Contracted Annual Recurring Revenue (CARR) was an obscure metric in the SaaS world years ago. Today, it’s become a hot and controversial SaaS metric when discussing company growth and SaaS valuations.

CARR is a forward-looking SaaS revenue metric that estimates the maximum revenue size of a SaaS company. CARR combines two important aspects of revenue: current recurring revenue from our SaaS P&L and future revenue that sits in newly won customer contracts.

CARR is one of the many metrics in my 5 Pillar SaaS Metrics Framework. Understanding and tracking CARR is part of your SaaS metrics evolution. Buyers won’t mention CARR, but you should as a SaaS founder and operator.

You can download my CARR template below.

How to Calculate Contracted Annual Recurring Revenue (CARR)

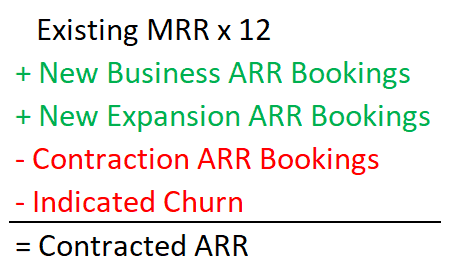

Calculating Contracted Annual Recurring Revenue (CARR) requires three data sources. First, we need recurring revenue from our most recent SaaS P&L. Second, we need our bookings data. Finally, we need future, indicated churn data.

The CARR formula provides a standardized method to build our “layers” of CARR. Not all CARR is created equally. It’s important to understand each layer.

The CARR formula requires each of these components:

- MRR from our SaaS P&L x 12

- + New ARR Bookings

- + Expansion ARR Bookings

- – Contraction ARR Bookings

- – Indicated ARR Churn

- = CARR

Step 1 – MRR from our SaaS P&L x 12

We need to start with the foundation of existing, recurring revenue. We source this from our most recent SaaS P&L. This also requires revenue recognition to be in place. And, yes, we do know with revenue recognition that there could be accounting noise in some months. We just must be aware of this as we annualize our MRR number.

Step 2 | + New ARR Bookings

We are sourcing this data from our CRM system. These are new customer wins that have not pushed into our revenue yet. You may need a software backlog report if there is a long delay between signing and go-live.

Step 3 | + Expansion ARR Bookings

We are sourcing this data from our CRM system. Use net expansion ARR won from your existing customers. Do not use “gross” renewals. We feed only the incremental expansion into this CARR layer.

Step 4 | – Contraction ARR Bookings

We are sourcing this data from our CRM system. This is the opposite of Step 3. We need the decremental change in the renewal booking where our customer chose to “purchase” less product. This reduces CARR.

Step 5 | – Indicated ARR Churn

Your accounting team or customer success team should track forward-looking churn. Indicated churn is a reply from your customer that they want to terminate your contract for software.

I do stray from the SaaS Metrics Standards Board on this. Rather than only count churn in the current accounting period, I include known or indicated churn in my CARR. As a CFO, I feel that I would be misleading third parties if I was excluding known churn that was disclosed to me. This could be material to the CARR number.

The Role of Contracted Annual Recurring Revenue (CARR) in M&A and Operations

Contracted Annual Recurring Revenue (CARR) plays an important role in M&A exits. SaaS founders and executive teams are using CARR as an anchor point for SaaS valuations. We’d rather apply a revenue multiple to CARR than current ARR or trailing twelve months recurring revenue.

Your CARR should be higher than ARR. If not, something is wrong in your business.

For startups and established companies alike, CARR offers a clear picture of anticipated future revenue performance, helping investors gauge the stability and velocity of your company’s go-to-market model. When selling to private equity, a strong AND supportable CARR number can significantly boost your company’s valuation by demonstrating sales velocity and sticky revenue.

CARR is particularly valuable as it reflects not just current recurring revenue performance, but also future commitments from customers. Remember, commitments equal contracted revenue. Not revenue sitting in your sales pipeline!

However, financial context is always important in M&A and internal operations. CARR is just one data point among many to support valuations and operational decisions.

SaaS metrics should never be used in isolation. They tell a more powerful story together when using my 5 Pillar SaaS Metrics framework.

