Operating your SaaS company without metrics is like flying a plane without instruments. Yeah, you are up in the air, but you might not know where you are headed. Or whether you have smooth air or turbulence ahead.

As an in-house SaaS CFO and now fractional CFO, I’ve seen firsthand how critical it is to have a clear and actionable metrics framework in place to navigate your company toward success.

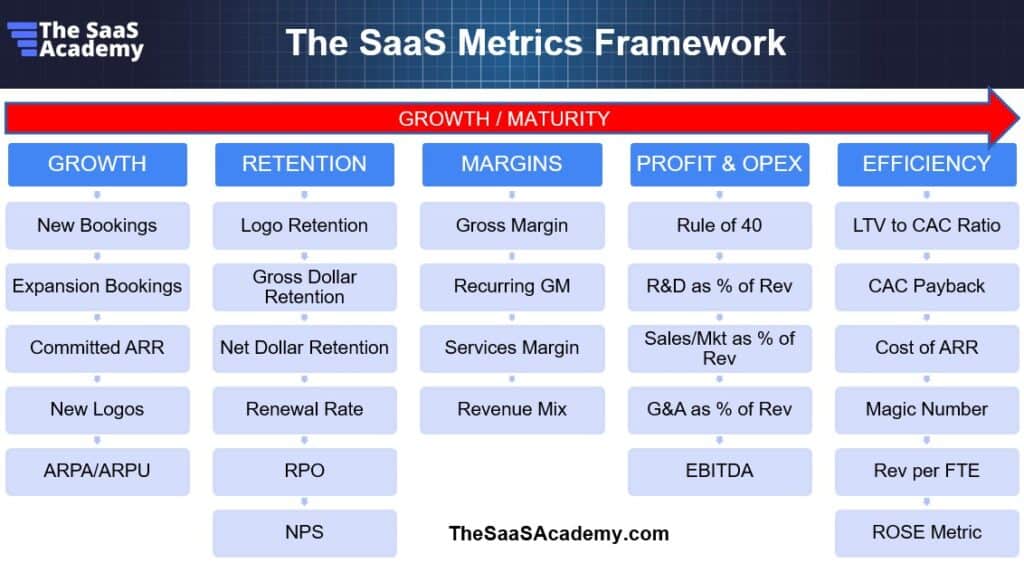

Enter my Five Pillar SaaS Metrics Framework. It’s your SaaS metrics roadmap. It’s a systematic process that I’ve developed to provide SaaS operators and investors with the financial transparency and insights needed to scale confidently.

This post will explore each pillar, how they interact, and why they are critical at every stage of your SaaS journey.

Why SaaS Metrics Matter

Think about the last time you stepped onto a plane. You look left into the cockpit, where a pane full of instruments provides pilots with the data they need to navigate safely to the intended destination.

Now imagine that cockpit with no instrumentation—no altimeter, no compass, no navigation, no collision avoidance system. Nervous yet?

