If you work in SaaS finance, you can’t get away from ASC606 and revenue recognition. Understanding ASC 606 is essential for SaaS finance professionals—whether you’re a CFO, controller, FP&A analyst, or accountant. In a recent No Fluff webinar, I hosted revenue recognition expert Jill Hauck. We dove into practical applications of ASC 606 for SaaS […]

Revenue

The SaaS Revenue Hierarchy: Why Defining Your Revenue Streams Matter

One of the most critical aspects of SaaS financial management is having clear and distinct revenue streams. A well-structured SaaS P&L provides fundamental data for analyzing margins, operational efficiency, and business health. However, many SaaS companies do a poor job of clearly defining their revenue streams. This has major impacts on how you manage your […]

- Due Diligence

- ...

Understanding Contracted Annual Recurring Revenue: A Comprehensive Guide

Contracted Annual Recurring Revenue (CARR) was an obscure metric in the SaaS world years ago. Today, it’s become a hot and controversial SaaS metric when discussing company growth and SaaS valuations. CARR is a forward-looking SaaS revenue metric that estimates the maximum revenue size of a SaaS company. CARR combines two important aspects of revenue: […]

Bookings vs Invoicing vs Revenue | The SaaS Revenue Cycle Explained

The SaaS revenue cycle all starts with bookings. But what is a booking? And how does a booking differ from invoicing and revenue? SaaS is full of metrics, but in this case, we are mixing SaaS and accounting terminology to make things even more confusing. In this post, I will explain the differences among a […]

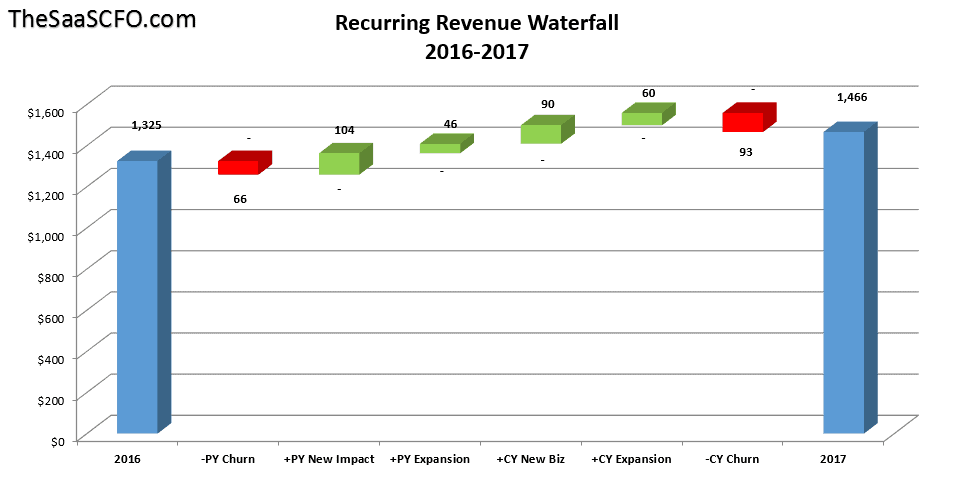

SaaS Revenue Waterfall Chart

SaaS Revenue Waterfall Chart Ugh, Budget Season! For most of us, we are beginning budget season or we are in the midst of budget season spending crazy hours manipulating numbers, building models, and meeting with department heads to create a workable first draft of the budget. I won’t dive into the pro’s and con’s of […]

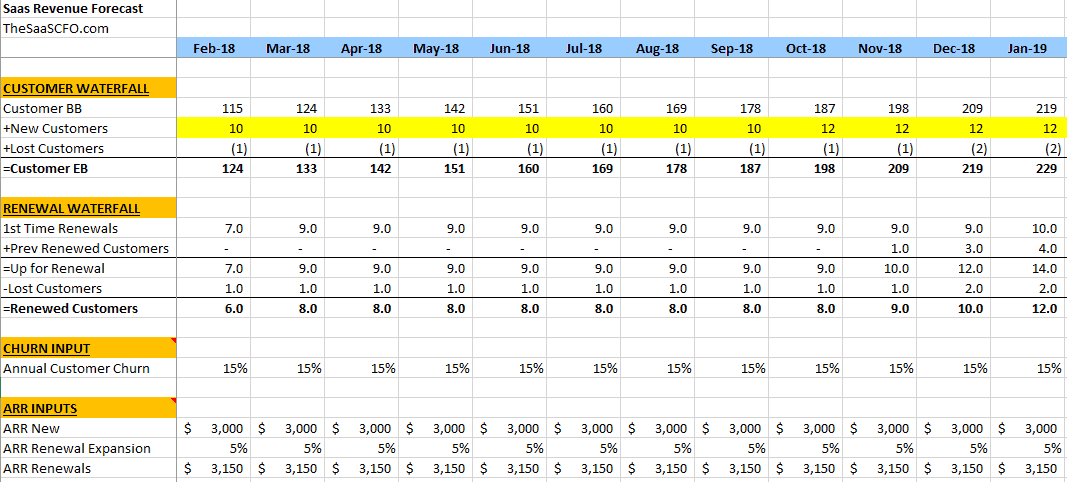

SaaS Revenue Forecast Model

SaaS Revenue Forecast Model I try to keep my financial statement models as simple as possible. I don’t forecast on one tab, but I also don’t have 30+ tabs of assumptions and formulas. I build my models around the operations of the business and the important metrics. Enough detail to be accurate and supportable but […]