There are four key finance data sources that we need monthly to scale our SaaS business. This data can mean the difference between running financially blind and financial transparency.

The data sources that I outline below are core to my financial framework. I follow a sequential process to build data discipline and data integrity. You can’t skip ahead because the process builds upon the previous step.

Without this data, it’s difficult to make data-driven decisions, allocate capital efficiency, and hire at the right times just to name a few.

Learn the four SaaS finance data sources that you need from your finance team. You need this today, not tomorrow.

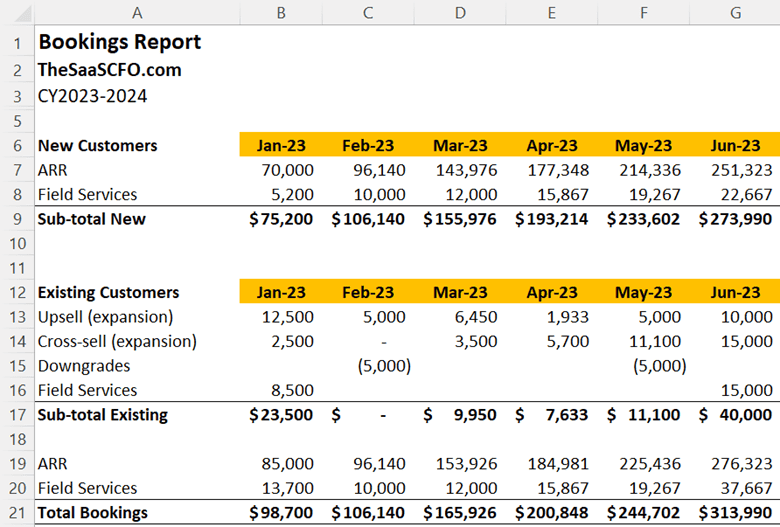

Bookings Data

A booking is an executed contract between you and your customer for software and/or services. This data is ideally stored in your CRM (customer relationship management) software. Even if you track this data in spreadsheets, please track this data.

If you live in the world of self-service SaaS (low price point, high volume of customers) you may not speak the bookings language. However, you still need this data. I’ll address your bookings data process in the Customer/Revenue data section.

We use bookings data for sales team and rep performance, commission calculations, and forecasts. It’s also used in sales and marketing efficiency metrics such as the CAC Payback Period and Cost of ARR.

Your bookings data is contained in Closed Won opportunities. It’s important to configure your opportunities correctly so that you can track the correct data.

Without bookings data, you cannot calculate your go-to-market (GTM) efficiency.

I like to pull bookings data on Day 3 of our financial close process. I make sure my number ties out with our sales ops manager. If we are off by even $100, we find the discrepancy.

Bookings data to track:

- Revenue type – suscription, variable, services, hardware, etc.

- Recurring value – ARR and TCV

- One-time value – professional service, hardware, etc.

- Contract duration – start and end date

- New vs. expansion opportunity

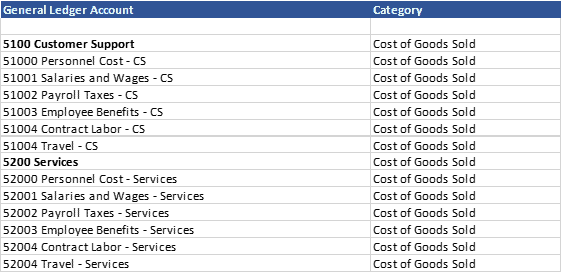

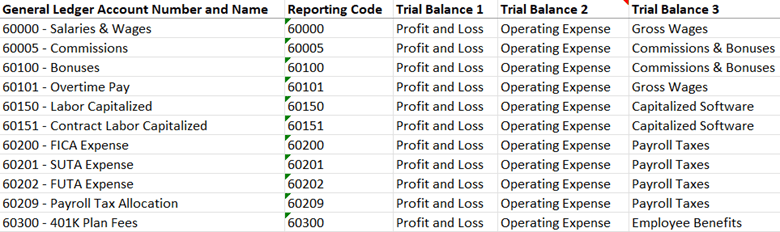

Financial Data

Financial data is sourced from our accounting software. We need our SaaS P&L (income statement), balance sheet, and cash flow statement. This seems easy, but it’s one of my most requested coaching calls.

The structure of chart of accounts (COA) is important in SaaS. A COA is a numerical and descriptive listing of our general accounts from the balance sheet to the income statement.

We can’t take the out-of-the-box COA and make it work for SaaS. We must “SaaSify” it.

There are two options to structure your COA for your P&L. First, we can use an inline structure. It’s a bit duplicative, but it’s very easy to create a SaaS P&L from this structure.

With an inline structure, we have sections in the expense area of our COA for each department in our org. For example, a section for R&D and Sales. This is the duplicative part. We have, for example, wage GL account for each department.

The second option for your COA is a dimensional structure. We have unique GL accounts (for example, only one wage account).To code the department level, we use a dimension. Dimensions have different names in different systems. In QBO, we can use Class or Department.

Without the proper structure, we cannot create an accurate SaaS P&L, forecast, and SaaS metrics. It’s foundational to our finance maturity.