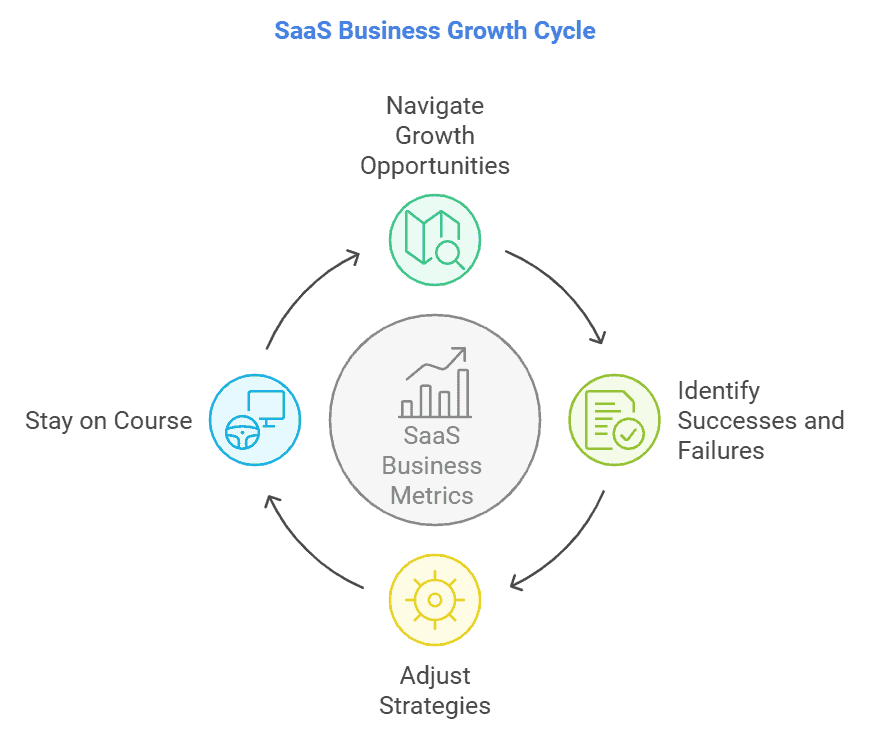

The same concept applies to running your SaaS business. Metrics act like cockpit instruments for your company, helping you navigate growth opportunities, identify what’s working and not working, and stay on course toward your goals.

Without these metrics, you’re not just flying blind—you’re putting your team, customers, and investors at risk.

Metrics serve several key purposes:

- Operational Clarity: They highlight what’s working and what’s not in your SaaS engine, from customer acquisition to retention and beyond.

- Alignment: Metrics create a common language across your teams, aligning company goals to department goals.

- Strategic Insights: They help you prioritize precious resources (capital, people), focus on levers that move the needle, and pivot when necessary.

Just as pilots are constantly monitoring their cockpit instruments, your SaaS company depends on accurate, timely metrics to weather storms and accelerate opportunities.

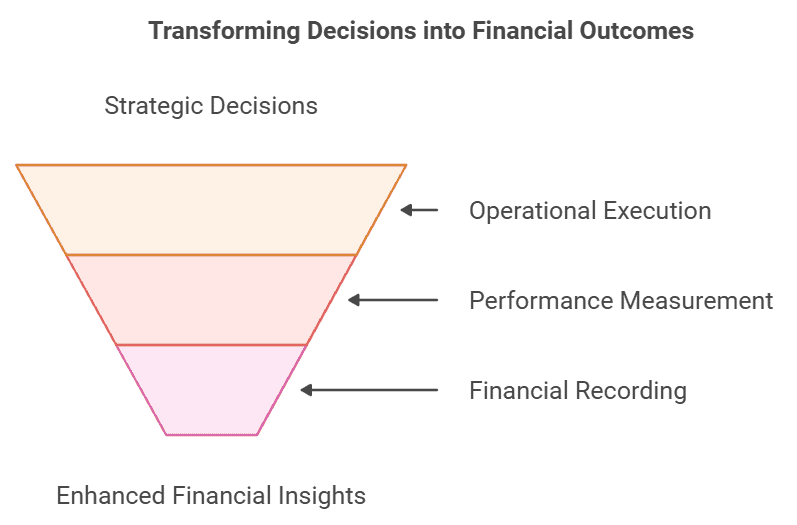

The Financial Funnel and Information Cycle

At the core of every SaaS company lies a financial funnel that connects your operational decisions to financial outcomes. Think about this:

- Actions and Decisions: Every initiative—whether it’s launching a new feature, running a marketing campaign, or optimizing onboarding—begins with a decision.

- Operations: These decisions drive day-to-day operations, from sales performance to product delivery.

- Financial Statements: The cumulation of these actions and decisions are recorded in your financial statements. It’s now our job to understand the financials and leverage the data for better outcomes.

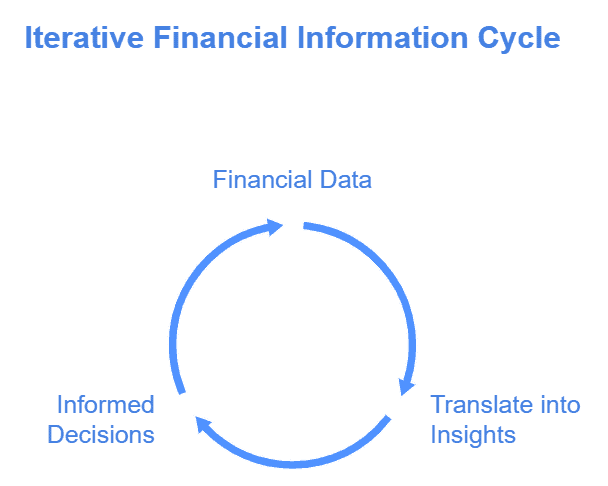

The Iterative Financial Information Cycle

This funnel feeds into an ongoing financial information cycle:

- Operations to Financial Results: Teams across your company execute initiatives that generate measurable outcomes.

