Taxes! It can be a scary subject both personally and for your business. As a CFO, I don’t like to bend the rules. Who wants to be audited? But what if I could tell you about a tax credit that was almost custom made for US-based SaaS companies? It’s called the R&D (research and development) tax credit.

The R&D tax credit is available to businesses of any size. It could reduce your tax liability and keep more cash in the bank. In this post, I’ll explain the basics of the R&D tax credit, what businesses and expenses qualify, the taxes it offsets, recent changes to the credit that dramatically affect SaaS companies, and who to contact to claim this credit.

This post has been updated as of March 30, 2023 to incorporate the latest section 174 changes.

What Is The R&D Tax Credit

The Internal Revenue Service (IRS) first introduced the R&D tax credit in 1981. It was created under The Economic Recovery Tax Act (ERTA) to spur economic growth and incentivize businesses to keep the technical jobs here in the United States. However, it was a temporary credit upon introduction, expired eight times, and has been extended fifteen times since 1981. The rules of the credit can be found in the Internal Revenue Code (IRC 41) – Credit for Increasing Research Activities.

The great news for SaaS founders and owners? It became a permanent federal incentive in 2015 under the Protecting Americans from Tax Hikes Act (PATH). The tax credit generally allows SaaS businesses to reduce their federal and state (varies by state) tax liabilities.

“It applies to businesses of all sizes, and you don’t have to be profitable to take advantage of the credit.”

And if you have not claimed the tax credit yet, the tax provisions allow businesses to go back three years for federal (similar for most states) taxes. You can amend your prior year tax returns to claim all development costs and unclaimed tax credits, which can generate cash refunds for the business or its partners and/or shareholders.

What Businesses Qualify for the R&D Tax Credit?

The tax credit applies to businesses of all sizes. And if you are a SaaS company, the odds are good that you will pass the IRS’ four-part test to qualify for the SaaS R&D tax credits. The IRS is detailed about what can be defined as qualified research activities (QRA). However, software development is one of those activities that is common in claiming the credit. Software businesses that invest resources to design and develop new software can generally claim the R&D credits.

Four-part Test

In order for an activity to qualify for the research credit, the business must pass all four parts of the test below. Don’t worry. You don’t have to go in this alone.

When the credit became permanent, many CPA firms decided to specialize in helping SaaS companies claim this credit. And the fee structure is often very compelling because some firms will only charge a fee if and when you actually realize the tax savings.

Specialized CPA firms will guide you through the process and conduct an initial study to make sure you qualify. The four-part test is summarized below. And, again, the good news is that software companies usually pass these tests.

- Permitted Purpose

- Technical Speak: The intended purpose of the activity or project must be to create or improve functionality, performance, reliability, or quality of a business component. The business component is defined as any product, process, software/technology, formula, patent, or invention.

- Plain English: If you are developing the version 1.0 of your software platform, you can claim the credit. If you continue to invest time and resources into coding enhancements for version 2.0 and beyond, you can claim the credit.

- Elimination of Uncertainty

- Technical Speak: The activities and projects in question must attempt to eliminate uncertainty related to design, development methods, or components capabilities.

- Plain English: Since there is no magic button to produce a software product, software development fulfills this requirement. Development teams do not know the optimal code design or coding methodology at the outset of the project. This is a technological uncertainty.

- Process of Experimentation

- Technical Speak: The activities must include a process of experimentation of the unknown that would include testing, evaluating alternative, or systematic trial and errors.

- Plain English: When was the last time you sat down to a computer and coded the perfect program from start to finish? The very nature of software development is iterative and experimental. Software development is a series of trial and error designed to evaluate alternative solutions to achieve the desired permitted purpose.

- Technological in Nature

- Technical Speak: The activities and process of experimentation must rely on hard sciences, such as computer science, engineering, chemistry, biology, or physics.

- Plain English: Since “computer science” is explicitly named in the test, you should pass this one with flying colors.

What Expenses Qualify for the Credit

Now that we have passed the four-part test for our software project, we must determine which expenses qualify toward the credit. And just to be clear, these must be US-based expenses.

- Wages – Taxable wages paid to employees directly engaged in qualified activities and/or those employees directly supervising and supporting those performing the direct research.

- Supplies – All supplies used and consumed for prototypes or for testing.

- Contract Research – Payments made to a US-based third party (contractor, subcontractor, vendor) to perform qualified research or testing on behalf of the taxpayer or business.

- Rental or Lease Costs of Computers – Computer rental expenses or expenses related to cloud computing costs (for example: Amazon Web Services or Microsoft Azure).

As a CFO who has claimed the SaaS R&D tax credit, I included only wages for the employees engaged in qualified activities. I did not have any contracted research expenditures. Keep in mind that not all the employees’ wages will count towards qualified research expenses. The R&D tax expert will interview staff to determine what roles and what percent of each employees’ wage will qualify.

For example, almost 100% of the wages of a software developer will count towards qualified research expenses. On the other hand, a lower percent of the wages for a product manager or business analyst will qualify.

What Taxes Can I Offset

Finally, it’s time to talk cash. What does this credit really mean for my bank account? The credit was initially single-purposed, but the reach of the credit expanded with the PATH act.

