Achieving a $100 (or pick your number) million SaaS exit isn’t just about revenue milestones or growth rates. Of course, that’s very important. It’s also about the “boring” stuff. You must ensure your business is legally sound and prepared for the rigorous scrutiny of buyers.

In a recent webinar, I hosted legal expert Omeed Tabiei. Omeed is a corporate, VC and M&A lawyer for SaaS founders.

Omeed shared nine legal strategies SaaS founders, CFOs, and investors must prioritize for a smooth and profitable exit. Here’s a breakdown of the insights, actionable steps, and why they matter in today’s SaaS landscape.

As Omeed highlighted, legal readiness is about value protection, not just value creation. This post outlines the key strategies to safeguard your hard-earned valuation and maximize your exit potential.

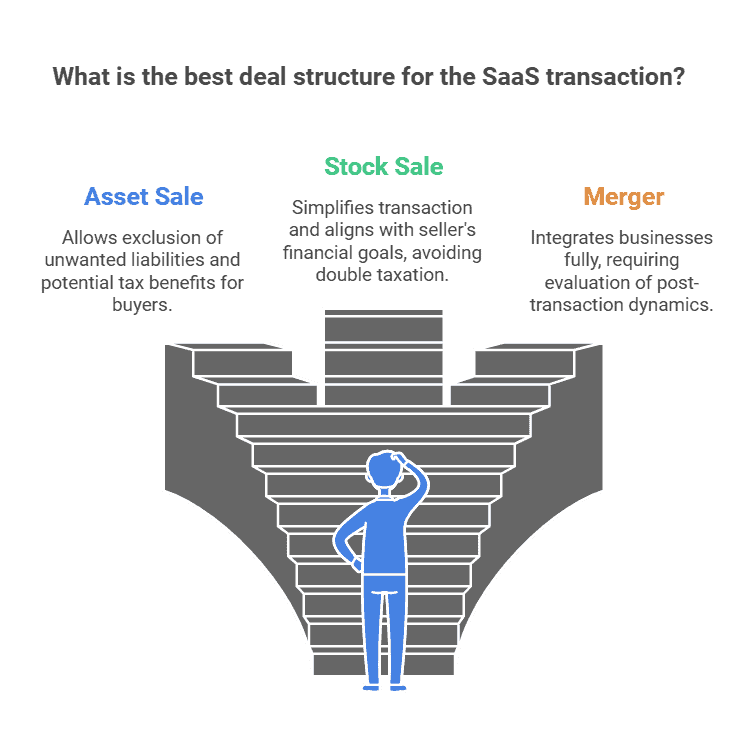

1. Choose the Right Deal Structure

Selecting the appropriate deal structure—asset sale, stock sale, or merger—is foundational. The structure you choose will have implications for tax treatment, liability management, and even post-transaction relationships. Most SaaS transactions are structured as stock sales because they are simpler and often better align with the seller’s financial goals. On the flip side, I’ve only been involved in asset purchase agreements when buying or selling SaaS companies.

Key Considerations:

- Tax implications: Buyers may prefer asset sales because they can “step up” the tax basis of the assets, reducing future tax liabilities. Sellers, on the other hand, often prefer stock sales to avoid double taxation.

- Liability management: Asset sales allow buyers to exclude unwanted liabilities, while stock sales transfer the entire business, liabilities included.

- Post-transaction dynamics: Stock-for-stock deals or earnouts can tie the seller to the buyer’s success post-transaction, requiring careful evaluation of the buyer’s financial health.

To avoid pitfalls, understand your company’s specific liabilities and the buyer’s motivations. Engage a skilled M&A lawyer early to craft a deal structure that protects your interests while maximizing value.