- Translation into Insights: Finance and accounting teams interpret financial results, distilling them into actionable insights.

- Feedback Loop: Insights inform the next round of decisions, creating a continuous improvement loop.

Why is this cycle critical? It ensures your company is always adapting. Metrics may highlight anomalies or opportunities that require focus, such as a declining gross margin or unexpected customer churn.

By iterating through this cycle, you can quickly address issues and realign resources and capital.

Think of this as the engine behind your SaaS company’s performance. It’s not static—it’s dynamic and requires regular tuning to keep everything running smoothly.

The Five Pillar SaaS Metrics Framework

To bring structure to your financial information, my Five Pillar SaaS Metrics Framework organizes key performance indicators (KPIs) into five distinct categories. These pillars provide a holistic view of your SaaS company’s financial health, helping you scale with the right data and metrics.

You can download a PDF of this post below.

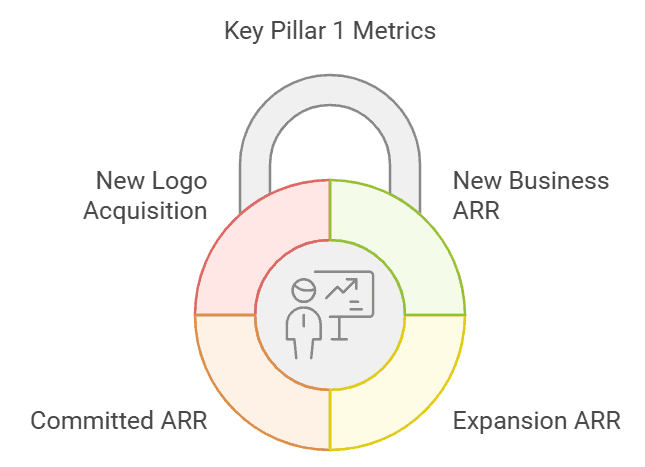

Pillar 1 – Growth

Growth in the form of ARR is the lifeblood of any SaaS business, especially in its early stages. This pillar focuses on the performance of your revenue engine, answering the question: “Do we have traction?”

Whether we are using spreadsheets or a CRM, it’s imperative to track new and expansion growth.

We must track our sources of growth from day 1. It’s getting harder to define ARR with changing pricing and revenue models, but ARR is the life of your SaaS company.

You can check out my detailed post on software bookings here.

Key Pillar 1 metrics include:

- New Business ARR: Tracks revenue generated from new customers, providing insights into acquisition performance.

- Expansion ARR: Measures incremental revenue from our existing customers, such as upsells or cross-sells.

- Committed ARR: A forward-looking metric that combines current ARR with booked ARR.

- New Logo Acquisition: Tracks how many new customers or users you’re acquiring. Still a sexy metric.

Why Growth Metrics Matter

Growth metrics help you understand whether your go-to-market strategy is working or if you have product-market fit. For example:

- If new logo acquisition is strong but expansion ARR is weak, it could indicate poor upsell strategies or customer dissatisfaction. Make sure you track NPS/CSAT!

- Committed ARR offers visibility into future performance. If CARR is growing then your revenue will be growing.

Remember! If you don’t track bookings data, you will not be able to calculate your GTM efficiency metrics in Pillar 5.

Pillar 2 – Retention

Retention metrics reveal how well your SaaS company keeps customers happy and renewing. Without strong revenue retention, it’s very hard to have a best-in-class growth profile. You may be great at acquiring new customers, but it takes strong NRR to power your valuation.

Core metrics include:

- Logo Retention: Percentage of customers retained over a given period, regardless of revenue size.