Check out my annual SaaS tech stack report for the top players in accounting software.

HRIS / Payroll / People Data

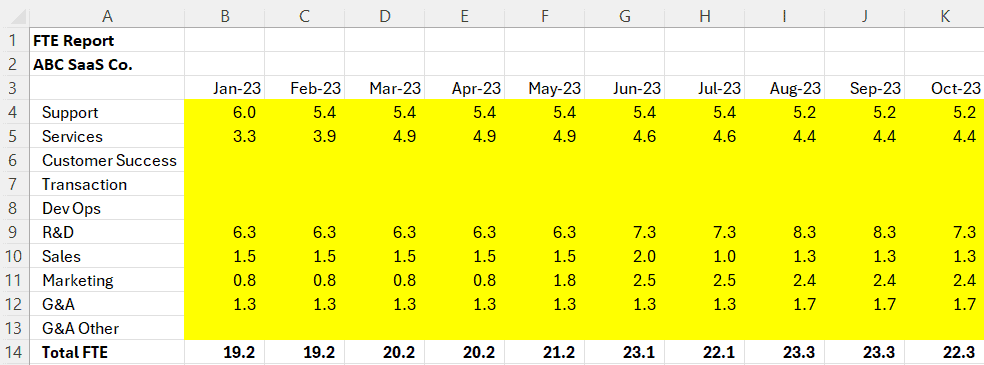

The largest expense on our SaaS P&L is people, but often we have poor headcount tracking. We need employee and contractor data to understand historical FTE trends and to feed our forecast model. It’s a highly overlooked data category. My FTE report is a standard report in my monthly close process.

We must validate that our employees are coded correctly in our payroll software. We don’t want our highly paid software engineer coded to marketing, for example. Headcount coding in our HRIS system is used by your accountants to code wages to the proper department on your P&L.

Your expenses will be impossible to decipher if employees are misclassified. This leads to problems in forecasting and inaccurate SaaS metrics. Same thing for contractors. Don’t code your outsourced engineers and marketers to one GL account. They should be coded to the department level.

The data we need in our monthly headcount report include:

- Name

- Title

- Department

- Wage rate

- Full-time or part-time

- Start date

- End date

Customer / Revenue Data

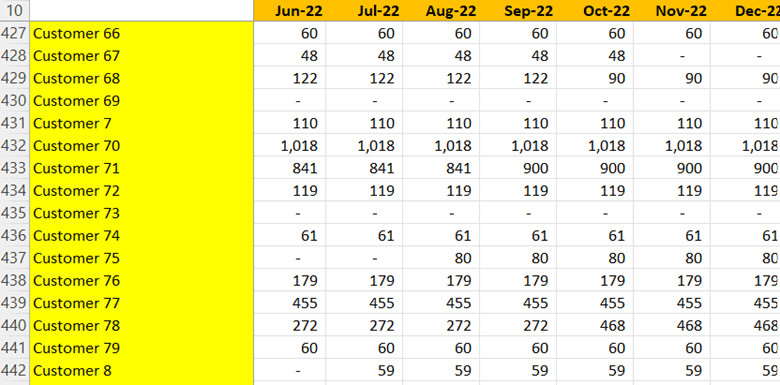

We need detailed customer and revenue data to calculate retention and feed our forecast model and metrics. Ideally, we have subscription management software in place to provide this critical data. If we don’t, we must dive into our invoice data.

Before we get fancy, we must understand customer counts, revenue by product line, and total MRR/ARR. I encounter many SaaS companies that cannot track these basic stats.

Ever heard of an MRR schedule? It’s core to SaaS financial data and a top request item in due diligence. With poor subscription and invoice data, it’s very difficult to build an MRR schedule. And if we do have poor data, we can’t rely on it for customer and revenue retention calculations.

Your MRR schedule feeds your retention formulas such as gross revenue retention and net revenue retention. These are core metrics to understand the health of our recurring revenue. They also support your valuation.

If we rely on invoice data to build our MRR schedule, we must track the following data points:

- Customer name

- Unique customer ID

- Invoice number

- Invoice amount

- Subscription start date

- Subscription end date

This may seem obvious, but my team and I have had to employ complicated Excel formulas to extract this data from memo fields in invoice data. And a lot of manual inputs to correct the data.

If you are self-service SaaS, we will use the MRR waterfall from my retention template to create your bookings data.

Check out my free SaaS CFO templates course on how to create your MRR schedule from invoice data. Resources below.

Action Items

We must strive for a repeatable data process each month. It cannot be a fire drill. This data builds the foundation of financial planning and analysis (FP&A) in SaaS companies.

The data flows downhill into our SaaS P&L, financial analysis, forecast model, SaaS metrics, due diligence data, and Board reporting. There are no quick recoveries from inaccurate SaaS metrics presented to your Board or an investor. Don’t lose your credibility.

Before we overlay technology on this data process, you need to achieve a consistent, manual process first. Then you can use technology such as FP&A software to turbocharge your speed and accuracy.

SaaS Resources

- Grab my MRR schedule and retention templates in this fee course at my Academy.

- Grab my bookings template in this post on software bookings.

- Learn about CRM opportunity setup in my No Fluff course series

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.