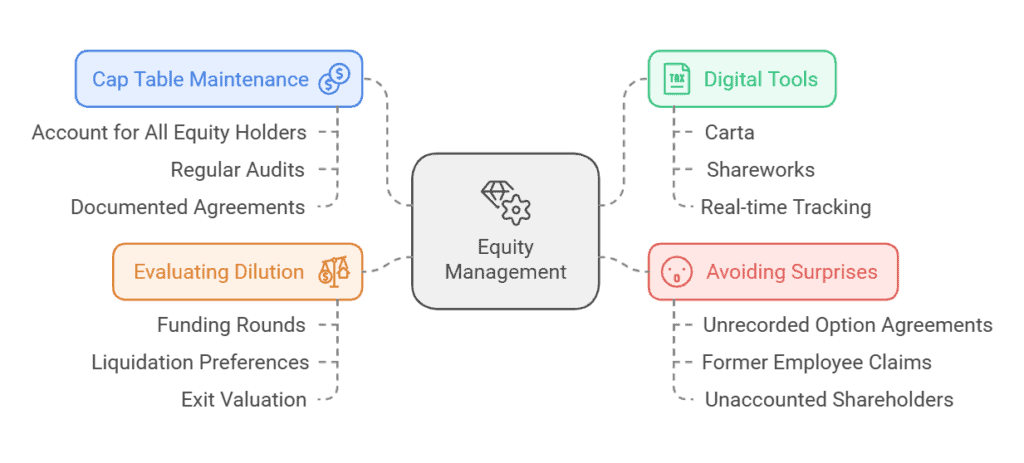

2. Manage Your Equity

A clean and well-maintained cap table is essential to avoid deal-stalling complications. Every equity holder, from early-stage investors to employees with stock options, needs to be accounted for. Your cap table must tie out exactly. Just like accounting, you can’t have unaccounted for shares or options. The clearer and more organized your equity records are, the smoother your negotiations will be. Carta is a popular cap table management software that helps in this process.

Expanded Guidance:

- Avoid surprises: Unresolved equity issues, like unrecorded option agreements, can create legal disputes during due diligence. For example, a former employee claiming unissued options could derail the deal. You don’t want unaccounted for shareholders coming to you after the sales.

- Use digital tools: Platforms like Carta and Shareworks simplify equity management by tracking shares, options, and other instruments in real-time.

- Evaluate dilution: Consider how previous funding rounds and liquidation preferences impact your exit valuation.

Practical Tip: Conduct regular equity audits to ensure all agreements are documented, signed, and reflected accurately in your cap table. This will save countless hours during due diligence. Anytime there is share or option activity, make sure it’s reflected in your cap table.

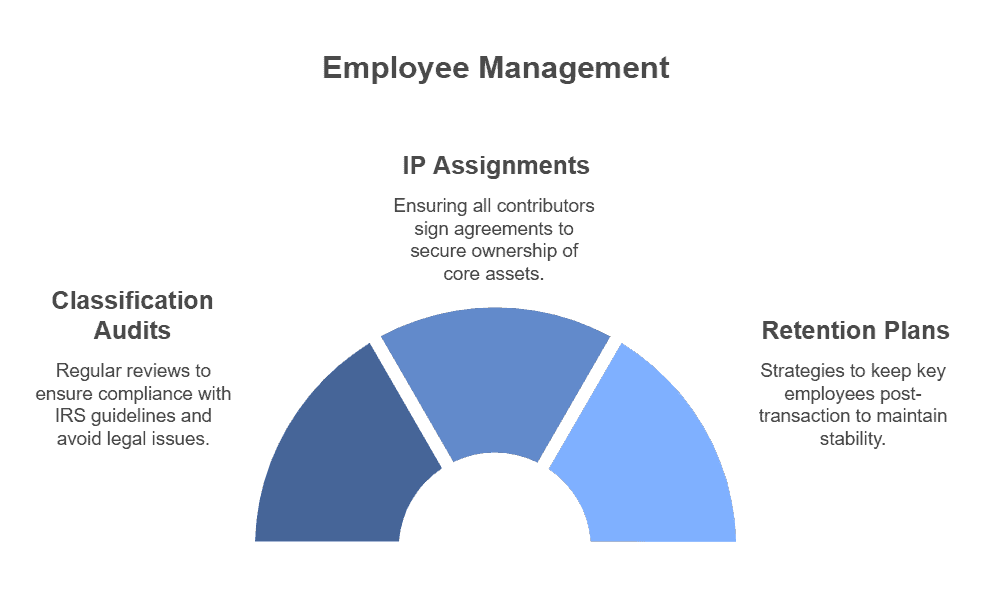

3. Manage Your Employees

Employees are a critical part of your business’s value proposition, but they can also introduce significant liabilities. Buyers will scrutinize employee classifications, contracts, and IP assignments to ensure there are no hidden risks.

Expanded Guidance:

- Classification audits: Regularly review whether your independent contractors meet the legal definition under IRS guidelines. Misclassification can lead to lawsuits, fines, and back taxes.

- IP assignments: All employees and contractors contributing to your technology must have signed IP assignment agreements. Without them, your company may not legally own its core assets. This is a big one. Get these agreements in place now. And be really careful with outsourced development agreements and who owns the IP.

