The health of your recurring revenue in SaaS is paramount. Healthy revenue drives predictable cash flow and higher valuations. Typically, you measure Gross Dollar Retention and Net Dollar Retention to assess the stickiness of your revenue. However, there is another metric that compliments retention. It’s called the renewal rate.

You need to understand more than the headline ARR number as operators or investors in SaaS. Metrics are more powerful when used in reference to each other. Although renewal rate is not a predictive measure, it is the leading tip of the sales spears when it comes to frontline activity.

In this post, I will explain how to calculate your renewal rate metric and apply it to your SaaS business.

What is the Renewal Rate Metric

The renewal rate metric tracks churn and retention to a specific month of invoicing. We are invoicing the customer because they either renewed their contract or it’s an intra-contract invoice (year 2 invoice of 5).

This is an important nuance. Renewal rate only applies to customers who are available to churn. Meaning, their contract is coming to an end. If we sign them up, for example, to another three-year contract, the next invoice would be included in the renewal rate formula.

Renewal rate tracks customers and dollars that are available to churn.

Rather than track churn and renewals against your entire customer base, you track renewals based on each cohort of monthly invoices. And those who are available to contractually churn.

The renewal rate metric is more applicable to SaaS businesses that offer customers single and/or multi-year contracts. If you invoice customers every month and they can cancel at anytime, then your renewal rate is equivalent to your retention rate.

The Renewal Rate Formula

The renewal rate focuses on just on the renewals due in a single month. For example, if you just processed your March 20XX renewals, you focus on the total number of customers due for renewal in March 20XX and the total number of customers who paid their invoice.

Of course, you may say that I already know that they will renew because they signed another contract. True! But if you have evergreen contracts, you may kick out another one year invoice if they didn’t commit to another long-term contract. In that case, you are not quite sure if they will renew.

You can track the renewal rate on both a customer count level and a total dollar level.

Customer Renewal Rate

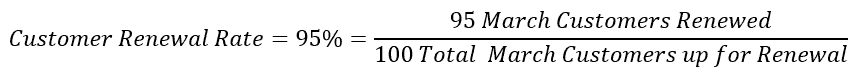

To calculate your customer renewal rate, you simply divide the number of customers who paid their renewal invoice by the total number of customers invoiced that were up for renewal.

For example, if I send out one hundred invoices for March-XX renewals, I track who paid their invoice and who churned against the March-XX renewals, not against my total customer count. If five customers churned, my March-XX renewal rate is 95% (95 renewed / 100 invoiced customers). Every month you continue this renewal rate tracking process.

Dollar Renewal Rate

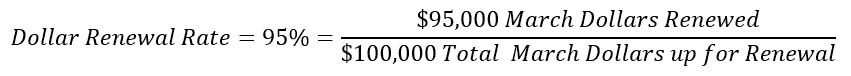

The dollar renewal rate formula follows the same logic. We swap customer counts for ARR. In this case, ARR that is up for renewal. To calculate your dollar renewal rate, you simply sum the ARR renewed by the total ARR up for renewal.

For example, if I send out $100K of March-XX renewals, I track who paid their invoice and who churned against the March-XX renewals. If $5K of ARR churned, my March-XX renewal rate is 95% ($95K renewed / $100K invoiced). Every month you continue this renewal rate tracking process.

Renewal Rate vs Retention Rate

The renewal rate metric is a great compliment to GDR and NDR. With retention rates, you can track total (your entire customer base) customer and dollar retention. And you can track retention on a cohort basis.

This differs from the renewal rate. The renewal rate is focused on a specific cohort of customers who are coming out of contract. You have a timing difference between the two metrics. With the renewal rate, you are also not as concerned with that happens between contract signing and contract expiration.

Upgrades and downgrades are tracked via cohort analysis retention. But you may want to understand your upsell rate.

Benefits of the Renewal Rate

Many SaaS metrics are historical-based. However, you should always forecast your metrics through your financial statement modeling process. There are several benefits with the renewal rate.

- The renewal rate may identify an early downward trend in renewals. The downward trend may be masked when tracking only aggregate churn and retention.

- It’s much easier to identify a pattern when isolating the five customers churning out of one hundred customers in Jan-XX versus five customers churning out of one thousand total customers.

- Organizing your renewals by month benefits your account management and customer success teams. These teams can gain forward visibility on upcoming renewals by month and the historical renewal trends.

- Great complimentary metric and supports your retention story.

Multi-year Contracts and Renewal Rates

One dangerous assumption that lurks in your aggregate churn and retention metrics involves multi-year contracts. I had not really considered this until it surfaced in a due diligence request during an exit process to private equity. We had great retention, why worry?

If you primarily sell multi-year contracts, we know that customers do not come up for contract renewal each year. You may “renew” them by sending them an invoice for contract year two of three, for example, but they are obligated to pay under the terms of your master agreement.

If you are touting 95% aggregate annual retention rates, what is the actual retention rate when you count only the customers who have the choice not to renew? That 95% retention rate may be artificially supported by customers who are locked into multi-year contracts and have no choice but to renew.

Knowing the segments of customers who are and are not locked into contracts can help focus your sales and customer success teams. It also gives you a more accurate view of retention and renewal rates.

Tips to Improve Your Renewal Rate

Recurring revenue is the core engine of our SaaS business. We have to monitor and maintain our revenue streams if we expect improved performance.

- Track your renewal rate. We can’t improve what we don’t measure.

- Provide renewal data to your account management and customer success teams.

- Be proactive. With the renewal data, develop a renewal playbook.

- Who reaches out to customers? When do you reach out? Do you have a framework in place for price increases? What’s the upsell and cross-sell potential with each customer?

- Communicate with your accounting team.

- Are renewal conversations taking longer than planned? Should they hold off on the evergreen invoice?

Download my renewal rate cheat sheet below.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.