- Gross Revenue Retention (GRR): Revenue retained from your existing customer base after accounting for contraction and churn.

- Net Revenue Retention (NRR): Revenue retained after factoring contraction and churn but then offset (hopefully) by upsells and cross-sells.

- Renewal Rate: This is the leading edge of retention. If you offer annual or multi-year contracts, you must measure the cohort of customers that are available to churn.

- Remaining Performance Obligations (RPO): This is a public company metric that is getting more traction in private SaaS. It measures your deferred revenue and your invoiced ARR sitting in multi-year contracts. Up is good.

- Net Promoter Score (NPS): Measures customer satisfaction and likelihood that your customer will recommend your product or company.

Why Retention Metrics Matter

Retention is why SaaS companies are valued so highly. It’s the annuity that keeps paying every year. Land the customer once, but they pay year after year. Retention metrics provide a health check for your revenue base:

- High NDR signals strong customer satisfaction and effective expansion strategies.

- Low GDR may indicate customer dissatisfaction or product-market misalignment.

Retention becomes increasingly critical as your business scales. Acquiring new customers is expensive—retaining existing customers is much cheaper and helps maximize customer lifetime value (LTV).

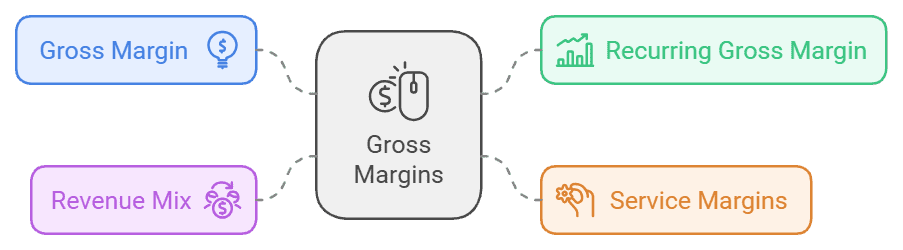

Pilar 3 – Gross Margins

Gross profit measures the efficiency of your delivery engine—how effective you are at delivering on your contractual obligations. This pillar provides insight into scalability, cash flow, and sustainability.

Gross profit is another reason why SaaS companies are valued so highly. SaaS is highly scalable. On the flip side, low gross profit is a high financial hurdle to financial sustainability and positive EBITDA.

Key gross margin metrics include:

- Gross Margin: Revenue – COGS = gross profit.

- Recurring Gross Margin: Focuses specifically on the profitability of your recurring revenue streams.

- Service Margins: Tracks profitability from services (e.g., implementation). I like to manage services as its own business unit. It must be profitable.

- Revenue Mix: Evaluates the proportion of SaaS recurring revenue versus non-recurring revenue. This impacts your valuation.

Why Margins Matter

Margins highlight the efficiency of your revenue delivery:

- Recurring Gross Margin reveals whether your subscriptions and variable revenue streams are profitable.

- Revenue Mix helps you understand dependency on non-recurring revenue, which may impact valuation.

Without accurate overall margin calculations and margins by revenue stream, you really do not know where to focus in your business.

