Deferred Revenue Important to Implement?

There are several important reasons. First, you have no idea about the financial performance of your SaaS business when in one month you have $100K of subscription revenue and in the next month you have $30K of subscription revenue.

It’s impossible to see how your recurring revenue is growing. And, you will not be able to properly calculate your SaaS gross margin and recurring gross margin. And without gross margins, it’s hard to steer the financial performance of your business or assess the impact of new bookings or new headcount.

You also won’t be able to properly calculate specific SaaS metrics such as customer lifetime value (CLV) or CAC payback period.

Investors and banks will also have a very difficult time understanding the performance of your business without proper revenue recognition. Impress them with accurate deferred revenue, proper SaaS accounting and a properly formatted SaaS P&L.

If you invoice subscription terms are quarterly, semi-annually, or annually, I recommend implementing a deferred revenue process from the beginning. It becomes that much harder to implement later.

SaaS Deferred Revenue Excel Schedule

I spent about five hours creating a free, SaaS revenue recognition and deferred revenue template in Excel below. If you currently handle deferred revenue and SaaS revenue recognition on spreadsheets or need to kick off the process, please try this Excel template and let me know how it works for you.

As you’ll see, though, the formulas become quite complex to handle the different date logic. I’ve passed annual financial audits with a spreadsheet process, but you lose so much visibility into deferred revenue and customer reporting, and you’re hoping that the auditors don’t find some hidden formula error that you overlooked.

Action Items

As your ARR grows, you must have proper revenue recognition. If you are performing revenue recognition on spreadsheets, it is time to to move to an online accounting software solution that is built for SaaS revenue recognition. And for the private US companies out there, don’t forget that ASC 606 must be adopted in 2019.

Ask your accountant about your revenue recognition policies. How are you handling deferred revenue, subscription revenue recognition, and your SaaS accounting? Are you still on cash basis accounting? Please post your comments or questions below.

Make sure you download my free SaaS revenue recognition and deferred revenue Excel template. This will jump start your accounting process.

Free download below.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Do you have any best practices or example chart of accounts showing how deferred revenue should be treated?

Matt,

Yes, please see the post below regarding a sample SaaS chart of accounts.

https://www.thesaascfo.com/sample-chart-of-accounts-saas/

Ben

Do you recommend tracking and showing MRR/ARR separately from recognized monthly revenue since the latter takes into account the # of days in a month and gets messy quickly? Thanks!

Hi LL, thanks for the question. Yes, I track normalized MRR/ARR separate from recognized revenue. By normalized, I mean that I recognize on a daily basis and normalize out the number of days in the month.

Hi Ben. Thanks for this template, it’s really useful! I’m looking at adapting your model to my organisation. I’m a bit confused as to what the “Close month” field in the template means. Could you please clarify?

Also, we have a mix of Annual/Quarterly/BiYearly advance payments – is there an easy way to adapt the template to incorporate these? Or is it only used for Annual advance payments?

Thanks,

Chris

Hi Chris,

The close month is the month/period that you are posting the invoice in your accounting system. This is important if you are late in posting an invoice where the subscription started in a prior month. The formulas will adjust for that so the revenue catches up.

You can use any subscription duration with the template. Just make sure the start and end dates are entered.

Ben

Hey Ben,

A little confused here. Probably misunderstanding on my end but in the example you mention (and in the v 2.0 workbook), if you were posting your invoice to the system late (eg april 19 as it is in the workbook) and the sub started feb 19…why would the schedule recognize all of Feb/March amounts of revenue in April (total amount of $585 recognized in april in the workbook example)? Wouldn’t you just make adjusting entries to show the revenue earned/recognized in the actual months of subscription (feb 19 and march 19 in this case)? So shouldn’t the schedule match the accounting?

So sorry if this is completely wrong, just trying to make sure I grasp what you’re saying.

Hi Andrew,

Good question. Yes, you could open the books back up, but you have to consider the materiality of the catch up. There always seems to be some timing in your rev rec. Invoices posted late or customer cancels and you have to issue a credit note which backs out the recognized revenue in one month. Rev Rec systems that I have worked with do the catch up in one month. System-wise, too complicated to open up the periods. Plus you are changing your historical financials that may have been distributed to different parties.

Ben

Hi

I have prepared forecasted balance sheets and the deferred revenue is really high on the balance sheet causing the current ratio calculations to look horrendous.

Do you omit deferred income when calculating the current ratio on the balance sheet.

Hi Clare,

There always seems to be a debate about deferred revenue. Even though it’s a liability, it’s still a good thing that the balance is increasing. You may want to track with and without deferred revenue in the calculation.

Ben

What if I receive an annual contract and recognize revenue evenly for twelve months, but we invoice quarterly (or we invoice 50% up front and the rest evenly the next two months, as an example). How do I book the invoice?

Hi Sonia,

Great question. You will still need to defer the revenue and recognize over the applicable time period (i.e. the quarter).

