SaaS operators must understand the balance between sales and marketing spend and the acquisition of net new revenue. Enter the SaaS Magic Number. Here are my thoughts on how to use the Magic Number in 2025.

Overinvest in sales and marketing relative to your new SaaS ARR bookings and will you not the see the expected margin expansion or cash creation.

Conversely, underinvest in sales and marketing when you have achieved product-market fit and you will miss out on opportunities for growth. Therefore, it’s important to calculate the SaaS Magic Number and other sales efficiency metrics to determine your sales health.

Download the SaaS Magic Number Excel template ⬇️

What is the SaaS Magic Number?

The SaaS Magic Number is a sales and marketing efficiency metric. It measures the the balance between sales and marketing spend and revenue growth.

It differs from the Cost of ARR, because the Magic Number focuses on revenue growth, not bookings growth. Of course, bookings growth drives revenue growth.

We have two inputs, well, maybe, three inputs for the SaaS Magic Number. And all of this data is sourced from our SaaS P&L.

We need:

- Recurring Revenue

- Sales Expense

- Marketing Expense

We can’t use total revenue if we have lumpy, one-time revenue such as professional services revenue. The result won’t be usable to drive decisions.

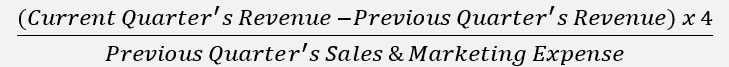

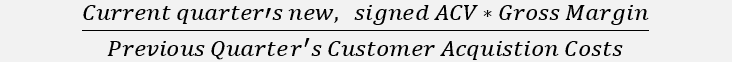

How to Calculate the SaaS Magic Number

The SaaS Magic Number is a widely used formula to measure sales efficiency. It measures the output of a year’s worth of revenue growth for every dollar spent on sales and marketing. To think of it another way, for every dollar in S&M spend, how many dollars of ARR do you create.

Let’s say you spent $1 on S&M in 1Q25. If your revenue then increased by 25 cents in 2Q25 (which annualizes to a $1), you would have a Magic Number of 1.0.

A magic number of 1.0 also implies that you paid back your customer acquisition costs in a one year timeframe. After year one, you should be generating margin on that customer (assuming ARR – ACS is positive). This metric does not discriminate between new business and existing. It measures growth from all areas.

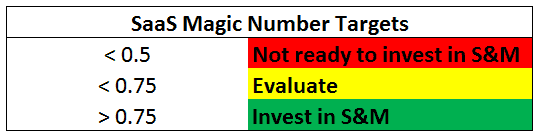

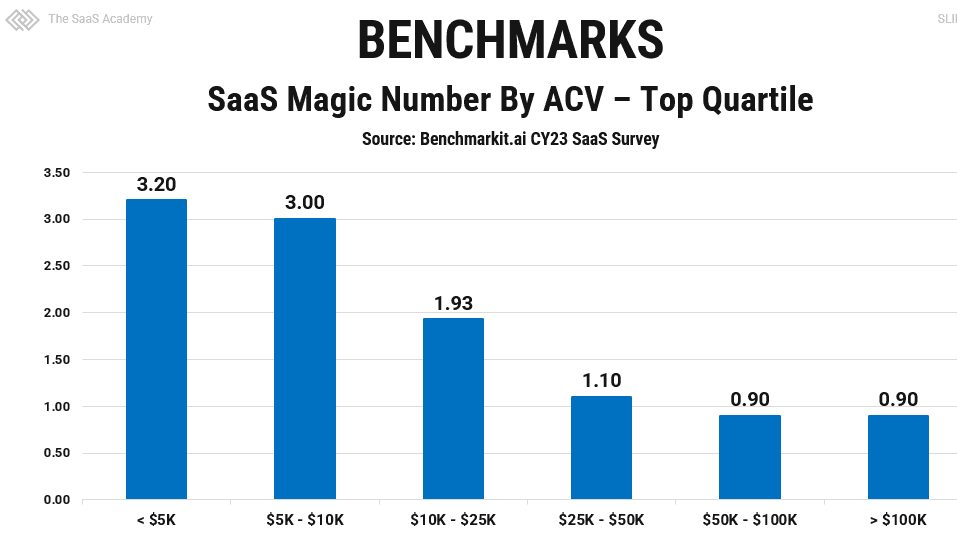

What’s a Good SaaS Magic Number?