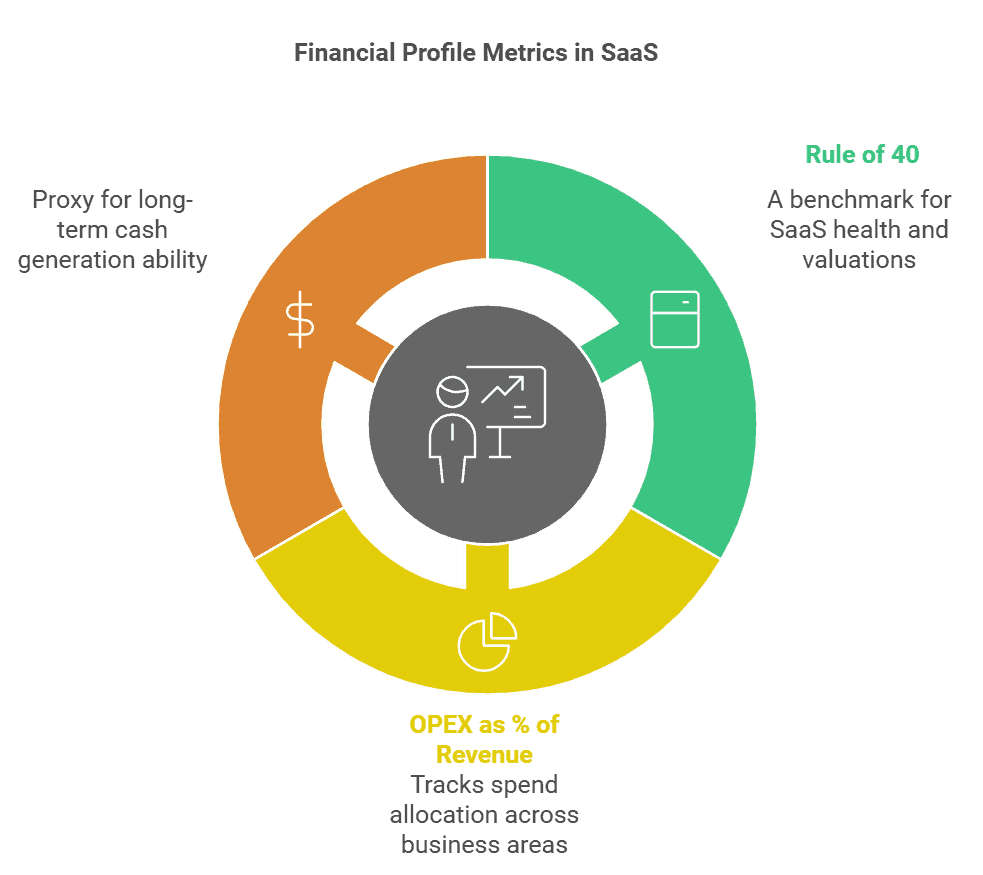

Pillar 4 – Financial Profile

Your financial profile tracks the overall health and sustainability of your business, balancing growth and profitability. OpEx requires major capital investment to scale your SaaS.

We have expectations for the OpEx section of our SaaS P&L. The OpEx section is where you can create operating leverage in your business which in turn creates cashflow.

Key metrics include:

- Rule of 40: The sum of your growth rate and EBITA %, a benchmark for SaaS health and valuations

- OPEX as a % of Revenue: Tracks spend allocation across R&D, Sales & Marketing, and G&A. Where are we investing and why.

- EBITDA: A measure of profitability before interest, taxes, depreciation, and amortization. Some haters of EBITDA out there, but it is a proxy for long-term cash generation ability in your business. You’ll need it at some point!

Why the Financial Profile Matters

This pillar ensures you’re scaling responsibly:

- A strong Rule of 40 score signals a balanced approach to growth and profitability.

- OpEx metrics identify areas where spending may need adjustment. Your OpEx profile should follow a pattern as you scale revenue.

- This is where operating leverage is built. More leverage, better cashflow, better EBITDA. Private equity loves EBITDA (so do I!)

For mature SaaS companies, financial profile metrics are essential for proper capital allocation and operational discipline.