- Retention plans: Develop strategies to retain key employees post-transaction, as their departure can harm the buyer’s confidence and disrupt operations. The buyer does NOT want everyone leaving post-transaction.

Practical Tip: Create a detailed employee handbook and make sure IP agreements are in place with employees and contractors.

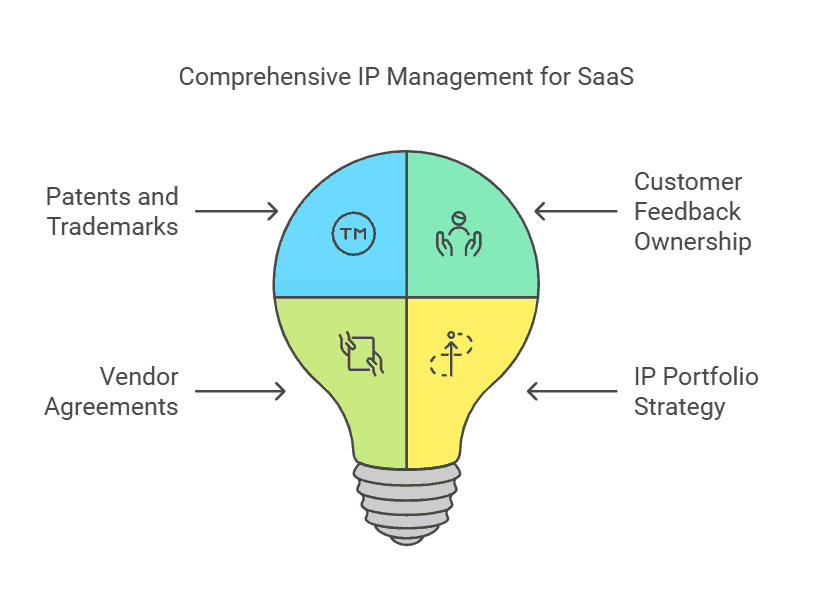

4. Manage Your IP

Intellectual property is often the crown jewel of a SaaS business, representing a significant portion of its value. Ensuring your IP is properly protected and documented is non-negotiable.

Expanded Guidance:

- Patents and trademarks: Secure filings for innovative technology and branding. For AI-driven SaaS businesses, patents can create defensible market advantages.

- Customer feedback ownership: Contracts should grant your company ownership over insights or improvements suggested by customers.

- Vendor agreements: Ensure that contractors and vendors who contribute to your software sign agreements that transfer IP ownership to your company. This is a big one!

Practical Tip: Develop a robust IP portfolio strategy that includes regular audits, enforcement measures, and even licensing opportunities to maximize value.

5. Keep Corporate Governance Clean

Buyers value companies with strong governance practices. A well-documented corporate history signals that your business is professionally managed and reduces the risk of unpleasant surprises. I know Board meeting minutes are tedious, but it’s good habit. Auditors like this too.

Expanded Guidance:

- Data room preparation: Buyers will request documents like bylaws, shareholder agreements, and Board minutes. Having these organized in a secure data room speeds up due diligence.

- Regular audits: Periodically review corporate records to ensure compliance with governance practices.

- Diverse board composition: A board with varied expertise, including industry leaders and independent directors, adds credibility and stability to your business.

Practical Tip: Make sure all of your entity-forming documents and any amendments are stored in a shared drive somewhere. Over time, it can become hard to find these documents. And keep track of any tax entity changes with the IRS. Moving from an LLC to an S-corp? They will want that letter from the IRS.

6. Have Strong Customer Contracts

Customer contracts reflect your revenue streams and directly impact your valuation. Weak or ambiguous contracts can introduce risks that deter buyers or reduce your multiple. Customer contracting is so often overlooked! You need contracts with your customers. Period. And keep them consistent. Try not to negotiate special terms with each deal or early-out clauses.

Expanded Guidance:

- Renewal clauses: Clearly define how and when contracts renew to avoid unexpected churn.

- Limitations of liability: Protect your company from excessive claims in the event of disputes.

- Data ownership: Contracts must specify that your company retains ownership of all customer data, even if anonymized.

Practical Tip: Work with legal counsel to review and standardize your customer agreements, ensuring they align with industry best practices. This will save you headaches down the road.

7. Have Strong Vendor Contracts

Vendor contracts are often overlooked but can introduce risks if not carefully managed. Buyers will scrutinize these agreements to understand what expenses or obligations you’ve committed the company to. Anytime we send an agreement with a third party, I save this in a Vendor Contracts folder. Buyers will want to see these major agreements.