See the table below for what SaaS Magic Number targets. These are the general rules of thumb when using the Magic Number.

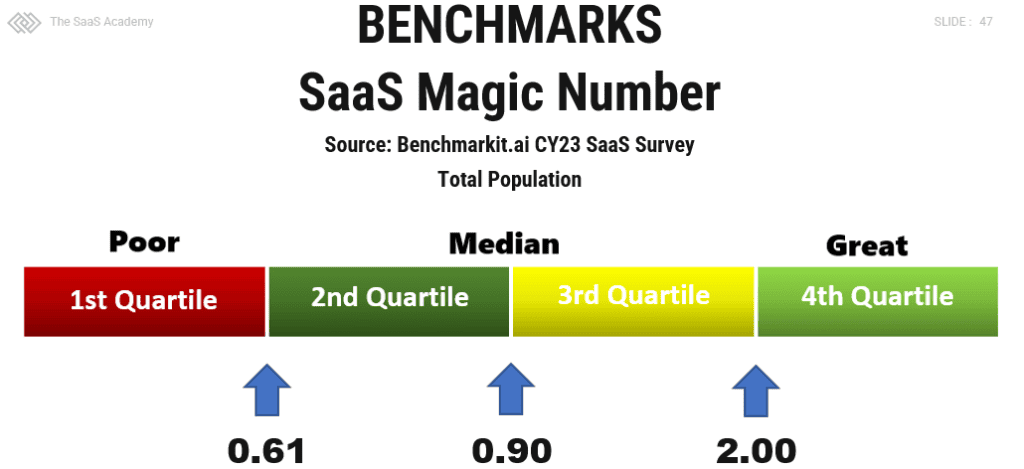

SaaS Magic Number Benchmarks

Of course, we have benchmarks for the SaaS Magic number. I use these benchmarks when using the SaaS magic number for my SaaS clients.

The benchmark below is from Ray Rike’s data at Benchmarkit.ai. Head over there to get your custom SaaS Magic number benchmark. This is for private SaaS B2B companies.

I like to benchmark by ACV for some metrics. I added the chart below as reference, but in the case of the Magic Number, I’m going to benchmark SaaS companies relative to similar size SaaS companies.

When to Use the SaaS Magic Number

When implementing go-to-market (GTM) efficiency metrics, we have to understand how our sales cycle impacts the period of measurement.

Meaning, if we have a 12-month sales cycle, my period of measurement will be a trailing 12 months. The SaaS Magic Number is applicable to SaaS companies with short sales cycles. Why?

The SaaS Magic Number measures quarter over quarter revenue growth versus the previous quarter’s sales and marketing spend. That’s a short sales cycle.

If we have enterprise sales cycles, the Magic Number is just not as applicable.

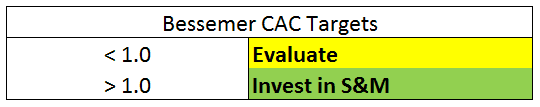

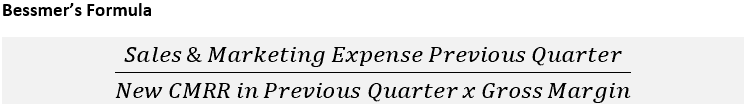

Bessemer CAC Ratio

The Bessemer CAC Ratio is similar to the Magic Number, but the formula is more defined to new acquisition. To me this ratio says, how fast does my gross margin pay for my new customer acquisition costs.

A ratio of means 1.0 indicates that within one year you are completely break even on a customer. In this case, I define break even as covering your gross expenses AND customer acquisition costs.

Whereas a SaaS Magic Number of 1.0 means that you have only covered your S&M expenses within the first year, and you are still out-of-the money at month 12 with the customer because you have not covered your gross expenses yet.

Please note that it appears that Bessemer does not publish this ratio anymore (at least that I can find.). They may have transitioned to the CAC payback period below.

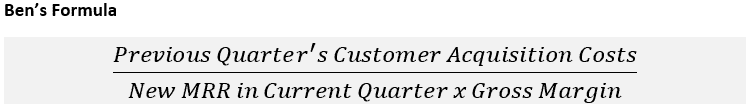

CAC Payback Period

This is similar to the Bessemer CAC Ratio, but it flips the numerator and denominator and uses MRR to convert this to monthly payback number. Please note that I’ve interpreted their ratio a bit differently in my formula below.