Ben

Hi Ben,

Shouldn’t Sonia recognize revenue on a monthly basis since services are delivered monthly over 12 months ? This is an annul contract and billing ( whether quarterly or 50% upfront and 50% ) shouldn’t affect the earning process, I would think.

Hi Avi,

Yes, Sonia should still recognize revenue over the contract term. I’m just saying that the invoices should be deferred, whether invoiced quarter by quarter, over two months, etc.

Ben

I have a question on revenue recognition in different time horizon in contracts. Your example used a 1 yr subscription that recognizes revenue at the end of year month. How does it work for longer subscriptions according to 606. Lets say there is a 5 year contract that requires you to pay the first year upfront and you have the option to renew at the same rate Year 2? Do you still allocate the upfront fee monthly? Or do you reflect the revenue up front for year 1.

Lets say the fee was 60,000 for 5 years. Do we reflect the revenue monthly? 1000 year month? Or do we reflect the revenue at the end of year 1?

Thanks,

Art

Hi Art,

Let’s say the customer pays 60K upfront for a five year contract. You would recognized $1000/month for five years. It’s also the same if they only pay you one year in advance ($12K) each year for five years. You would recognize $1000/month in the first year.

Regards,

Ben

Hi, our customers sign annual contract which we invoice equally over 12 months. Our services are provided over 9 of the 12 months. How should we account for the revenue recognition for ASC 606? Using only our invoice amounts, it creates a pretty uneven revenue recognition.

Thanks,

Lindsey

Hi Lindsey,

Are you referring to your services revenue recognition? It really depends on the payment terms and the materiality of the services revenue. Services revenue can be deferred and recognized as percent complete (POC). Or invoiced via performance milestones in which case you are earning the revenue when it achieved/invoiced. Services revenue can be a bit lumpy.

Ben

Hi Ben,

Great article, thanks for sharing! Perhaps this does not relate strictly to the deferral concept, but was wondering if you could give me some guidance on the recognition of subscription revenue when it flows through a distributor (i.e. Apple Store) it is not totally clear whether we should account for the revenue on a net or on a gross basis. I guess first it should be determined who acts as the principle, fortunately both ASC 606 and IFRS 15 give some guidance on the topic and given that we are setting the price and customers contacts us when there is an issue with the software (Apple also stats in T&C that they are acting as an agent for 3rd party apps) I think it is fair to say that we are the principle and we need to account the revenue in full and the commission should go into COGS. Is that the right interpretation?

Thanks,

Daniel

Hi Daniel,

Yes, this is definitely principal versus agent consideration, and there is no clear cut answer since it is a framework that you have to follow. See if the points below help.

Indicators that an entity controls the specified good or service before it is transferred to customer and is therefore a principal

->The entity is primarily responsible for fulfilling the promise to provide the good or service

->The entity has inventor risk before the specified good or service has been transferred to the customer

->The entity has discretion in establishing the price of the specified good or service

->Who bears the risk if the customer does not like the good or service?

“when a customer asks for refund, how do we account for (1) in ARR booking, do we reduce and readjust or just keep it separate and book it under a separate GL account “Credit/Refund” in PL (2) if we choose to reduce ARR to reflect, should we re-write past financial revenue?

Hi Akaash,

Great question. From a revenue perspective, if you invoiced the customer and the revenue is flowing to the P&L, typically, you process a “credit note” (in my accounting system language) which reverses the revenue recorded to date and offsets any future revenue recognition. You would not want to open up the “books” and change previously recorded revenue.

From a bookings perspective, if this was a newly acquired customer and not a renewal, I would remove this ARR from the bookings report if they canceled immediately after becoming a customer. This may also affect your commissions payout depending on the plan design.

Regards,

Ben

Hi Ben,

Thanks for the template, this is very useful. Quick question regarding the SCR example you gave. It seems to be giving a full refund to the client by writing off all the recognised revenue as well, isn’t?

Best,

Bechara

Hi Bechara,

In the SCR example, maybe, the customer churned but you had already invoiced. Or you made a mistake on the invoice and must re-invoice. That would be the case for a credit note rather than a refund. The customer had not paid yet.

Ben

Hi Ben,

If you sell a 5 year SAAS contract with billing amounts that increase every year for no change in number of transactions. The client has no right to terminate for convenience. Should you recognize the revenue monthly based on that years invoice or should you recognize the revenue based on the average monthly revenue?

Hi Sarah,

Great question and one that I addressed briefly with my auditors. If the increases are material and typical for your contracts, you may need to look at recognizing based on an average value. This is a tricky one, especially with the rev rec changes. I would definitely speak to your auditors or engage a firm to perform a 606 assessment.

Ben

Hi Ben!

I want to thank you for all those great articles & templates that you’re sharing here on your blog. It’s really helpful!

One question came to my mind if Upgrade or Downgrade happened during the subscription period. Based on your deferred revenue model 2.0, how would that be translated? I was thinking perhaps adding a new line in Sales invoicing (upgrade) / Credit notes (Downgrade) based on the difference in price between new plan & old plan?

Cheers & thanks again!