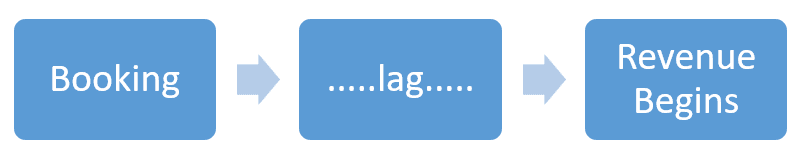

CARR is All About the Lag

CARR is very relevant to SaaS companies that offer mid-market and enterprise style contracts. Meaning, higher annual contract values (ACV). If you have a self-service SaaS offering (low price point, high volume of customers), typically, there is no lag between customer sign up and when the revenue hits your P&L. In this scenario, CARR is not a meaningful metric.

When when you sell higher ACV contracts and use an outbound sales motion, we usually have a lag between contract execution and customer go-live or revenue start. This is the perfect time to measure CARR. CARR attempts to capture the dollar lag between contract execution and the start of revenue.

All CARR is Not Created Equally

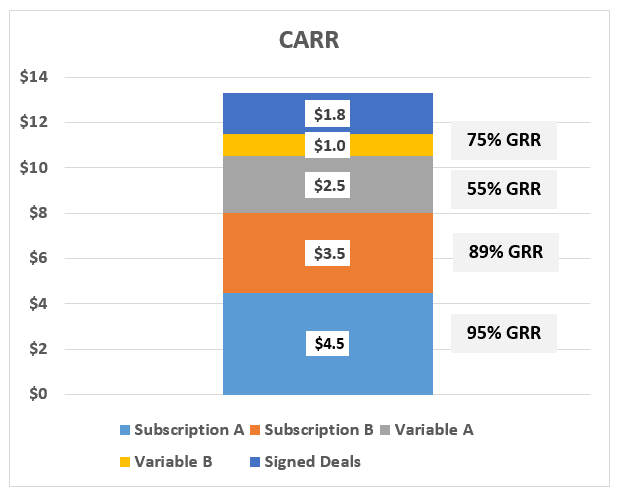

What type of revenue should we include in CARR? This has become very confusing in a SaaS+ model where we offer subscriptions and variable revenue (usage, processing, consumption, etc.).

We definitely do no not want to include one-time revenue in CARR. An example would be professional services revenue. Services revenue is one-time in nature. Also I’d argue that we do not include any people powered services revenue such as managed services revenue in our CARR number.

We are valued on our IP and product, not services business models.

Of course, services revenue is important when onboarding customers, but we generally do not receive credit for services or one time revenue when discussing SaaS valuations. We want as much IP or product powered revenue as possible.

Variable Revenue in CARR

Including variable revenue is a key consideration in CARR. However, not all revenue streams are created equally.

I argue that we should marry our layers of CARR with gross revenue retention numbers for each layer. See the chart above as an example.

If we have one layer of CARR with 95% gross revenue retention and another layer of car with 55% gross revenue retention, I’d want to know that as an investor, potential investor, or Board member.

A headline CARR number may look sexy but investors are wise. They will find out sooner or later what you are including in your CARR number.

CARR vs. Bookings

A software booking is an executed contract between our company and our customer for our products and services. It’s a non-GAAP measure, but a critical data point for SaaS companies.

Bookings are a component to the CARR build. CARR requires detailed tracking of new customer wins and expansion wins within our CRM system. Often, I see very poor bookings data which then makes it very difficult to calculate not only CARR but also our sales and marketing efficiency metrics in Pillar 5 of my framework. No bookings, no S&M efficiency metrics.

See my post on software bookings on to track your bookings data.

Common Challenges in Measuring and Managing CARR

CARR requires accounting data and CRM data. This can pose challenges if we have an immature accounting process and poor bookings data

We need revenue recognition in place to rely on solid CARR number. If we are on a cash basis, we cannot just take our latest MRR from our P&L and multiply by 12.

The introduction of variable revenue (usage, transaction, processing) has also complicated our bookings tracking if we land a new customer with variable revenue. We must understand if there is a minimum commitment in the contract in order to track that as a booking. Without a minimum revenue commitment it’s hard to include a number in our bookings data and use this in our CARR.

Known, future customer churn must also be tracked by your accounting our customer success team.

Action Items

CARR is an important metric to understand for founders and owners. Buyers aren’t going to ask for your CARR, but you should putting forth a well-supported CARR number when posturing in exit discussions.

CARR requires detailed tracking of your revenue layers, your bookings data, and your know churn data.

You can download my CARR template below.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.