In Bessemer’s formula, they use the previous quarter as the time period in both the numerator and denominator. In my experience, there is typically a lag between the investment in S&M and when you see results (new MRR or ARR).

You will want to make sure this timing is relevant to your business as everyone’s sales cycle is different. As such, I take MRR in the current quarter versus the previous quarter’s customer acquisition spend (I measure against S&M from a year ago for longer sales cycles). I also drop the Committed from the CMRR and take only the portion of S&M expenses dedicated to new customer acquisition.

I interpret Bessemer’s original payback formula above as an all-in formula that includes growth from new and existing customers. Why? Because they use CMRR which typically includes churn from existing customers. And sales the marketing spend is not defined specifically to just new customer acquisition costs.

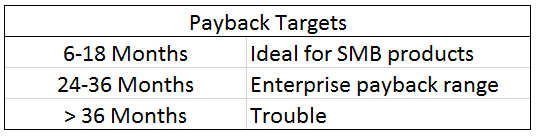

The table below outlines ideal payback months per Bessemer.

What Metrics to Measure in Your SaaS?

In SaaS, there are metrics as far as the eye can see. It’s hard to know where to start.

I created a free 5-part training program at my Academy for SaaS operators and investors. Click the picture below to enroll.

You can also download my 5 Pillar SaaS Metrics Framework. It acts as your SaaS metrics roadmap.

Conclusion

It is interesting to calculate all of these sales efficiency metrics for your business, but I find that the CAC Payback Period formula is powerful. It incorporates gross margin (the SaaS Magic Number does not) and quantifies it in months which is easy to understand. It can also cut through the noise of what appears to be great bookings growth but at the cost of over investing in sales and marketing that will take years to payback if at all.

Please enter your valid email below (no spam) for the instant download.

If you do not receive the download, please contact me.

Want all of my models? Download 30+ models with here.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Awesome Formula “SaaS Magic Number”

[…] determines your efficiency in generating incremental recurring revenue. In the SaaS community, a SaaS Magic Number of 1 or greater is considered ideal, but should you really pour more money into sales and marketing […]

Hi Ben,

If company ABC sold product for company XZY at list and was later paid a commission for that sale, would you include that in company ABC’s bookings? Basically, would you include partner application sales in bookings? More details, ABC sells a minimal amount of the XYZ product – makes up less than 1% of total sales as the main product ABC sells is it’s own SaaS product.

Thanks,

Kelly

Hi Kelly,

Thanks for the question. If you are reselling products, I would track that separately from your own bookings. And if you have service bookings, keep that on its own line as well.

Ben

Hi Ben,

Good stuff. I would note that these formulas work for more mature SAAS companies. For startups, revenue and gross margin for example are unpredictable and lumpy, which would throw-off your magic number and ultimately not be a useful indication of sales performance.

Hi Travis,

Yes, definitely. Early on, there is not enough “volume” of financial data to produce reliable SaaS metrics.

Ben

Hi Ben-

Very helpful post. How do you typically recommend SaaS companies count customer success costs? In our world, customer success represents 3 functions: technical support, account management & professional services (primarily to enable successful deployments, near zero revenue). They are primarily responsible just for renewals, but obviously have an impact on expansions. Is that considered part of sales + marketing or is it just part of the ACS?

Thanks in advance

Hi Surag,

If customer success is purely focused on retention (no upsell), then I would include in COGS. If they are involved with upselling the customer, I would code to sales.

Ben

Sorry, but I dont really see why 0.75 = time to scale S&M.

Shouldnt the ratio exceed 1.0 like for the Bessemer formula before scaling?

I suppose it would be good to have a few quarters of data showing ratio is consistently above a certain level prior to committing costs to additional S&M.

Thanks

Or if you take the inverse, you get a $1.33 cost to acquire $1 of revenue growth. Easier to understand. I’d make sure your targets fit to how your company views acquisition expenses.

In the Saas magic number, why is the numerator annualized (x4) but the denominator is not? Why divide projected growth for the year by the cost of S&M for only one quarter?

Hi Jackson, it’s almost like the Cost of ARR. We are trying to get an annual number generated in quarter. It is a bit counter-intuitive but it’s a quarter to quarter match.