Hi Dimitri, thanks for the question and the feedback! If you invoice for the net change in ARR or MRR for the upgrade, you can just enter that as an invoice in the spreadsheet. With a downgrade, that usually doesn’t happen until the renewal, so the revenue stream would be reflected in the new invoice that incorporates the downgrade.

Hi Ben, thanks for sharing this article. We are a SaaS business not only based on licenses but also volume-based (i.e. customer acquire yearly licenses together with yearly packages of credits they can spend during that year; but it is not a pay per usage). We would in that case differ the license and credits amount into 12 months for that first contract, however many times our customers spend their credits before the renewal date (let’s say in month 8), in which case they either buy more credits until renewal (upsell generating a new revenue recognition for months 9-12) or they acquire credits for 12 months again and we “extend” their licenses for those same 12 months (i.e. upgrade, in which we credit the remaining 4 months of the license and we invoice again for the new 12 months license and credits, getting to recognise again the total amount in the next 12 months). However we have an issue in the upgrade case in how to treat the revenue already recognised for the credits on the first contracts in the last 4 months of the contract (i.e. months 9 to 12 have revenue recognised from the first purchase however once the upgrade is sold, months 9-12 will have a new credits invoice and hence MRR of the total account will result in an increase in month 9 (double revenue recognised from first contract and upgrade) and a decrease in month 12 (once the first package recognised revenue is over). We feel this shows in our metrics a “fake” upsell and downsell but don’t know hot to best treat that case. Any ideas or tips?

Hi Ben, I had a question around revenue recognition. Our company collects an annual subscription upfront but should be amortising revenue on a monthly basis as the service is delivered. We collect our payments in Stripe and use Xero. Could you please advise how I should be recognising revenue in these systems (Stripe or Xero)? Ideally I want my cashflow statement to reflect the correct cashflow (as it is earned according to IFRS) accounting standards).

Hi Nandini,

I don’t believe Xero has any revenue recognition features for SaaS. You’ll either need to calculate your rev rec in spreadsheets and then post the proper entries. Or sign up for rev rec software that integrates with Stripe (Chargify, for example) which then will perform the necessary calculations.

Ben

Hi Ben,

I have a question in terms of how to treat “one-time” credits to customers that do not impact future subscriptions. Examples would be things like service credits, one-time partial credits in exchange for an early renewal of a subscription, etc. These credits would be issued as a reduction against the invoicing of the new subscription, and would not reduce the amount up for renewal.

My question is whether you would consider these one-time credits as a reduction of ARR? My sense is since these credits are nonrecurring that they would not affect ARR or be considered as churn (although they would clearly decrease GAAP revenue).

Thanks!

Hi Larry,

Yes, if they were just one-time credits in one month, for example, I would not reduce my bookings number. It’s more of a revenue thing.

Ben

Hi,

If a salesperson signs a client to a 3-year contract. Would the commission need to be deferred/recognized evenly over the length of the contract?

e.i. Earns 5% on year 1, and 1% in year 2 and 3.

Thanks

Hi Claudio,

Under ASC 606, you need to capitalize (defer) the commission and amortize over time. I’ve argued with my auditors that we should use an average contract length rather than track contract by contract.

Regards,

Ben

Ben, I’ve got a bit of an unusual scenario. My company works with commercial real estate office buildings where each building LLC is a customer. From time to time these buildings are sold and the LLC is updated. How would you handle such a situation? Our primary concern is not to overstate churn but also make a manageable internal process. Welcome your feedback.

Hi Anna,

Yes, I would not count that as churn but I would track that turnover metric. Sometimes this is a manual process to track.

Regards,

Ben

Thank you so much, Ben! You have explained it quite clearly and simply, with the clear goal of helping the SaaS business have a better picture of its financial health.

Hi – let’s say my company sells 3 year contracts, and invoices annually. At the initiation of the contract, would I recognize just the first year invoice into deferred revenue or all 3 years? It’s confusing because technically the remaining two years are contracted as revenue and I owe that service, but there is no invoice so not sure what the offsetting entry would be. Please advise.

Hi Robert,

I only defer the first year’s invoice amount and not the uninvoiced amounts for years two and three. In some industries, you do uninvoiced balance sheet amounts but I have not seen that with SaaS companies that I have worked with.

Ben

Hi Ben – thanks for this article. In terms of the impact to cash flow for deferred revenues, I thought I would use the change in the deferred revenue account to show the impact to cash flow. But it seems like it doesn’t work because the “amortization” of deferred revenue decreasing the balance, which has no real impact on cash flow. Any suggestions for forecasting the impact on cash flow from deferred revenues? Do you suggest having a line item for deferred revenue and an offsetting line item for “amortization” to keep them separate?

Hi Michael,

Yes, in my three-statement models, I have an invoicing line that increases deferred, a “burn” line that decreases deferred. For the cash impact, that comes from logic around AR collections.

Ben

Thank you for publishing this article. If a SaaS company sells a pre-launch lifetime subscription at the end of a year but the purchasers don’t get access until the SaaS product launches the following year, can the company defer the recognition of the revenue generated?