Expanded Guidance:

- Scope of services: Clearly outline deliverables, timelines, and performance metrics.

- Change of control provisions: Avoid clauses that allow vendors to renegotiate or terminate contracts upon your sale. Same goes for customer contracts.

- IP ownership: Ensure that vendors transfer all IP rights for any work they perform for your company.

Practical Tip: Implement a contract management system to monitor vendor performance against SLAs and maintain records for due diligence.

8. Identify and Mitigate Potential Legal Risks in High-Value Exits

High-value exits come with heightened scrutiny. Identifying and mitigating risks proactively ensures a smoother transaction. This compliance doesn’t just happen at exit. You must have this foundation in place while operating the business.

Expanded Guidance:

- Tax compliance: Conduct a detailed review of your sales and use tax obligations across jurisdictions. Don’t ignore sales tax! There is great software to help you stay compliant.

- Privacy laws: Ensure compliance with regulations like GDPR and CCPA. Non-compliance can lead to fines and loss of customer trust.

- Regulatory shifts: Stay ahead of emerging regulations, particularly those affecting data and AI usage.

Practical Tip: Engage external auditors or consultants to identify hidden risks and provide recommendations for remediation.

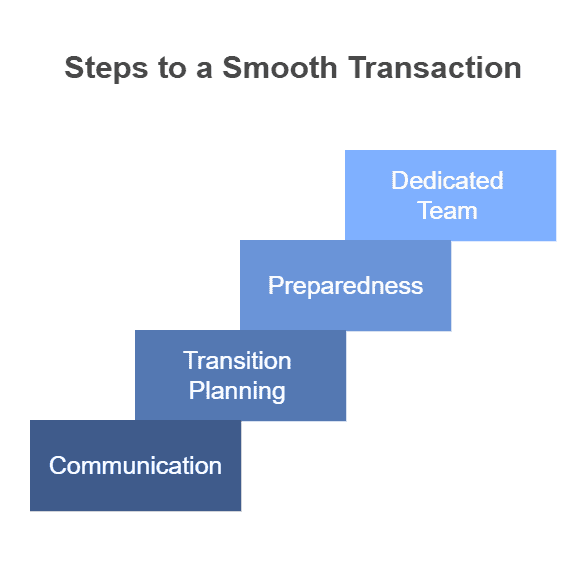

9. Ensure a Smooth Transaction

A smooth transaction process minimizes deal fatigue and increases the likelihood of closing the deal at your desired valuation. The better prepared you are the faster you can close the deal. Buyers don’t like unknowns. Big unknowns can kill deals. They don’t want to sign up for unknown risks.

Expanded Guidance:

- Communication: Maintain open and transparent communication with buyers to build trust.

- Transition planning: Develop detailed post-transaction integration plans to reassure buyers of operational continuity.

- Preparedness: Address potential bottlenecks, such as missing signatures or unorganized documentation, before negotiations begin.

Practical Tip: Assign a dedicated team to oversee transaction readiness and address issues as they arise. Typically, you bring a small team “under the tent” when working on an exit. Clear communication about roles and confidentiality are critical.

Actionable Takeaways

- Start legal audits and cleanup early—don’t wait for the deal to start this process.

- Use tools like Carta for equity management and organized data rooms.

- Align your contracts (employee, customer, vendor) with best practices to avoid last-minute surprises.

- Stay proactive with IP filings, renewals, and enforcement.

- Build trust with buyers through transparency and a well-prepared data room.

Ready for a $100 Million SaaS Exit?

Exiting a SaaS business at large enterprise values requires more than just growth metrics—it demands a legally sound and well-organized corporate foundation.

By following these nine strategies, you can mitigate risks, speed up negotiations, and protect the value of the year’s of effort put into scaling your SaaS.

Ready to start? Begin your legal readiness audit today to ensure you’re prepared when the opportunity arises. Don’t wait. We’ve heard of too many deals that blow up due to missing data, documents, and/or poorly organized financials.

Legal Disclaimer:

The information provided in this blog post is for general informational purposes only and does not constitute legal, financial, or business advice. While the content is based on insights shared by experienced professionals, every business and M&A transaction is unique, and the strategies discussed may not apply to your specific situation.

Readers should consult with qualified legal, financial, and tax advisors before making decisions related to mergers, acquisitions, or any other significant business transactions. The authors and contributors of this post are not responsible for any actions taken based on this information without appropriate professional guidance.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.