The R&D tax credit can offset:

- Federal and states (varies by state) tax liabilities

- Payroll tax for Qualified Small Businesses

- Alternative minimum tax (AMT) for Eligible Small Businesses

The R&D tax credit can be used to offset federal and state (varies by state) cash tax liabilities. The PATH Act in 2015 expanded the reach of the credit by allowing qualified small businesses (QSB) to take the R&D tax credit against the FICA portion of its payroll taxes for tax years beginning after December 31, 2015. This credit is capped at $250,000 for each qualified year.

Qualified small businesses include:

- Less than $5 million in gross receipts in the eligible year

- Having gross receipts for no more than five years (so ideal for startups)

This was one of the most significant changes to the tax code. And primarily for the SaaS industry. As cash is king for startups, and SaaS businesses, you no longer need to be in a profitable tax position to use the tax credits!

Even pre-revenue companies can start offsetting their payroll taxes the quarter after you claim the tax credits.

Additionally, effective January 1st, 2016, Eligible Small Businesses (ESB) can now use the tax credits generated against their alternative minimum tax. An ESB is defined as a business with less than $50 million in average gross receipts for the three preceding years.

What Do Recent Section 174 Changes Mean for SaaS Companies?

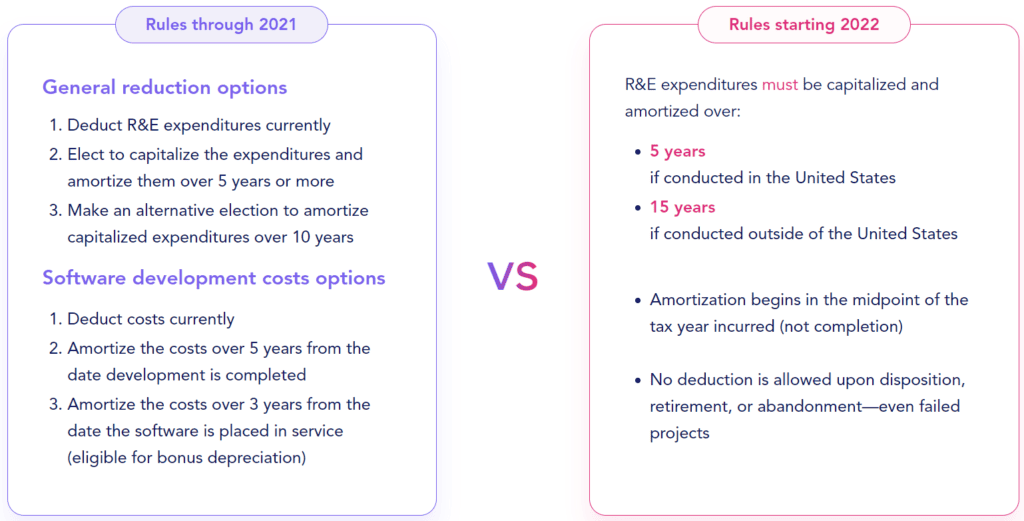

Previously, tax-paying SaaS companies could rely on Rev. Proc. 2000-50 to fully deduct software development costs on their tax return in the year they were incurred. Now, things are changing.

While the TCJA doesn’t change the R&D credit calculation per-say, it now explicitly calls out the software development industry, requiring them to amortize their expenses over 5 years (for domestic expenses) or 15 years (for international expenses).

Effective as of December 31, 2022 (for 2022 tax returns), deductions of ordinary and business expenses will now stretch out over 5 and 15 years, as opposed to previously being able to deduct them the year they occurred. This will significantly impact a SaaS company’s tax liabilities, and ultimately reduce their cash flow. And for startups that aren’t turning a profit yet? The TCJA changes could mean paying taxes on income they don’t even have.

Here’s a quick glimpse of how these recent Section 174 changes could affect a SaaS company:

Thankfully, these recent changes did not affect the definition of QREs—the basis of the R&D tax credit calculation. R&D tax credits are more valuable than ever, easing the increased burden of these new rules.

How to Claim the SaaS R&D Tax Credit

When I claimed this credit, I relied on my tax accountant to file the appropriate tax schedules and returns for my business. However, I hired a CPA firm who specialized in claiming this credit for SaaS businesses.

In the process of claiming this credit, the R&D tax specialist provided detailed documentation and calculations, so that I felt confident in claiming this credit.

But where do you start to claim the SaaS R&D tax credit?

Google SaaS R&D tax credit? I’ve done the homework for you. I partnered with Strike R&D Tax Advisory who services clients nationwide.

Strike are specialists in helping SaaS companies claim this credit by having R&D tax credit consultants, CPAs, technologists, engineers, and PhDs on staff that understand the nature of your SaaS business. They will make sure your claim stays compliant with Section 174 changes so you can be confident about your credits.

And they have kindly offered a limited-time discount on their services just for The SaaS CFO community! Enter your name and email below and Strike will reach out to set up an introductory meeting.

Calculate Your R&D Tax Credits in 30 Seconds

Strike has an R&D Tax Credit Calculator where you can input your 2019-2023 yearly expenses (payroll, US contractors, supplies, and cloud computing costs). Just select your industry, pick your state, and within 30 seconds the calculator will output an estimated range of federal and state R&D tax credits that you may be eligible for.

Are you claiming this credit? Please post below. I’d love to hear.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.