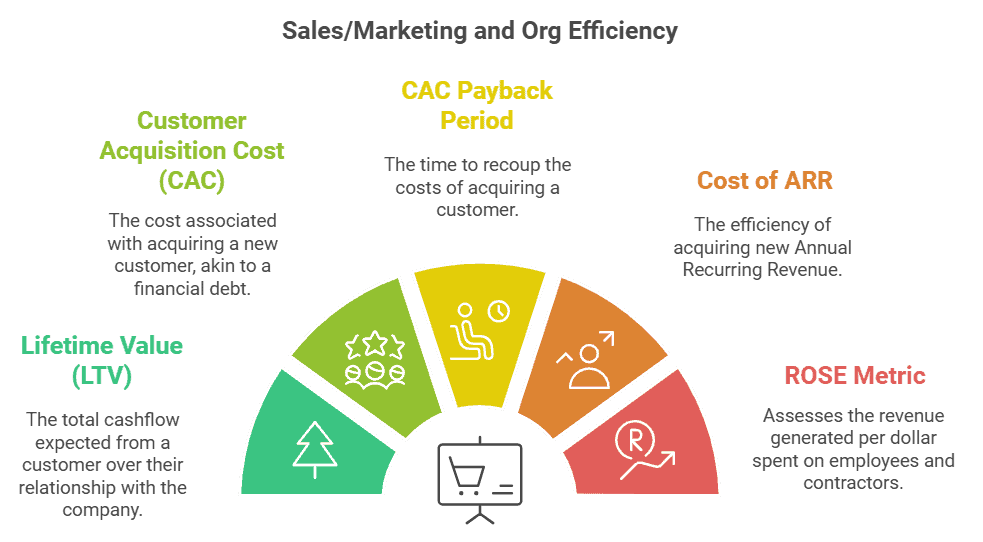

Pilar 5 – Sales/Marketing and Org Efficiency

Sales and marketing efficiency measures the ROI of your go-to-market investments. For every dollar that we invest, how much return in the form ARR do we receive?

Don’t forget org efficiency! If you want better cashflow and a path to profitability (or better profitability), you need to implement my ROSE Metric.

Key efficiency metrics include:

- LTV: Lifetime value of a customer, reflecting total cash flows from a customer.

- CAC: Customer acquisition cost, revealing the efficiency of your new customer acquisition strategy. CAC is like debt.

- CAC Payback Period: The number of months to pay back the upfront CAC costs. You must use the gross-margin adjusted formula.

- Cost of ARR: Efficiency in acquiring net new ARR.

- SaaS Magic Number: A widely used metric for revenue growth efficiency.

- ROSE Metric: The amount recurring revenue generate for every dollar of employee and contractor investment. You can’t scale without this metric improving.

- Revenue per FTE: less effective measurement metric than the ROSE Metric but still useful when applying benchmarks.

Why Sales & Marketing Efficiency Matters

Your GTM machine requires A LOT of investment. It’s easy to burn through these dollars without frameworks in place. It’s difficult to scale your SaaS without a GTM metrics playbook:

- A high LTV to CAC ratio indicates good balance between ARPA, retention, and customer acquisition.

- Short CAC Payback Periods improve cash flow, a critical factor for SaaS growth, and allows you to “reuse” your capital faster.

As your company matures, these metrics help you optimize investments and prioritize winning customer acquisition channels.

Adapting the SaaS Metrics Framework to Your Stage

You must use the right metrics for the right stage of your business. However, if you are above $10M ARR, you should have a metric calculated in each box on my framework.

The left to right arrow is there for a reason. We mature through this framework.

- Early Stage: The focus is on acquiring new customers and then if we are keeping those customers.

- Implement pillars 1 and 2

- Scaling Stage: Prioritize Margins and Financial Profile to ensure scalability.

- ARR is growing. Now we need to make sure the SaaS engine is tuned for performance. Implement pillars 1 to 4.

- Mature Stage: Incorporate metrics from all five pillars for full financial transparency.

- Generally, once you hit $5M in ARR, I can calculate a metric in each box of the framework. Above $10M ARR, you may potentially be segmenting your metrics.

This framework allows you to focus on the right metrics while avoiding the overwhelm of tracking too many metrics.

A Framework for Decision-Making

The Five Pillar SaaS Metrics Framework isn’t just about tracking numbers—it’s about driving better decisions. To scale your SaaS, it requires a formulaic approach. I hear this all of the time from SaaS founders who appear on my podcast.

With these metrics in place, you can:

- Align teams around shared goals.

- Identify what’s working and not working in your business.

- Confidently communicate performance to staff, investors, your Board, and potential investors.

When due diligence or board meetings arise, this framework ensures you’re prepared with actionable data and insights that showcase your command of the business and the health of your SaaS business.

Key Takeaways

- SaaS metrics are your cockpit instruments—essential for navigating your SaaS journey.

- The financial funnel and information cycle create a feedback loop for continuous improvement.

- The Five Pillar SaaS Metrics Framework organizes metrics into Growth, Retention, Margins, Financial Profile, and Sales & Org Efficiency.

- Align your metrics with your company’s stage to focus on what matters most.

By adopting my SaaS metrics framework, you’ll not only operate with greater clarity but also set your SaaS business up for sustainable growth and long-term success.

Are you ready to implement the Five-Pillar Metrics Framework in your SaaS business?

Download this post below!

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.